Re Ian Bremmer 'Could third-party candidates upend the 2024 US election?' 3 April The current political movement in the USA…

Global Economy 2014

Written by Diana Thebaud Nicholson // December 8, 2014 // Global economy // 3 Comments

Oil as a Political Weapon

The Economic Consequences of Global Oil Deflation

(Counterpunch) There are at least three major potential impacts on global economic instability that will likely follow in the wake of global oil price deflation, some of which have already begun to appear:

First, a more rapid appreciation of the US dollar, and the corresponding relative decline in the currencies of a number of emerging market economies (EMEs) — in particular those dependent on commodity exports and especially those for whom oil exports make up a significant percent of total exports. There is a long, historical and documented relationship between falling oil prices and a rising US dollar. So global oil deflation means a rising US dollar.

A second destabilizing impact from falling oil prices will be to contribute toward general deflation in Europe and Japan. Economies there have already entered recession. Despite trillions of dollars of liquidity injections by their central banks in recent months, price levels have still fallen to zero or less. Oil deflation will add significantly to a general deflationary drift in both Europe and Japan. That in turn will likely lead to even more liquidity injections by their central banks, in the form of more quantitative easing (QE), further feeding stock market and bond asset bubbles.

Third, decline in financial assets tied to oil could increase the tendency toward global financial instability. Oil deflation may lead to widespread bankruptcies and defaults for various non-financial companies, which will in turn precipitate financial instability events in banks tied to those companies. The collapse of financial assets associated with oil could also have a further ‘chain effect’ on other forms of financial assets, thus spreading the financial instability to other credit markets.

7 December

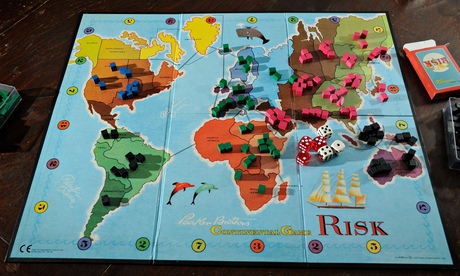

Why the world is like a real-life game of global domination

Why the world is like a real-life game of global domination

Five mighty empires across the globe are gearing up for an economic wargame where there could be no winners

Putin gives a speech and the rouble falls. Europe’s central bank boss gives a speech and the stock markets fall. Opec meets in Vienna and the oil price plummets. Japan’s prime minister calls a snap election and the yen’s slide against the dollar accelerates. All these things in the last six weeks of an already fractious year.

There are suddenly multiple conflicts being played out in the global markets, conflicts the global game’s usual rules are not built to handle.

The first concerns a clear game of beggar thy neighbour between China and Japan. Since 2012 Japan has printed money hand over fist, with the aim of kickstarting economic growth. With growth stalling for a third time in the final quarter of 2014 its premier Shinzo Abe printed more. China perceives this as unfair competition, and with its own growth slowing, it responded in late November with a surprise interest-rate cut.

Many see this as the outbreak of a classic currency war, along 1930s lines, where rival economic giants engage in a pointless game of devaluing their own currency – boosting exports but hitting the spending power of their people – to their mutual detriment. By hitting each other’s capacity to export, they edge the region towards deglobalisation.

The second new dynamic is the game of chicken being played over the oil price between America, Russia and Opec.

26 November

Martin Feldstein: The Geopolitical Impact of Cheap Oil

(Project Syndicate) The low price of oil is good news for the United States economy, because it implies higher real incomes for American consumers. Within the US, the lower price is transferring real income from oil producers to households, which raises short-term demand because households spend a higher proportion of their incomes than oil firms do. For the same reason, the lower price also gives a boost to aggregate demand in Europe, Asia, and other oil-importing regions.

The big losers from falling oil prices include several countries that are not friends of the US and its allies, such as Venezuela, Iran, and Russia. These countries are heavily dependent on their oil revenue to support their governments’ spending – especially massive transfer programs. Even at $75 or $80 a barrel, these governments will have a difficult time financing the populist programs that they need to maintain public support.

Although Saudi Arabia and several of the Gulf states are also major oil exporters, they differ from other producers in two important ways. First, their cost of extracting oil is extremely low, which means that they will be able to produce profitably at the current price – or even at a much lower price. Second, their enormous financial reserves allow them to finance their domestic and international activities for an extended period of time, as they seek to transform their economies to reduce their dependence on oil revenue.

A further decline in the price of oil could have major geopolitical repercussions. A price of $60 a barrel would create severe problems for Russia in particular.

16 November

G20 Brisbane: final communique lists 800 measures for economic growth

G20 Brisbane: final communique lists 800 measures for economic growth

G20 leaders approve a package estimated to increase global growth by at least 2.1% by 2018 after two-day summit

G20 leaders have approved a package of 800 measures estimated to increase their economic output by at least 2.1% by 2018 if fully implemented.

At the end of the two-day summit in Brisbane, Australia, leaders representing 85% of the world’s economy also called for “strong and effective action” on climate change, with countries urged to reveal new emissions reduction targets in the first few months of next year.

Australia, the host nation, had wanted to keep the summit focused on economic growth rather than climate change, but new commitments by China, the US and Japan helped build momentum for stronger global action to curb greenhouse gases.

Communiqué

Raising global growth to deliver better living standards and quality jobs for people across the world is our highest priority. We welcome stronger growth in some key economies. But the global recovery is slow,

uneven and not delivering the jobs needed. The global economy is being held back by a shortfall in demand, while addressing supply constraints is key to lifting potential growth. Risks persist, including in financial markets and from geopolitical tensions. We commit to work in partnership to lift growth, boost economic resilience and strengthen global institutions.

38 maps that explain the global economy

A New Multilateralism for the 21st Century: the Richard Dimbleby Lecture

By Christine Lagarde

London, 3 February 2014

(IMF) The existing instruments of cooperation have proven extremely successful over the past decades, and they must be preserved and protected. That means that institutions like the IMF must be brought fully up to date, and made fully representative of the changing dynamics of the global economy. We are working on that.

More broadly, the new multilateralism must be made more inclusive—encompassing not only the emerging powers across the globe, but also the expanding networks and coalitions that are now deeply embedded in the fabric of the global economy. The new multilateralism must have the capacity to listen and respond to those new voices.

The new multilateralism also needs to be agile, making sure that soft and hard forms of collaboration complement rather than compete with each other. It needs to promote a long-term perspective and a global mentality, and be decisive in the short term—to overcome the temptation toward insularity and muddling through.

Fundamentally, it needs to instill a broader sense of social responsibility on the part of all players in the modern global economy. It needs to instill the values of a global civil market economy—a global “guild hall”, as it were.

What might this mean in practice? It clearly means many things, starting with all global stakeholders taking collective responsibility for managing the complex channels of the hyperconnected world.

For a start, that means a renewed commitment to openness, and to the mutual benefits of trade and foreign investment.

It also requires collective responsibility for managing an international monetary system that has traveled light years since the old Bretton Woods system. The collective responsibility would translate into all monetary institutions cooperating closely—mindful of the potential impact of their policies on others.

In turn, that means we need a financial system for the 21st century. What do I mean by that?

I mean a financial system that serves the productive economy rather than its own purposes, where jurisdictions only seek their own advantage provided that the greater global good prevails and with a regulatory structure that is global in reach. I mean financial oversight that is effective in clamping down on excess while making sure that credit gets to where it is most needed. I also mean a financial structure in which industry takes co-responsibility for the integrity of the system as a whole, where culture is taken as seriously as capital, and where the ethos is to serve rather than rule the real economy. …

We also need the new 21st century multilateralism to get to grips with big ticket items like climate change and inequality. On these issues, no country can stand alone. Combating climate change will require the concerted resolve of all stakeholders working together—governments, cities, corporations, civil society, and even private citizens. Countries also need to come together to address inequality. As but one example, if countries compete for business by lowering taxes on corporate income, this could make inequality worse. (Video of the lecture)

China’s skyscraper craze ‘may herald economic crash’

Tall-building boom may indicate impending disaster in China and India, claims report by Barclays Capital

(The Guardian) China could be the next country to go bust, if its headlong rush to build ever-taller skyscrapers is a guide to its future economic health.

According to a study by Barclays Capital, the mania for skyscrapers over the last 140 years is a sure indicator of an imminent crash.

It points out that the construction boom that threw up New York’s Chrysler and Empire State buildings preceded the New York crash of 1929 and Great Depression.

More recently, Dubai built a forest of skyscraping offices, hotels and apartment buildings, including the world’s tallest, the Burj Khalifa, before it got into terrible financial difficulties. In 2010 Dubai had to be bailed out by its neighbour, Abu Dhabi, to avoid going bankrupt. (11 January 2012)

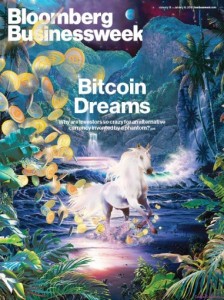

See Wednesday-Night,com BITCOIN

Into the Bitcoin Mines

(NYT) On the flat lava plain of Reykjanesbaer, Iceland, near the Arctic Circle, you can find the mines of Bitcoin.

To get there, you pass through a fortified gate and enter a featureless yellow building. After checking in with a guard behind bulletproof glass, you face four more security checkpoints, including a so-called man trap that allows passage only after the door behind you has shut. This brings you to the center of the operation, a fluorescent-lit room with more than 100 whirring silver computers, each in a locked cabinet and each cooled by blasts of Arctic air shot up from vents in the floor.

These computers are the laborers of the virtual mines where Bitcoins are unearthed. Instead of swinging pickaxes, these custom-built machines, which are running an open-source Bitcoin program, perform complex algorithms 24 hours a day. If they come up with the right answers before competitors around the world do, they win a block of 25 new Bitcoins from the virtual currency’s decentralized network.

The network is programmed to release 21 million coins eventually. A little more than half are already out in the world, but because the system will release Bitcoins at a progressively slower rate, the work of mining could take more than 100 years. (21 December 2013)

*****************************************

14 October

William Watson: In the long view, we’re far less unequal

(Gazette/Ottawa Citizen) The OECD recently published a 274-page study called How Was Life? Global Well-Being since 1820. It’s not entirely clear why an organization of 34 rich countries is analyzing economic history. But both the study and its interactive website are fascinating.

Seen in the historical perspective the OECD’s work provides, inequality means that a few people now have astronomically more than past generations while most of the rest of us have only humongously more. Yet some observers are now so obsessed with inequality they would overturn the social system that has generated such unprecedented well-being. History will weep if we let them.

How Was Life? — Global Well-being since 1820

How was life in 1820, and how has it improved since then? What are the long-term trends in global well-being? Views on social progress since the Industrial Revolution are largely based on historical national accounting in the tradition of Kuznets and Maddison. But trends in real GDP per capita may not fully reflect changes in other dimensions of well-being such as life expectancy, education, personal security or gender inequality. Looking at these indicators usually reveals a more equal world than the picture given by incomes alone, but has this always been the case? The new report How Was Life? aims to fill this gap. It presents the first systematic evidence on long-term trends in global well-being since 1820 for 25 major countries and 8 regions in the world covering more than 80% of the world’s population. It not only shows the data but also discusses the underlying sources and their limitations, pays attention to country averages and inequality, and pinpoints avenues for further research.

9 October

Rival Brics’ New Bank may be stillborn

(Emerging markets) Starting a $100bn multilateral bank is no easy task, especially with Brazil, Russia, India, China and South Africa as its founding shareholders. Experts are warning that disagreements between the five sponsors could make life impossible for the New Development Bank

The sheer headache of starting any such bank is immense. But rivalry and disagreements between the five sponsors of what is officially called the New Development Bank could make life impossible.

Brazil, Russia, India, China and South Africa may find many ways to “stumble over each other”, or make investment decisions that are politically rather than economically motivated, said Harinder Kohli, president and CEO of Centennial Group, a strategic policy and advisory firm.

Kohli – who spent a quarter-century at the World Bank, promoting financial and private sector reforms in east Asia – said governance would be critical to whether the NDB, which hopes to lend up to $34bn a year to projects across the developing world, flails or takes flight.

24 August

2013 St. Petersburg G20 Summit Interim Compliance Report

The 2013 St. Petersburg G20 Summit Interim Compliance Report reviews progress made on selected commitments set out at the 2013 St. Petersburg Summit for the period of 7 September 2013 to 16 June 2014. A report on the full compliance period since the St. Petersburg Summit will be released on the eve of the Brisbane Summit in November 2014.

15 July

BRICS set up bank to counter Western hold on global finances

(Reuters) – Leaders of the BRICS emerging market nations launched a $100-billion development bank and a currency reserve pool on Tuesday in their first concrete step toward reshaping the Western-dominated international financial system.

The bank aimed at funding infrastructure projects in developing nations will be based in Shanghai and India will preside over its operations for the first five years, followed by Brazil and then Russia, leaders of the five-nation group announced at a summit.The biggest challenge for BRICS success? Big brother China

1 July

Mind the gap: why UN development goals must tackle economic inequality

The sustainable development agenda is doomed without a goal to end poverty. It’s time to reject the politics of the fortunate few

There is little doubt that the steady stockpiling of wealth, income and power by the richest in our societies is a disaster for the sustainable development agenda. Pope Francis just about summed it up with his “root of all evil” tweet: inequality undercuts virtually everything the international community is working to achieve. To leave it out of the sustainable development goals (SDGs) is to ignore a key driver of poverty, environmental decline and ill health.

The New Economic Foundation is adding our voice to calls from leading economist Joseph Stiglitz, Oxfam and others for a standalone SDG on eliminating extreme economic inequality.

Everyone agrees on the need to eradicate extreme poverty. Yet the evidence shows that this cannot be done without addressing economic inequality (pdf). This is especially true now that most of the world’s poor live in middle-income countries, where there may be enough money and resources to go around but they are piling up in the hands of a few.

30 June

Brett House & Kevin English: Why Canada needs to push for a truly multilateral financial system

(Globe & Mail) On of the 70th anniversary of the July 1, 1944 Bretton Woods conference – the landmark gathering that created the International Monetary Fund (IMF), the World Bank and later the World Trade Organization (WTO) – it’s hard to know whether it’s the best or worst of times for multilateralism.

On one hand, as American political scientist Daniel Drezner details in his recent book, The System Worked, international co-operation trumped fear, nationalism and protectionism in response to the 2008 financial crisis and rescued the world from a 1930s-style economic death spiral.

On the other hand, more recent events belie any notion of a golden age of internationalism. The WTO is being undermined by mega-regional trade deals and protectionism is on the rise. Emerging markets are getting side-swiped by the end of quantitative easing. Europe remains consumed with its own existential problems, while Southeast Asia, the BRICS and Latin America consider regional alternatives to the IMF.

27 June

The Pitchforks Are Coming… For Us Plutocrats

Memo: From Nick Hanauer

To: My Fellow Zillionaires

The most insidious thing about trickle-down economics isn’t believing that if the rich get richer, it’s good for the economy. It’s believing that if the poor get richer, it’s bad for the economy.

(Politico Magazine July|August 2014)) Republicans and Democrats in Congress can’t shrink government with wishful thinking. The only way to slash government for real is to go back to basic economic principles: You have to reduce the demand for government. If people are getting $15 an hour or more, they don’t need food stamps. They don’t need rent assistance. They don’t need you and me to pay for their medical care. If the consumer middle class is back, buying and shopping, then it stands to reason you won’t need as large a welfare state. And at the same time, revenues from payroll and sales taxes would rise, reducing the deficit.

25 June

Dodge, Carney and the return of pragmatic economics

it is refreshing to hear pragmatic economic policy advice from a respected former senior official of the federal government. The real dragons to be slain are not deficits and debt, but the dismal economic prospects confronting millions of Canadians seeking stable, well-paying jobs.

Central bank governors are not normally known for being outspoken or critical of prevailing economic policies. Not the case, it seems, for Mark Carney and David Dodge, former governors of the Bank of Canada.

Mr. Dodge, in a report for the legal firm Bennett Jones, has recently warned against premature fiscal tightening in the current economic climate. Indeed, he and his coauthors advocate an expansion in infrastructure spending — in ports, roads and transit systems — among other things. Even though this will mean continuing fiscal deficits, they say that “in the current environment of low long-term interest rates, fiscal prudence does not require bringing the annual budget balance to almost zero immediately”. Such counsel flouts the current policy stance of the federal Conservative government, which is to eliminate the budget deficit next year.

Since 2008, policymakers have debated how to prevent the financial crisis from precipitating a second Great Depression. In 2008-09, the Group of 20 (G20) agreed to inject a considerable amount of fiscal stimulus to maintain aggregate demand. At the same time, central banks have implemented interest-rate reductions and provided enormous amounts of liquidity to their banks to maintain confidence and to prevent seizure in payments systems.

Today, it is clear that these countercyclical initiatives helped to avert a global economic catastrophe. But they did not foster economic recovery. By 2010, the revival of financial and corporate profits were mistakenly taken as an indicator of the “green shoots” of economic recovery, even though employment continued to languish below pre-crisis levels.

11 June

How to combat the tightening grip of inequality around the globe

Income inequality has been rising over the past three decades, in the United States most of all, but also in the United Kingdom, Canada and France, according to new findings by the OECD. Among its findings: The … the share of income going to the richest citizens grew in many countries, with the wealthiest 1 percent of the population in the U.S. more than doubling their share since 1980 to nearly 20 percent of all income.Judy Woodruff talks to Angel Gurria, secretary-general of the OECD, about how inequality depresses economic growth.

9 June

Calls for fairness, greater equality at international conference

(Montreal Gazette) A fairer, more egalitarian world economic and financial system received much support Monday — at least rhetorically — at the launch of the 20th annual Conférence de Montréal.

What’s more, Christine Lagarde, managing director of the International Monetary Fund (IMF) endorsed — cautiously and conditionally — the notion of a carbon tax or a cap and trade system.

Lagarde, who received an honorary degree from the Université de Montréal, said at the International Economic Forum of the Americas that the very concept of growth must be redefined and reinvented.

“From China to the U.S., from Germany to Japan, the array of methods of the engines of growth are being re-examined and are changing the economic landscape,” she told a luncheon audience.

Growth is returning — unevenly but steadily, she conceded — after the global recession, but she warned against “the twin enemies of complacency and fatigue.” (CBC) IMF head says world must come to grips with climate change costs— Christine Lagarde says don’t wait for new targets, start carbon tax or other measures now

29 May

Piketty’s Capital: An Economist’s Inequality Ideas Are All the Rage

21 May

Brett House: Turning Economic Threats Into Opportunities

(CIC OpenCanada) The next ten years present a multi-layered set of macroeconomic challenges for Canada and the world that will need to be addressed concurrently. In the short run, enough stimulus needs to be provided to get national and global economies to take-off velocity. At the same time, economic authorities need to begin engineering the conditions to sustain this growth over the long run. Finally, our international institutions need to be renewed to keep them legitimate and effective.

14 May

Russia crisis threatens to wreck fragile global economic recovery

(Emerging Markets) The EBRD is set to publish a gloomy economic forecast as analysts grow increasingly gloomy over the scale of the impact of the Ukraine crisis on the global economy

Fears were growing last night that a Russian recession could cause growth to stall across Europe and through the world economy.

The EBRD is on Wednesday expected to announce a bearish forecast for regional growth, tainted by geopolitical problems in Russia and Ukraine and hostage to growth in the European Union.

“The current probability of western Europe falling into recession has now risen, from zero at the start of the year to 20% now,” said Marcin Mrowiec, chief economist at Warsaw-based Bank Pekao.

Last week Suma Chakrabarti, EBRD president, warned that the bank’s new forecasts for emerging Europe and North Africa would “not be good news”, and would likely represent a downgrade on the 2.7% it forecast for the region’s 2014 growth that it published in January.

9 May

Thomas Piketty: “You do need some inequality to generate growth”

(Globe & Mail) The kind of policy conclusions I derive in the book are already in the public debate. For instance, we have this talk about tax havens. Five years ago, people were saying that nothing would ever happen; Swiss banks would keep their accounts secret and would never accept having automatic transmission of information. And then suddenly there were U.S. sanctions against Swiss banks and things began to change. I think these general moves will continue.

It’s not an all-or-nothing approach. We don’t need a fully global wealth tax to make progress. I think a lot of progress can be made at the U.S. level, at the European level, through intergovernmental cooperation. Even in china, everyone is talking about wealth inequality… People right now are talking a lot about introducing property taxation in China.

7 May

(WEF) The World Economic Forum on Africa is opening in Abuja, Nigeria’s capital on Wednesday with participants, including Heads of Governments and Statesmen, CEOs of global firms, leading financiers and policy and development technocrats, from over 80 countries attending.

It is the first time that the forum is holding in West Africa and Africa’s largest economy is hosting the event that equally attracts global players.

Ahead of the forum, preparations reached top gear on Tuesday with the Nigeria Police Force increasing presence in the capital city and surrounding towns.

The security measure is necessary to ensure that participants are safe, after a bomb attack in Nyanya area of the Federal Capital Territory on May Day, suspected to have been carried out by members of the Boko Haram sect, triggered fear of insecurity in the capital city.

6 May

Global economy strengthening but significant risks remain, says OECD in latest Economic Outlook

The global economy will strengthen over the coming two years, but urgent action is still required to further reduce unemployment and address other legacies from the crisis, according to the OECD’s latest Economic Outlook.

“Advanced economies are gaining momentum and driving the pick-up in global growth, while once-stalled cylinders of the economic engine, like investment and trade, are starting to fire again,” OECD Secretary-General Angel Gurría said while launching the Outlook during the Organisation’s annual Ministerial Council Meeting and Forum in Paris.

“But with the world still facing persistently high unemployment, countries must do more to enhance resilience, boost inclusiveness and strengthen job creation. The time for reforms is now: we need policies that spur growth but at the same time create opportunities for all, ensuring that the benefits of economic activity are broadly shared,” Mr Gurría said (read the full speech).

GDP growth across the 34-member OECD is projected to accelerate to a 2.2% rate in 2014 and 2.8% in 2015, according to the Outlook. The world economy will grow at a 3.4% rate in 2014 and 3.9% in 2015.

29 April

The Resource Revolution

(Project Syndicate) The world is on the threshold of the biggest business opportunity in a century, rivaling both the first Industrial Revolution, which transformed labor productivity, and the second,which mobilized unprecedented amounts of capital to build cities. The new revolution centers on the third primary factor of production: natural resources.

The revolution arrives not a moment too soon. After centuries of wasteful production and consumption practices – facilitated by ever-lower commodity prices that have declined by an average of 0.7% a year in peacetime over the past century – the world is in dire need of technologies that enable producers and consumers alike to do more with less.

28 April

The Economist weighs in on Piketty

Reading “Capital”: Part 4, Conclusion, and recap

So what are the book’s main contributions? First and perhaps most important is the data. As impressive as “Capital” is, it may ultimately prove less influential and significant than the World Top Incomes Database, on which much of the book is based. That, and the data on the distribution and evolution of wealth, represents an enormous achievement and the basis for the narrative. It’s worth pointing out again that Mr Piketty has been just one of many economists working to pull these figures together. Were it not for this effort, the ongoing discussion on inequality would not be as serious and relevant as it is.

Second, the book challenges conventional wisdom concerning the economic history of the rich world in several important ways. Once again, Mr Piketty is not alone in demonstrating, for instance, that Simon Kuznets’ view that inequality would rise and then fall as industrialisation proceeded, or that the shares of national income flowing to capital and labour are not constant. But Mr Piketty has given these ideas new prominence, and with them the view that the 20th century’s dramatic compression of wealth and incomes was largely down to the one-off shock of the interwar era. Putting this all together, Mr Piketty’s book goes a long way toward challenging the 20th century orthodoxy that distribution is not particularly important.

Third, “Capital” provides a framework for thinking about how inequality might evolve in future. Mr Piketty’s data gives us a view of the past. He also gives us his thoughts on how things might unfold in future (albeit with plenty of caveats). But even if readers doubt his forecasts for the rate of return on capital or of economic growth, they will have a way to think about how key distributions will change thanks to this book.

Inequality hurts everyone apart from the super-rich – and here’s why

The extraordinary success of Thomas Piketty’s best-seller shows that progressive ideas are at last winning

(The Guardian) Piketty has written a marvellous, persuasive book that breaks with modern economics’ love affair with mathematics. It is in the same literary tradition as JM Keynes’s The General Theory of Employment, Interest and Money and Adam Smith’s The Wealth of Nations, with an impressive sweep and grasp of economic history. Most important, it is rooted in the facts of inequality that cry out for explanation.

He challenges the conventional postwar view that capitalism was developing in a balanced way so that “growth would float all boats”. This complacent assumption was true of the postwar reconstruction, but only as a “consequence of war and of policies adopted to cope with the shocks of war”. The physical destruction of wealth by war was followed by the further destruction of private wealth as governments reduced their own war debts through inflation. …

The second piece of evidence for my contention that the tide is turning is also important, as it shows that this rising inequality, far from being a price worth paying, actually slows down growth. This research is not from some group of flaming radicals but the International Monetary Fund, an intrinsically conservative institution.

Its report Redistribution, Inequality and Growth compares different countries’ growth and their degree of redistribution (through progressive taxes, benefits, and universal services like health and education). The conclusion is that “lower net inequality is robustly correlated with faster and more durable growth”. There is only weak evidence that even exceptionally large redistributions hamper growth.

The political implications can hardly be overestimated.

26 April

(The Economist cover story) Over the next 20 years the global population of those aged 65 or more will almost double, from 600m to 1.1 billion. That has caused all sorts of worries about slower economic growth. In our cover leader, we point to a new trend: highly-skilled people are continuing to work ever later in life, earning ever more and increasing inequality. This will have dramatic consequences for many countries.

A billion shades of grey — An ageing economy will be a slower and more unequal one—unless policy starts changing now

Across the rich world, well-educated people increasingly work longer than the less-skilled. Some 65% of American men aged 62-74 with a professional degree are in the workforce, compared with 32% of men with only a high-school certificate. In the European Union the pattern is similar.This gap is part of a deepening divide between the well-educated well-off and the unskilled poor that is slicing through all age groups. Rapid innovation has raised the incomes of the highly skilled while squeezing those of the unskilled. Those at the top are working longer hours each year than those at the bottom. And the well-qualified are extending their working lives, compared with those of less-educated people (see article). The consequences, for individuals and society, are profound.

Older, wiser and a lot of them.

The world is on the cusp of a staggering rise in the number of old people, and they will live longer than ever before. Over the next 20 years the global population of those aged 65 or more will almost double, from 600m to 1.1 billion. The experience of the 20th century, when greater longevity translated into more years in retirement rather than more years at work, has persuaded many observers that this shift will lead to slower economic growth and “secular stagnation”, while the swelling ranks of pensioners will bust government budgets.

But the notion of a sharp division between the working young and the idle old misses a new trend, the growing gap between the skilled and the unskilled. Employment rates are falling among younger unskilled people, whereas older skilled folk are working longer. The divide is most extreme in America, where well-educated baby-boomers are putting off retirement while many less-skilled younger people have dropped out of the workforce.

Jim Yong Kim discusses World Bank restructuring

The World Bank is undergoing a restructuring to build organizational trust and promote innovation, says the bank’s president, Jim Yong Kim. “We’re trying to end extreme poverty in the world. If we’re really going to address this challenge then we’re going to have to change, and that’s what we’re going through now,” he says. The Washington Post (tiered subscription model)/On Leadership blog (4/10)

12 March

CIGI paper outlines ‘blueprint for sovereign debt forum’ and offers menu of reforms for preventing future crises

International policy makers should establish a sovereign debt forum to address temporary liquidity problems before they undermine a country’s fundamental solvency, according to a new paper from the Centre for International Governance Innovation (CIGI).

In A Blueprint for a Sovereign Debt Forum, CIGI Senior Fellows Richard Gitlin and Brett House outline a proposal for a sovereign debt forum that would provide a venue to facilitate “early engagement among creditors, debtors and other stakeholders” when sovereigns encounter trouble. This would produce “a more efficient and effective resolution of sovereign financial distress to prevent scenarios where deep debt restructuring becomes the inevitable resolution of severe sovereign crises.”

Gitlin and House detail the limitations of the status quo for addressing sovereign crises, noting the lack of substantial policy improvements since 2003. The result, they write, is that “the world has been caught between the spectre of a rejected proposal for a statutory Sovereign Debt Restructuring Mechanism and a collective action clause-based ad hoc approach to voluntary, market-oriented restructurings that does not produce optimal results.” They illustrate how recent history shows that “sovereigns tend to delay restructuring their debt and, when they do pursue a debt treatment, they are often insufficiently ambitious in seeking to produce a debt burden that is sustainable.”

The authors’ other recommendations include:

• the non-statutory, incorporated, non-profit, membership-based sovereign debt forum would provide an independent standing body to research and preserve institutional memory on best practices in sovereign debt restructuring; and,

• an annotated menu of non-statutory, incremental, but potentially powerful reforms complementary to the sovereign debt forum that could be pursed individually or in groups to address ex ante, in medias res and ex post impediments to reaching better sovereign debt treatments.

OECD could change rules to limit funding to better-off countries

Aid to wealthier developing countries from the Organisation for Economic Co-operation and Development is coming under scrutiny amid concerns that not enough funding is reaching the poorest countries, writes Claire Provost. The Guardian (London)

9 March

Joseph Stiglitz:The Innovation Enigma

(Project Syndicate) In a simpler world, where innovation simply meant lowering the cost of production of, say, an automobile, it was easy to assess an innovation’s value. But when innovation affects an automobile’s quality, the task becomes far more difficult. And this is even more apparent in other arenas: How do we accurately assess the fact that, owing to medical progress, heart surgery is more likely to be successful now than in the past, leading to a significant increase in life expectancy and quality of life?

Still, one cannot avoid the uneasy feeling that, when all is said and done, the contribution of recent technological innovations to long-term growth in living standards may be substantially less than the enthusiasts claim. A lot of intellectual effort has been devoted to devising better ways of maximizing advertising and marketing budgets – targeting customers, especially the affluent, who might actually buy the product. But standards of living might have been raised even more if all of this innovative talent had been allocated to more fundamental research – or even to more applied research that could have led to new products.

Yes, being better connected with each other, through Facebook or Twitter, is valuable. But how can we compare these innovations with those like the laser, the transistor, the Turing machine, and the mapping of the human genome, each of which has led to a flood of transformative products?

Paul Krugman: What can be done about income inequality?

(Economic Times of India) Almost 40 years ago Arthur Okun, chief economic adviser to President Lyndon Johnson, published a classic book titled “Equality and Efficiency: The Big Tradeoff,” arguing that redistributing income from the rich to the poor takes a toll on economic growth. Okun’s book set the terms for almost all the debate that followed: Liberals might argue that the efficiency costs of redistribution were small, while conservatives argued that they were large, but everybody knew that doing anything to reduce inequality would have at least some negative effect on gross domestic product.

But it appears that what everyone knew isn’t true. Taking action to reduce the extreme inequality of 21st-century America would probably increase, not reduce, economic growth.

25 February

Bitcoin exchange Mt. Gox goes dark in blow to virtual currency

Bitcoin exchange Mt. Gox goes dark in blow to virtual currency

(Reuters) – Mt. Gox, once the world’s biggest bitcoin exchange, abruptly stopped trading on Tuesday and its chief executive said the business was at “a turning point” but gave no details.

Several other digital currency exchanges, including Bitstamp and BTC-E, issued statements attempting to reassure investors of both bitcoin’s viability and their own security protocols.

The website of Mt. Gox suddenly went dark on Tuesday with no explanation, and the only activity at the company’s Tokyo office was outside, where a handful of protesters said they had lost money investing in the virtual currency.

Hours later, Mt. Gox CEO Mark Karpeles told Reuters in an email: “We should have an official announcement ready soon-ish. We are currently at a turning point for the business. I can’t tell much more for now as this also involves other parties.” He did not give any other details.

18 February

David Yermack: Bitcoin Lacks the Properties of a Real Currency

(MIT Technology Review) Bitcoin also lacks additional characteristics usually associated with currencies. It cannot be deposited in a bank; instead it must be held in “digital wallets” that have proved vulnerable to thieves and hackers. There is nothing comparable to the deposit insurance relied on by banking consumers. No lenders use bitcoins as the unit of account for consumer credit, auto loans, or mortgages, and no credit or debit cards are denominated in bitcoins.

Even if volatility subsides and the currency finds a place in the world payments system, it has another fatal economic flaw. Only 21 million units can ever be issued, and a fixed money supply is incompatible with a growing economy. In a bitcoin-dominated economy, workers would have to accept pay cuts every year, and prices for goods would gradually fall. Such conditions might lead to public unrest reminiscent of the late 19th century’s free-silver and populist movements—an ironic consequence of a currency known for its futuristic cachet.

13 February

Exclusive: World Bank aims to boost lending by 50 percent over 10 years

(Reuters) – The World Bank hopes to boost its lending by 50 percent over 10 years by cutting costs, loosening a restriction on how much it can lend, and charging richer nations higher fees for some services, several people familiar with the matter said.

The bank’s board signed off on the plan to raise lending by $100 billion this week, and the details are supposed to be worked out ahead of the spring meetings of the World Bank and the International Monetary Fund in April, said the sources, who were not authorized to speak publicly.

The bank’s current loan portfolio is around $200 billion.

The World Bank, a poverty-fighting institution based in Washington, has been undergoing its first major strategic realignment since 1996 to make it more efficient and attuned to what countries need.

Under the new strategy, the bank said it was seeking ways to boost its overall lending portfolio in order to keep itself relevant amid greater competition for development funds.

12 February

Bitcoin is under attack

(CNN Money) Bitcoin is under attack by cybercriminals, bringing down some of the world’s largest Bitcoin exchanges in the process.

Unknown attackers are exploiting a Bitcoin design flaw to record fake transactions, muddying up the Bitcoin system’s public accounting and causing widespread confusion for the centers where people trade them.

The Bitcoin flaw allows these attackers to make a withdrawal from their own account and tamper with the record of that transaction. So they could cash out, but claim they never got the Bitcoins.

7 February

Developing Economies Hit a BRICS Wall

(Spiegel) Until recently, investors viewed China, Brazil and India as a sure thing. Lately, though, their economies have shown signs of weakness and money has begun flowing back to the West. Worries are mounting the BRICS dream is fading. … reality has begun to catch up to the BRICS states. Growth rates in 2013 were far below where they were at their high-water marks. Whereas China’s growth rate reached a high of 14 percent just a few years ago, for example, it topped out at just 8 percent last year. In India, economic expansion fell from a one-time apex of 10 percent to less than 5 percent in 2013; in Brazil growth went from a high of 6 percent to 3 percent. Such values are still higher than those seen in the EU, but they are no longer as impressive.

And worry is spreading. Now, there is a new moniker being used to describe the developing giants: the “fragile five” … meant as a warning to the now brittle-seeming countries of Brazil, India and South Africa as well as to Turkey and Indonesia, both of which are threatened with collapse.

29 January

IMF Raises 2014 Global Growth Outlook

Sees Global Economic Growth at 3.7%, With U.S. Leading Recovery

(WSJ) The International Monetary Fund raised its global economic growth outlook for the year on Tuesday, with expansion to be fueled by U.S., euro-zone and Japanese growth, though deflation and financial-sector risks threaten a full recovery.

“The recovery is strengthening,” though it is still weak and uneven, IMF Chief Economist Olivier Blanchard said as the fund released its latest World Economic Outlook report.

The IMF raised its 2014 global growth forecast to 3.7%, up 0.1 percentage point from its last outlook in October (21 January 2014).

UNDP: Global economic growth is creating more inequality

Developing countries experienced an 11% increase in the gap between poor and rich between 1990 and 2010, the United Nations Development Programme says in a report. If this gap isn’t closed, it could lead to societal unrest, UNDP warns. Reuters (1/29), Inter Press Service (1/29)

25 January

Davos 2014: World Economic Forum – Day Four as it happened

(The Guardian) Highlights from the final day of the World Economic Forum in Davos, including a debate on the Global Economic Outlook this afternoon

Davos 2014: What is at stake?

As world leaders meet at the World Economic Forum, we ask what it would take to lessen the divide between rich and poor.

(Al Jazeera) The theme of this year’s gathering is ‘The Reshaping of the World: Consequences for Society, Politics and Business,’ which looks at the causes of future global instability, like climate change, income inequality and the vast and growing rates of youth unemployment around the world.

One of the highlights of the event was the speech by Iran’s President Hassan Rouhani. Making his most public effort yet to present a friendly face to the world, he said: “No country can resolve their problems on their own. No economic institution can actually grow without paying attention to social issues. No power can have permanent domination over anything. The economic recession, the economic problems in the world show that all of us are on the same ship, the same boat. And if we do not have wise pilots for the ship, we will have problems. Recent problems have shown that economic policies should be based on social justice and the interests of everybody involved … so that everybody’s interests are protected … so that we have durable systems of governance … so that all people can benefit from them.”

Rouhani is positioning himself as a leader vital to global stability and security. His was a speech that combined themes of conciliation, moderation and investment.

Japanese Primer Minister Shinzo Abe also took the chance to remind everyone that Asia has become the growth engine of the world.

But while world leaders are discussing growth, Oxfam said in advance of the annual meeting that the world’s elite have rigged laws in their own favour, undermining democracy and creating a chasm of inequality across the globe.

Inequality has run so out of control, that the 85 richest people on the planet “own the wealth of half the world’s population,” Oxfam said in an introduction to a new report on widening disparities between the rich and poor.

Davos 2014: What we learned

(BBC) … Technology – job destroyer?

There was a lot of discussion about whether advances in technology would lead to a loss of jobs as more and more things become automated. This led to countless comparisons to the industrial revolution.

And it was surprising just how many – including Google’s Eric Schmidt – thought that, although these developments in technology were a good thing, it would result in more people being jobless.

“The jobs problem will be the defining one of the next ten to twenty years,” Mr Schmidt said in a small discussion on the sidelines of the Economic Forum.

One participant – who argued that algorithms were already doing most jobs including writing a magazine – came up with a very unexpected argument (for Davos anyway). Imagine the day when all jobs were done by robots, and we were left to choose how we spent our days – without being driven by the need to pay the mortgage. What a radical thought!

24 January

Davos diary: A new sense of dread is settling over the world’s elites

In Davos, two scenarios are taking shape, like tribal forces on opposing mountainsides. The coming waves of innovation will show who’s right, whether government – having saved the financial system – should now get out of the way of a new industrial revolution. Or whether those states need to step it up, spending tax money on training, helping pick winning technologies and pumping consumers with even more credit to buy what the innovators are creating. At least for now there is general agreement with Eric Schmidt’s take on the race between humans and machines – “that it’s important the humans win.”

(Globe & Mail) Once again, the argument between creative destruction and state-funded stability is the talk of policy-makers, who have woken up to a new year of economic growth around the world and yet a dreaded sense that this global expansion will not bring nearly enough jobs and wage increases to satisfy any public. It’s a tension not seen, perhaps, since the late 1930s, when Schumpeter made his case and a three-decade-long burst of innovation proved him right. For then.

Another machine revolution is upon us. There is a new wave forming behind the past decade’s surge of mobile technology, with disruptive technologies like driverless cars and automated personal medical assistants that will not only change lifestyles but rattle economies and change pretty much every assumption about work.

The talk of one Davos session this week was 3-D printers – for housing. A prototype, it was claimed, is already printing small houses fit for human habitation. Within five years, the entire construction industry could be replaced by a phalanx of printers. Goodbye, a million construction jobs. Hello, a thousand code-writers. …

For all the talk of growth, though, the global economy is also in an employment morass that has the smartest people in the room humbled and anxious. The rebound is not producing jobs and pay increases to the degree that many of them expected. Most governments are tapped out, fiscally, and can only call on the private sector – “the innovators” – to do more.

That in itself seems humbling. Davos was the place where governments often found succor, in a cacophony of panels, speeches and forums that seemed to usually conclude with the view that a government – democratic or theocratic, clean or corrupt – had good reason to go home and get on with it.

Of course, after 9/11, governments coming here expressed dismay at their seeming inability to fight the new enemy. State warfare was gone. Then came the financial crash of 2008, and the state was back. Bailouts, crackdowns, virtual printing presses for money – the interventionists had their day in the Swiss sun.

But rather than a celebration, these countries are all owning up to a new challenge, as amorphous and yet more insidious than anything else on the agenda. You wander into the Google Club and sense that much of what Davos has known is coming unglued. [See comments from Guy Stanley and Tony Deutsch below]

And across the ocean, The British Virgin Islands: A Forbidden City

(ICIJ) In the British Virgin Islands students learn finance in high school, hoping to land a job in the offshore services industry. A French journalist for Le Monde attended a lecture in which teenagers were told: “The Virgin Islands have survived a terrible hurricane. And that hurricane’s name is I-C-I-J!”

21 January

Davos 2014: from PMs and CEOs to Goldie Hawn, Matt Damon and Bono

Simon Goodley explores the ‘constellation of egos’ that makes the World Economic Forum the ultimate business meeting

(The Guardian) … one particular crowd-puller – and hugely important for all those stressed executives who are a little short of me-time – is likely to be actress Goldie Hawn holding forth on the merits of meditation. The star of Shampoo and Private Benjamin is part of a “mindfulness” panel – one of 25 sessions that will cover mental health and wellbeing.

For those keen on learning about life away from the boardroom, the private jet and swish ski resorts there is a 75-minute simulation session available which is designed to demonstrate exactly what it is like to be a Syrian refugee.

16 January

Think-tank raises heat in IMF sovereign debt debate

(Financial Times) The fund is now locked in a protracted consultation period with governments, investors, bankers and academics on how to overhaul the process, and will present formal recommendations to its board in June.

The latest body to step into the politically sensitive and contentious debate is the Centre for International Governance Innovation, a prominent Canada-based think-tank, which presented its arguments directly to the IMF’s executive board on Thursday.

The CIGI’s experts[Brett House and co-author Richard Gitlin] proposed setting up a “Sovereign Debt Forum” for countries and their creditors that the think-tank argued would ameliorate many of the problems identified by the IMF without treading into more controversial areas.

World Economic Forum warns of ‘lost’ generation, dangers in growing inequality

A chronic gap between rich and poor is yawning wider, posing the biggest single risk to the world in 2014, even as economies in many countries start to recover, the World Economic Forum said on Thursday. Its annual assessment of global dangers … concludes that income disparity and attendant social unrest are the issue most likely to have a big impact on the world economy in the next decade.

Ben Bernanke’s Global Legacy

The world is still struggling to digest Alan Greenspan’s mixed legacy as Chairman of the US Federal Reserve Board from 1987 to 2006. So it is too soon to assess whether his departing successor, Ben Bernanke, is headed for history’s chopping block or its pedestal. But the crucial international role that Bernanke and the Fed played during his tenure – a time when domestic economic weakness translated into relatively ineffective American global leadership – should not be overlooked.

In these last five crisis-ridden years, the Fed has affected the world economy in two ways: through its hyperactive policy of purchasing long-term assets – so-called quantitative easing (QE) – and through its largely overlooked role in providing international liquidity. Let us consider each.

Whatever the impact of QE on the US economy, its impact on the rest of the world has been, on balance, generally benign. The first round of QE was unambiguously beneficial, because it minimized, or even eliminated, the tail risk of a global depression after the collapse of Lehman Brothers in September 2008. (14 January)

Traders Losing $1 Million Build EU Case for Bitcoin Rules

(Bloomberg) Trading Bitcoins could bleed you dry, the European Union’s top banking regulator said as it weighs whether to regulate virtual currencies.

Thefts from digital wallets have exceeded $1 million in some cases and traders aren’t protected against losses if their virtual exchange collapses, the European Banking Authority said today in a report warning consumers about the risks of cybermoney.

Virtual currencies such as Bitcoin have come under increased scrutiny from regulators and prosecutors around the globe. China’s central bank barred financial institutions from handling Bitcoin transactions last week and German police arrested two suspects in a fraud probe into illegally generated Bitcoins worth 700,000 euros ($963,000). — Dec 13, 2013

Bitcoin: More Than a Currency, a Potential for Innovation

by David Descôteaux

(Montreal Economic Institute) Bitcoin digital currency has attracted the regular attention of the financial press for the past several months. Its price fluctuates enormously, influenced by new innovative developments but also by positive or negative decisions by governments and central banks concerning its use. Is the Bitcoin system here to stay and become an integral part of our economic lives? Whatever the outcome of this particular experiment, the innovations made possible by new information technology have the potential to revolutionize monetary and financial matters. This Economic Note offers an overview of the Bitcoin phenomenon in order to better understand the issues that it raises.

9 January

‘Businessweek’ Cover Dreams Up a Fantasy Land of Bitcoins and Unicorns

‘Businessweek’ Cover Dreams Up a Fantasy Land of Bitcoins and Unicorns

The Bitcoin-Mining Arms Race Heats Up

Bitcoin is the digital currency that thrills nerds, inspires libertarians, and incites the passions of economists who debate the value of money made from nothing but ones and zeroes. Devotees watch the fluctuations of Bitcoin’s price with a fanaticism typically reserved for college football scores. Alternative currency startups are being lavishly funded by venture capitalists while visionaries gush about the world-changing possibilities of money free from government control. Silicon Valley is the natural center for Bitcoin mania. An advocacy group named Arisebitcoin recently put up 40 billboards around the Bay Area with messages such as: “The Revolution has started … where do you stand?”

As with an actual precious metal, Bitcoins are in limited supply—they must be “mined.” Unlike with precious metals, this mining is done purely by computer. Miners set their machines to run a series of complex calculations that tally up and certify all the transactions of other Bitcoin holders around the world. If the miner’s computers complete these calculations and solve a complex mathematical puzzle before anyone else, he earns about 25 Bitcoins as payment. It’s a nice haul: With the price of each Bitcoin nosing up near $1,000, that’s $25,000 for 10 minutes or so of work. For the moment at least, miners are the rare grunts who can also get rich.

Mint condition: countries tipped as the next economic powerhouses

Forget the Brics and the Civets, Mexico, Indonesia, Nigeria and Turkey are the new kids on the bloc according to economists

(The Guardian) First it was the Brics. For a while the Civets were in vogue. Now the Mints are the ones to watch. Confused? Well, once you know your acronyms it all becomes clear.

The Brics are Brazil, Russia, India and China – four emerging economies lumped together in 2001 by Jim O’Neill, then at Goldman Sachs, to show that western investors needed to take notice of what was happening in the post-cold war global economy.

Robert Ward, of the Economist Intelligence Unit, linked Colombia, Indonesia, Vietnam, Egypt and Turkey but the Civets never really took off. Now O’Neill is championing the Mints, a name first coined by the fund managers Fidelity, for what he thinks will be the second generation of emerging market pace-setters: Mexico, Indonesia, Nigeria and Turkey.

The Mints share some common features. They all have big and growing populations with plentiful supplies of young workers. That should help them grow fast when ageing and shrinking populations will lead inexorably to slower growth rates in many developed countries (and China) over the coming decades.

And they are nicely placed geographically to take advantage of large markets nearby, with Indonesia close to China, Turkey on the edge of the European Union and Mexico on America’s doorstep.

The only problem with this is: Turkey’s economic success threatened by political instability

8 January

Joseph Stiglitz: A dismal new year for the global economy

Unemployment levels in the US and the eurozone point to a tough 2014 despite some small signs of optimism

(The Guardian) Economics is often called the dismal science, and for the last half-decade it has come by its reputation honestly in the advanced economies. Unfortunately, the year ahead will bring little relief.

Real (inflation-adjusted) per capita GDP in France, Greece, Italy, Spain, the United Kingdom, and the United States is lower today than before the Great Recession hit. Indeed, Greece’s per capita GDP has shrunk nearly 25% since 2008.

There are a few exceptions: After more than two decades, Japan’s economy appears to be turning a corner under Prime Minister Shinzo Abe’s government; but, with a legacy of deflation stretching back to the 1990s, it will be a long road back. And Germany’s real per capita GDP was higher in 2012 than it was in 2007 – though an increase of 3.9% in five years is not much to boast about.

Elsewhere, though, things really are dismal: unemployment in the eurozone remains stubbornly high and the long-term unemployment rate in the US still far exceeds its pre-recession levels.

In Europe, growth appears set to return this year, though at a truly anaemic rate, with the International Monetary Fund projecting a 1% annual increase in output. In fact, the IMF’s forecasts have repeatedly proved overly optimistic: the Fund predicted 0.2% growth for the eurozone in 2013, compared to what is likely to be a 0.4% contraction; and it predicted US growth would reach 2.1%, whereas it now appears to have been closer to 1.6%.

With European leaders wedded to austerity and moving at a glacial pace to address the structural problems stemming from the eurozone’s flawed institutional design, it is no wonder that the continent’s prospects appear so bleak.

6 January

Klaus Schwab: The Global Economy in 2014

Ultimately, however, the path to sustained growth requires not just new policies, but also a new mindset. Our societies must become more entrepreneurial, more focused on establishing gender parity, and more rooted in social inclusion. There simply is no other way to return the global economy to a path of strong and sustained growth.

(Project Syndicate) the world’s four largest economies are currently undergoing major transitions. The US is striving to boost growth in a fractured political environment. China is moving from a growth model based on investment and exports to one led by internal demand. Europe is struggling to preserve the integrity of its common currency while resolving a multitude of complex institutional issues. And Japan is trying to combat two decades of deflation with aggressive and unconventional monetary policies.

For each, the formulation and outcome of complex and sensitive policy decisions implies many “unknowns,” with global interdependence heightening the risk of large unintended consequences. For example, the US Federal Reserve’s policy of quantitative easing (QE) has had a major effect on other countries’ currencies, and on capital flows to and from emerging markets.

3 Comments on "Global Economy 2014"

Nick’s Gleanings #546

The world of finance is changing. Wall Street has lost the Dodd-Frank war (with Goldman’s latest quarterly earnings being down QoQ, & significantly so from five years ago, evidence thereof?); for the seemingly endless, & still waxing, string of revelations that Wall Street’s & London’s once much-hyped ‘Masters of the Universe’ had been little more than self-serving cheats & narcissists of little ‘value-added’ merit for the real economy gave US lawmakers little choice but to bite the bullet & the hands that have long fed them. In this context it’s interesting that on January 16th Stephan Leithner, the member of the Deutsche Bank’s ‘management board’5 responsible for personnel & legal matters, , told the German business paper Handelsblatt “If you don’t have the necessary moral compass, you can’t work for us … Acceptance in society is a very valuable asset for Deutsche Bank”, going on to say “some of our employees may have left to pursue transactions at other firms no longer possible at Deutsche Bank”, thereby insinuating that, while the bank had gotten the message, there were others who still haven’t.

[Editor’s note: Apparently not everyone on Wall Street has received the message, judging by today’ announcement that JPMorgan Increases CEO Dimon’s 2013 Pay 74% to $20 Million]

Re Davos diary: A new sense of dread is settling over the world’s elites

Fun reading, thanks, Diana. Innovation has , so far, been unpredictable, but generally came through. Bureaucrats picking winners is an oxymoron. Anyone who can really pick winners can do much better than working for a government. There is a genuine problem I see in all this. An appreciable portion of the working age-population now lacks the literacy and/or is insufficiently numerate to be able to produce value on the job in excess of the minimum wage. I would start putting resources into early childhood education, so as to minimize the problem down the road. What you can do about re-training 55 year-olds is a question of fact, to which I do not know the answer.

I do not think I could do any better even if someone sustained me on prosciutto and Chablis.

Cheers,

Tony

Re Davos diary: A new sense of dread is settling over the world’s elites

Tony’s quite right..a “fun” article. The supposed “deep” insight on innovation waiting to break free will not come to pass if customers can’t buy the products. The only way expansion occurs is if debt is created somewhere. Governments – the lowest risk borrowers – are best positioned to initiate the process. They have to borrow some money and buy something important. Ideally it should add to productivity as it also generates higher growth and jobs. Infrastructure upgrades is the usual thing. The higher growth rates will lower the debt/gdp that bankers seem worried about. Inflation – if it shows signs of igniting as employment picks up – can also be tackled by higher taxes.

Wait! There’s more. Governments also have to be able to break up monopolies and enforce competition. There are enormous barriers to competition in the simplest things now – intellectual property rights durations and bans on re-engineering are much stricter now now than a generation ago, big networked products dominate the evolution of computing, industrial standards setting is mostly a negotiation among dominant producer, regulatory protocols are way to complex (owing to justified fears of cronyism) . Competition is the motor that keeps markets and governments efficient and effective and that ensures a market for innovation.

What about the workers? Turns out people will tolerate competition if they can be sheltered from major risk by a comprehensive social safety net based on sharing productivity increases.

Unfortunately, the “weak state” the Davos crowd has been touting for years no longer has the power to implement such programs as I’ve described. Governments can perhaps set the price of money but can’t raise taxes when they need to. They certainly can’t break up the huge companies that dominate the key industries in the global economy. Moreover, the part of the global economy that has been outperforming the rest for 20 years are state capitalist countries in which the monopolists of political power work in partnership (cahoots?) with the massive global companies who invest there rather than in “free enterprise” societies. (Forget about social programs. Or on the job safety standards. Let workers jump out of the factories if they’re unhappy)

The economic formula I described above is actually the original version of the West German Social Market economy that helped catapult them from ruin to top European economy after the war. Granted, there’s a lot more to the story than the combination of competition and a social compact. But that program or something like it I think would tackle the Davos dilemma successfully. And we’d probably get Google glasses and new materials aircraft etc. a lot faster.

(Let’s see if anyone agrees)