Re Ian Bremmer 'Could third-party candidates upend the 2024 US election?' 3 April The current political movement in the USA…

Global Economy 2015

Written by Diana Thebaud Nicholson // December 28, 2015 // Geopolitics, Global economy // 1 Comment

Martin Feldstein: The Global Economy Confronts Four Geopolitical Risks

(Project Syndicate) The end of the year is a good time to consider the risks that lie ahead of us. There are of course important economic risks, including the mispricing of assets caused by a decade of ultra-low interest rates, the shifts in demand caused by the Chinese economy’s changing structure, and European economies’ persistent weakness. But the main longer-term risks are geopolitical, stemming from four sources: Russia, China, the Middle East, and cyberspace.

Michael Burry, Real-Life Market Genius From The Big Short, Thinks Another Financial Crisis Is Looming

(New York Magazine) … we are right back at it: trying to stimulate growth through easy money. It hasn’t worked, but it’s the only tool the Fed’s got. Meanwhile, the Fed’s policies widen the wealth gap, which feeds political extremism, forcing gridlock in Washington. It seems the world is headed toward negative real interest rates on a global scale. This is toxic. Interest rates are used to price risk, and so in the current environment, the risk-pricing mechanism is broken. That is not healthy for an economy. We are building up terrific stresses in the system, and any fault lines there will certainly harm the outlook.

What makes you most nervous about the future?

Debt. The idea that growth will remedy our debts is so addictive for politicians, but the citizens end up paying the price.

What, if anything, makes you hopeful about the future?

Innovation, especially in America, is continuing at a breakneck pace, even in areas facing substantial political or regulatory headwinds. The advances in health care in particular are breathtaking — so many selfless souls are working to advance science, and this is heartening. Long-term, this is good for humans in general. Americans have so much natural entrepreneurial drive. The caveat is that it is technology that should be a tool making lives better in the real world, and in line with the American spirit of getting better and better at something, whether it’s curing cancer or creating a better taxi service. I am less impressed with the market values assigned to technology that enhances distraction.

9 November

OECD Trims Global Growth Forecast on Emerging-Market Slowdown

(IBT) World output will expand 2.9 percent in 2015 and 3.3 percent in 2016, down from the 3 percent and 3.6 percent predicted in September, the Organization for Economic Cooperation and Development said in a semi-annual report published Monday.

“Global growth prospects have clouded this year,” the Paris-based organization said. “The outlook for emerging-market economies is a key source of global uncertainty at present.”

With Russia and Brazil in recession and China poised to deliver its weakest expansion in more than two decades, the economies that powered world growth in recent years are now slowing it down. Developed economies are feeling the brunt in the form of reduced demand for both commodities and manufactured goods.

27 October

Oil Price Not Done Crashing, Saudi Arabia Could Be Broke In Five Years: Reports

Saudi Arabia projected to run massive deficits

(HuffPost) Despite oil prices having already fallen 60 per cent from their highs last year, investment bank Goldman Sachs says they could suffer another major decline as storage space for refined fuel gets closer to full capacity.

Meanwhile, a report from the IMF warns that Middle Eastern oil-exporting countries, particularly Saudi Arabia, could go broke within five years if oil prices stay at current low levels.

The bank has been bearish on oil’s prospects for months, warning in September that it could take oil prices as low as US$20 a barrel to clear the global glut of oil.

With many analysts now predicting a prolonged period of low oil prices ahead, attention is turning to the many countries that rely primarily on oil for their wealth. The IMF warned in a report issued last week that Middle Eastern oil-exporting countries, particularly Saudi Arabia, risk bankruptcy if oil prices remain low and government policies don’t change.

With the exception of Kuwait, Qatar and the United Arab Emirates, Middle Eastern oil exporters “would run out of buffers in less than five years because of large fiscal deficits,” the IMF said.

15 October

The story of the world economy is about to be up-ended. For the last 30 years, global growth has been premised on a fast-growing China. Matt Phillips explains how the coming Chinese slowdown will affect everything from emerging-market currencies to, possibly, US borrowing costs, showing just how closely it’s all interconnected.

The last 30 years of global economic history are about to go out the window

(Quartz) This year will see the first net outflow of capital from emerging markets in 27 years, according to the Institute of International Finance, a trade group representing international bankers. The group expects more than $500 billion worth of cash previously invested in things like Chinese factories, Brazilian government bonds, and Nigerian stocks to cascade out of such markets this year. In a profound change of narrative for both the global economy and markets that are closely tied to it, the story of fast Chinese growth—a story that has soothed investors and corporate managers around the world since the 1980s—is looking increasingly tough to square with the evidence. And it’s even tougher to imagine anything else like China—a billion new consumers joining the global economy—emerging any time soon.

13 October

Half of world’s wealth now in hands of 1% of population – report

Inequality growing globally and in the UK, which has third most ‘ultra-high net worth individuals’, household wealth study finds

The middle classes have been squeezed at the expense of the very rich, according to research by Credit Suisse, which also finds for the first time that there are more individuals in the middle classes in China – 109m – than the 92m in the US.

“Middle class wealth has grown at a slower pace than wealth at the top end,” said Tidjane Thiam, the chief executive of Credit Suisse. “This has reversed the pre-crisis trend which saw the share of middle-class wealth remaining fairly stable over time.”

10 October

Central bank cavalry can no longer save the world

In 2008 central banks, led by the Federal Reserve, rode to the rescue of the global financial system. Seven years on and trillions of dollars later they no longer have the answers and may even represent a major risk for the global economy.

A report by the Group of Thirty, an international body led by former European Central Bank chief Jean-Claude Trichet, warned on Saturday that zero rates and money printing were not sufficient to revive economic growth and risked becoming semi-permanent measures.

“Central banks have described their actions as ‘buying time’ for governments to finally resolve the crisis… But time is wearing on, and (bond) purchases have had their price,” the report said.

World’s financial guardians near funding crisis point

(Emerging Markets) The World Bank, IMF and regional development banks are coming under pressure to ask for more capital in the face of mounting demand for help from ailing and failing middle and lower income countries

Leading multilateral lenders face an increasingly fraught future as they seek to tap new credit lines in an attempt to fund new projects across the emerging and developed worlds as their finances are stretched to breaking point.

All the world’s major institutions are under mounting pressure to prop up ailing and failing countries, and to pump much-needed capital into number of private and public sector projects.

Pressure varies by multilateral. The International Monetary Fund is faced with the need to be able to react quickly and robustly if emerging markets collapse under the combined weight of slow growth and rising debts, or simply run out of cash.

Having focused virtually wholesale on struggling eurozone and emerging Europe since the 2008/09 financial crisis, questions now loom over which other emerging markets, whether in Latin America, Africa, or Asia, may need propping up.

The IMF’s capacity to meet any extra demand on its resources arising from the mounting problems in emerging markets is strong, officials say. “In fact, it’s never been stronger,” one told Emerging Markets.

Over at the other Bretton Woods institution, the question is whether the World Bank has enough capital to provide support for projects strewn across the developing and middle-income worlds.

Speaking earlier this week, Reserve Bank of India governor Raghuram Rajan called publicly for wealthier nations to inject more capital into the sprawling group, creating a “global safety net” designed to help nations buckling under economic strain and short of liquidity.

9 October

The Scariest Trade Deal Nobody’s Talking About Just Suffered a Big Leak

(The New Republic) The Obama administration’s desire for “fast track” trade authority is not limited to passing the Trans-Pacific Partnership (TPP). In fact, that may be the least important of three deals currently under negotiation by the U.S. Trade Representative. The Trans-Atlantic Trade and Investment Partnership (TTIP) would bind the two biggest economies in the world, the United States and the European Union. And the largest agreement is also the least heralded: the 51-nation Trade in Services Agreement (TiSA).

TiSA has been negotiated since 2013, between the United States, the European Union, and 22 other nations, including Canada, Mexico, Australia, Israel, South Korea, Japan, Norway, Switzerland, Turkey, and others scattered across South America and Asia. Overall, 12 of the G20 nations are represented, and negotiations have carefully incorporated practically every advanced economy except for the “BRICS” coalition of emerging markets.

The World Bank and International Monetary Fund meet in Peru. The groups’ joint annual meetings are taking place in Lima, as the IMF warns of a triple threat to the world’s economy and the World Bank issues a dire warning about mass migration. (Spoiler alert: Europe’s migrant crisis is just the beginning.)

7 October

IMF Warns of Growing Emerging-Market Risks as Fed Nears Liftoff

(Bloomberg) China, in particular, faces a “delicate” task in shifting to more consumption-driven growth without exposing the weaknesses of highly indebted companies and banks saddled with rising non-performing loans. “Recent market developments underscore the complexity of these challenges, as well as potentially stronger spillovers from China,” the fund said in the periodic report.

Meanwhile, problems lingering from the financial crisis still pose risks to advanced nations, including elevated public and private debt, and “remaining gaps in the euro area financial architecture.” Changes to the structure of the world’s bond markets, including a reluctance by traditional dealers to serve as market makers, may leave investors starved for liquidity when interest rates rise, according to the Washington-based fund.

2 October

Top Banker: Climate Change Threatens Global Financial Crash

(Truthdig) A warning that climate change might make the world’s stock markets and banks unstable and lead to a financial crash has come from Mark Carney, chairman of the G20 countries’ Financial Stability Board.

Carney, who is also Governor of the Bank of England, particularly warns about the effects on the market if panic selling occurs and there is a plunge in value of shares in fossil fuel companies and industries that produce a lot of carbon dioxide.

These companies, some of the world’s largest, control one-third of stock market assets. If investors realise these stocks are overvalued and try to sell them all at once, it will cause chaos, Carney said.

The stark warning is a “remarkable intervention” from one of the world’s most conservative and influential bankers, who says he will be advising the world’s richest nations at the G20 summit in November to put policies in place to prevent climate change causing future severe turmoil in the markets.

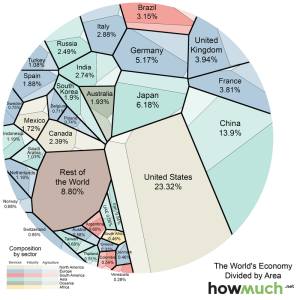

This striking diagram will change how you look at the world economy

This striking diagram will change how you look at the world economy

(Vox) Here’s a very cool data visualization from HowMuch.net that took me a minute to figure out because it’s a little bit unorthodox. The way it works is that it visualizes the entire world’s economic output as a circle. That circle is then subdivided into a bunch of blobs representing the economy of each major country. And then each country-blob is sliced into three chunks — one for manufacturing, one for services, and one for agriculture. (August 2015)

Jeffrey Sachs on the Future of Economic Development

(Mercatus Center) … looking back, I would put more weight on the political economy aspects probably than the pure, market-driven “Dutch disease” aspects which I talked about a quarter century ago. The idea at the time was that if you have resource wealth that pulls you away from more labor-intensive and technology-intensive industries. You don’t learn as much. You don’t develop as much endogenous growth.

Now I would say if you have resource wealth, one problem is you’re likely to be invaded. You have more vulnerability to geopolitics as well as to internal politics to mess things up. (9 April 2015)

On the eve of the 2015 World Economic Forum (Davos), Christine Lagarde writes Why 2015 Is a Make-or-Break Year for the Global Economy,

(HuffPost) As 2015 begins, policymakers around the world are faced with three fundamental choices: to strive for economic growth or accept stagnation; to work to improve stability or risk succumbing to fragility; and to cooperate or go it alone. The stakes could not be higher; 2015 promises to be a make-or-break year for the global community.

[NB This is a re-post of her article in Project Syndicate titled The Right Choices for 2015]

Does Davos Actually Do Anything?

Research shows that the World Economic Forum, a meeting reserved for the one percent, might actually affect the rest of us (World Post, 23 January 2015)

Mark Carney: most fossil fuel reserves can’t be burned

Bank of England governor lends his support to ‘carbon bubble’ theory that coal, gas and oil assets are at risk

(The Guardian) The governor of the Bank of England has reiterated his warning that fossil fuel companies cannot burn all of their reserves if the world is to avoid catastrophic climate change, and called for investors to consider the long-term impacts of their decisions.

According to reports, Carney told a World Bank seminar on integrated reporting on Friday that the “vast majority of reserves are unburnable” if global temperature rises are to be limited to below 2C.

Carney is the latest high profile figure to lend his weight to the “carbon bubble” theory, which warns that fossil fuel assets, such as coal, oil and gas, could be significantly devalued if a global deal to tackle climate change is reached.

The movement has gained traction in recent weeks, with the World Bank leading an initiative with 73 national governments, 11 regional governments, and more than 1,000 businesses and investors to build support for a global price on carbon emissions during the United Nations climate summit in New York. (13 October 2014)

24 September

Obama contacts Mexico, not Canada, to help conclude Pacific Rim deal

U.S. President Barack Obama is reaching out to his Mexican counterpart, Enrique Pena Nieto, as Washington launches a charm offensive to close a massive Pacific Rim trade deal next week.

As of Thursday afternoon, he had not made a similar call to Canadian Prime Minister Stephen Harper.

23 September

The post-2015 agenda and the evolution of the World Bank Group

(Brookings) This paper argues that the Addis Action plan and the SDGs represent a milestone in the changed thinking about the role of the multilateral development banks (MDBs) and the World Bank Group (WBG) in particular. By elaborating on a universal agenda for sustainable development, rather than a narrow focus on reducing poverty, the scope and ambition of support needed by low and middle-income countries has widened substantially. This paper looks at how the WBG might respond to these new challenges.

The SDGs cover a far broader scope than the Millennium Development Goals, and represent, in many ways, a validation of what the WBG has been doing for many years. The Addis Ababa Action Agenda for the third U.N. financing for development conference shows why:

– It puts the responsibility for development squarely on countries themselves; “Cohesive nationally owned sustainable development strategies, supported by integrated national financing frameworks, will be at the heart of our efforts.” The role of development agencies, in this view, is to support country-led processes, not replace them. This favors organizations like the World Bank Group with country-based operational structures and strong country presence, compared to, for example, vertical funds that have a global thematic focus but weaker country footprints.

– It gives prominence to “blended finance” and the leveraging of grants and other support with money raised on private capital markets. The Bank has always done this, with particular success in partnering with the Global Environment Facility (GEF), various climate trust funds, the Global Partnership for Education, and the Global Agriculture and Food Security Program.

– It calls for multifaceted interventions.

7 September

The Inclusive Road to Growth

By Klaus Schwab & Richard Samans

(Project Syndicate) Policymakers have yet to develop an internationally recognized policy framework – with a corresponding set of indicators and measurable milestones – to guide countries targeting broad-based improvements in living standards, rather than simply continuing to use GDP growth as the bottom-line measure of national economic performance.

The extent to which growth creates opportunities and improves living standards depends on an array of structural and institutional economic policies, including many in areas outside of education and redistribution (the areas most commonly featured in discussions about inequality). There is a growing recognition of the importance of institutions – particularly legal frameworks and public agencies that administer rules and incentives – in the development process. But this recognition has yet to penetrate fully the approach to economic growth that most economists and policymakers take.

31 August

A Tale of Two Theories

Jean Pisani-Ferry examines the main competing explanations for the global economy’s persistent malaise.

(Project Syndicate) Global growth disappoints again. A year ago, the International Monetary Fund expected world output to rise 4% in 2015. Now the Fund is forecasting 3.3% for the year – about the same as in 2013 and 2014, and more than a full percentage point below the 2000-2007 average.

In the eurozone, growth in the latest quarter was underwhelming. Japan has returned to negative territory. Brazil and Russia are in recession. World trade has stalled. And China’s economic slowdown and market turmoil this summer have created further uncertainty. …

There are essentially two competing explanations. The first, the Secular Stagnation Hypothesis, has been proposed by Larry Summers. Its key premise is that the equilibrium interest rate at which demand would balance supply is currently below the actual interest rate …

The alternative explanation for the persistence of weak global growth has been best formulated by the Bank for International Settlements, an organization of central banks. The BIS maintains that excessively low interest rates are a big reason why growth is disappointing. This explanation may seem even more paradoxical than the first, but the logic is straightforward: Governments often try to escape the hard task of improving economic efficiency through supply-side reforms and rely on demand-side fixes instead. So, when confronted with a growth slowdown caused by structural factors, many countries responded by lowering interest rates and stimulating credit.

28 August

Why $40 oil is killing Iraq, Venezuela and others, but not Russia [or Scotland]

(Reuters) Putin and Sturgeon’s popularity is propelled by a force more powerful — at least to date — than the desire for better living standards. Especially in Russia, there is a pride in displaying courage and patriotism in the face of deprivation and aggression, seen as coming largely from the United States. In Scotland, the propaganda is more muted and the English enemy less clearly delineated, but nationalism needs a foe, and the English are it.

There is no question of which nationalism is more dangerous. An independent Scotland would reduce the UK’s authority, further weaken the EU and greatly damage the state itself. Russian nationalism on the other hand is a danger, perhaps a disaster, on a global scale, not least because its political success spawns imitators. For example, China, heading into harder times and taking the world with it, has a leader keen on promoting the “Chinese dream” — a stronger, more nationalistically inclined China.

Nationalism hasn’t gone out with the tide: it’s coming in waves.

24 August

Why is China’s stock market falling and how might it affect the global economy?

Concerns about inflation, shares and interest rates are raised after ‘Black Monday’ chaos sees billions wiped off markets around the globe

Officials in Beijing are under pressure to step in with more measures to restore stability to China’s stock markets. The trouble they face is that every action is also perceived as a further sign of quite how worried they are about the slide in shares and the wider economy.

From Thursday, investors will be looking to the US and a symposium of central bankers in Jackson Hole, Wyoming, for signs of how this new bout of market volatility may influence their interest rate decisions.

11 August

China’s devaluation fires cannon in global currency war

The global “currency war” entered a new phase on Tuesday as China’s surprise devaluation threatened to unleash competitive devaluations and keep monetary policy around the world looser for longer, perhaps even forcing the U.S. Federal Reserve to delay its expected interest rate rise.

“Currency wars”, a phrase used by Brazil’s former finance minister Guido Mantega in 2010 to describe how competing countries explicitly or implicitly weaken their exchange rates to boost exports, have intensified in recent years.

As interest rates have fallen to zero in some developed economies and money printing has proliferated, exchange rate policy has become one of the few remaining levers to stimulate business activity and in some cases avoid deflation. So investors are now concerned that China may elect to keep pushing the yuan lower.

(Quartz) China devalued its currency, and markets reacted. The central bank lowered the value of the yuan by 1.9%, its biggest drop in more than 20 years, sending the currency to 6.32 against the dollar, from 6.21 on Monday. That dealt a blow to exporters such as car makers and luxury goods companies that sent European stocks down in the morning. In the Asia-Pacific region, several currencies, including the Australian dollar, lost value; metals also weakened on the news.

9 August

BCA’s Peter Berezin comments:

• Worries about flagging global growth and brewing deflationary pressures continue to weigh on global equities.

• Central banks will be hard-pressed to raise rates in such an environment, which should help keep bonds well bid.

• Chinese policymakers are stepping up efforts to support the economy, but concerns about high debt levels are likely to limit their room for maneuver.

• The good news is that a greater-than-expected slowdown in Chinese growth would not generate the dramatic spillovers to the rest of the world that many people fear. Far from being a global “growth engine”, China is more like a caboose.

• That said, weaker Chinese growth would still have a significant adverse effect on commodity exporters and a number of Asian economies.In addition, if a deceleration in Chinese growth was accompanied by a further generalized slowdown in other emerging markets, this could have far-reaching consequences for global asset markets.

6 August

From Our Chief Economist –The TPP is dead

(The Economist) The latest talks on the Trans-Pacific Partnership (TPP) did not end well and election timetables in Canada and the US mean that the prospect of a deal being ratified before the end of 2016 (at the earliest) is remote. The usual problem of agricultural markets was prominent, headlined by Canada’s refusal to open its dairy sector. For New Zealand—one of the four founder countries of the TPP, along with Brunei, Chile and Singapore—this was a non-negotiable issue. Dairy was not the only problem. As usual, Japan was worried about cars and rice, and the US about patent protection for its pharma companies.

The TPP was probably doomed when the US joined, and certainly when Japan did. It then became more of a political project than an economic one. Big trade agreements had hitherto focused on physical goods, while the TPP had an aim of forging rules of trade beyond this in intellectual property, investment and services. China was a notable absence, and the US and Japan, in particular, were keen to set these rules with enough of the global economy behind them such that China would be forced into line later on. For now, the shape of international standards in these areas remains up for grabs. The next step for the TPP, if anything, is whether a smaller group—such as the founding four —will break away and go ahead on their own, with a much smaller share of global GDP involved, and in the hope that others will join later.

4 August

Kenneth Rogoff: A New Deal for Debt Overhangs?

(Project Syndicate) The International Monetary Fund’s acknowledgement that Greece’s debt is unsustainable could prove to be a watershed moment for the global financial system. Clearly, heterodox policies to deal with high debt burdens need to be taken more seriously, even in some advanced countries.

Ever since the onset of the Greek crisis, there have been basically three schools of thought. First, there is the view of the so-called troika (the European Commission, the European Central Bank, and the IMF), which holds that the eurozone’s debt-distressed periphery (Greece, Ireland, Portugal, and Spain) requires strong policy discipline to prevent a short-term liquidity crisis from morphing into a long-term insolvency problem.

The orthodox policy prescription was to extend conventional bridge loans to these countries, thereby giving them time to fix their budget problems and undertake structural reforms aimed at enhancing their long-term growth potential. This approach has “worked” in Spain, Ireland, and Portugal, but at the cost of epic recessions. Moreover, there is a high risk of relapse in the event of a significant downturn in the global economy. The troika policy has, however, failed to stabilize, much less revive, Greece’s economy.

27 July

Can the world end extreme poverty?

(Brookings) In 2015, about 840 million people, or 13 percent of the world, are living in extreme poverty—on less than $1.25 per day. There’s been rapid progress in reducing this number: more than 1 billion people have escaped extreme poverty since 1990. This success has encouraged the development community to rally around a new, ambitious goal of ending extreme poverty by 2030. At least two in five of those in extreme poverty live in unstable or conflict-ridden areas. Others have been left behind in lagging areas of their countries, often unable to find jobs or other opportunities to sustain their livelihoods. Still others have fallen back into poverty, or failed to escape poverty, because they could not recover from one or more shocks—climatic, health, or economic. This highlights three critical challenges that must be overcome by those who seek to end extreme poverty:

24 July

World Post weekend roundup: Pepe Escobar writes that Tehran, Beijing, Moscow, Islamabad and New Delhi have been establishing interlocking security guarantees — including the Eurasian Economic Union, the BRICS’ New Development Bank, the Shanghai Cooperation Organization and the Asian Infrastructure Investment Bank — and that a “Eurasian Big Bang” will soon make the West “sweat bullets.” .”

15 July

Just Enough, Just in Time: Improving Sovereign Debt Restructuring for Creditors, Debtors and Citizens

by: Richard Gitlin and Brett House

(CIGI) Recent international financial turmoil — most notably in Greece — has refocused attention on the risks posed by severe sovereign debt crises and weaknesses in our approaches to restructuring sovereign debt. Since early 2010, these risks have driven a range of debt-related policy proposals and actions in individual economies, across regions and at the international financial institutions. While some incremental first reform steps have been taken, these have not yet produced a more efficient, effective or resilient international framework for handling severe sovereign debt crises and effecting sovereign debt workouts. In contrast, some institutional and policy changes made in the heat of the euro-zone crisis have raised as many questions as they have resolved. Old policy ideas are also being resurrected and configured in new ways for current challenges. After years of substantial fiscal stimulus and exceptional monetary policies, high debt burdens across the advanced economies, fears of secular stagnation, signs of an imminent increase in US borrowing costs and deteriorating demographics together make a compelling case for concerted action to improve international arrangements for dealing with distressed sovereign debt.

8 July

Modernizing the IMF

(Project Syndicate) The international system of economic governance is at a turning point. After 70 years, the Bretton Woods institutions – the International Monetary Fund and the World Bank –appear creaky, with their very legitimacy being questioned in many quarters. If they are to remain relevant, real changes must be made.

The IMF, in particular, is facing challenges on all sides. In the United States, Congress is stalling not only on international issues like trade, but also on the implementation of reforms that would expand the role of emerging economies in the IMF. For its part, Europe has drawn the organization into its debt crisis, with Greece having already missed a payment on its IMF loans (though the Fund is not calling it a default). And, in Asia, the IMF still carries a stigma, because of its flawed response to the region’s financial crisis in the late 1990s.

How can the IMF reprise its role as a guardian of international financial stability? One solution could be to adjust its international reserve asset, the Special Drawing Rights (SDR), by adding the Chinese renminbi to the basket of currencies that determines its value.

2 July

The Worst-Case Scenario for the Global Economy

If Greece and China both falter, here’s how it could all come tumbling down.

(Foreign Policy Magazine) The most obvious risks are in the eurozone and China. If Greece defaults and eventually has to abandon the euro, the currency’s sheen of invulnerability will disappear. The impossible will have become possible, and investors will be forced to consider the fact that other countries — Portugal may be next in line — might someday exit the eurozone as well.

Uncertainty about the underlying value of the euro will increase dramatically. There will be no way to know what the euro or euro-denominated securities ought to be worth if the makeup of the eurozone itself is unpredictable.

All other things equal, though, Greece’s exit will make the euro more valuable. Countries with weaker fiscal positions and demand for securities only serve to dilute the strength of Germany, France, and the other euro stalwarts. But the appreciation of the euro could hurt exports from those same countries, eroding the scant economic growth they’ve been able to achieve — and they’re much more important to the global economy than Greece.

Now throw in the bursting stock-market bubble in China. Companies there have used high stock prices to pay off debt through new public offerings. But investors have borrowed hundreds of billions to finance their portfolios, pushing prices still higher. If the markets crash — and even a loosening of rules on margin trading hasn’t been able to stop their recent slide — free-spending companies will have garnered an undeserved measure of solidity at the expense of millions of Chinese households. Billions in private saving will have financed a raft of pointless projects, destroying wealth and distorting incentives at the same time.

29 June

Leaked document: World Bank rife with ‘fear and retaliation’

(ICIJ) Many World Bank Group employees complain the bank’s managers are shutting down internal debate and ruling by fear, according to a confidential document obtained by the International Consortium of Investigative Journalists and The Huffington Post.

“The World Bank has evolved into a place of fear and retaliation,” one employee said, according to a 163-page compilation of open-ended comments that were submitted last year as part of an in-house bank survey. “Intellectual debate is no longer welcome. Management is inept and there is no captain in this ship. Senior management does not know its own organization… only fear, fear, fear.” “Managers have a lot of power and use it for retaliation,” another employee wrote.

Employee surveys that invite staffers to submit anonymous responses often reflect some dissatisfaction, especially in an institution with the size and reach of the World Bank Group, a global financier that backs dams, roads and hundreds of other development projects each year. But the harshly critical responses to the survey completed by about 12,000 employees – 79 percent of the bank’s workforce – appear to go well beyond typical gripes about pay and fairness. The survey shows a startling lack of support among the bank’s employees for senior management – and reflects deep worries about a culture that many characterize as toxic.

Just 26 percent of employees who responded to the survey’s specific questions said they agree that bank leadership “creates a culture of openness and trust.” Only 41 percent said they were confident they could report unethical conduct without fear of reprisal.

26 June

Rodrigue Tremblay: Pitfalls of Economic Globalization

(Global Research) … the rise of economic globalization … has brought the increased interdependence of national economies and a rise in competition, not only between corporations but also between countries.

This interdependence and competition have increased much more quickly than could have been envisaged, 25 or 30 years ago, with the result that international economic integration today greatly exceeds the realm of international trade to encompass the international mobility of corporations and the integration of financial and money markets. In some areas dominated by technology, especially in the field of digital and information technology, we already live in a world almost without national borders. The consequences of increased globalization are not only economic; they are also political and social.

But globalization also means a greater complexity of economic relations and an increased vulnerability of national economies to shocks from outside. This requires, for a given country, that the net benefits resulting from globalization must be greater than the net losses of any nature arising from such greater complexity and greater vulnerability.

Beside the purely economic costs of complexity, there are social and political costs that arise from such enhanced global economic complexity.

27 May

Building modern-day Silk Roads

The Silk Road Fund and the Asian Infrastructure Investment Bank are part of China’s “One Belt, One Road” strategy, which has the potential to transform development finance.

(Open Canada) After a late flurry of additions to the founding membership of the Asian Infrastructure Investment Bank, attention now turns to setting the China-led AIIB’s rules and regulations. But important questions remain – most important, whether the AIIB is a potential rival or a welcome complement to existing multilateral financial institutions like the World Bank.

Since China and 20 mostly Asian countries signed the AIIB’s initial memorandum of understanding last October, 36 other countries – including Australia, Brazil, Egypt, Finland, France, Germany, Indonesia, Iran, Israel, Italy, Norway, Russia, Saudi Arabia, South Africa, South Korea, Sweden, Switzerland, Turkey, and the United Kingdom – have joined as founding members.

Like the $50 billion New Development Bank announced by the BRICS countries (Brazil, Russia, India, China, and South Africa) last summer, the AIIB has faced considerable scrutiny, with some Western leaders questioning its governance, transparency, and motives. Indeed, many in the West have portrayed their establishment as part of an effort to displace existing multilateral lenders.

But the new development banks seem less interested in supplanting current institutions than in improving upon them – an objective shared by those institutions themselves. As Deputy Finance Minister Shi Yaobin pointed out recently, by recognizing the need to reform their governance, existing multilateral lenders have shown that there are, in fact, no “best practices” – only “better practices.” There is no reason improvements cannot originate elsewhere.

20 April

A Global Marshall Plan

(Project Syndicate) This year’s major global meetings – the Conference on Financing for Development in July, the meeting at the United Nations to adopt Sustainable Development Goals in September, and the UN Climate Change Conference in Paris in December – should be sufficient. And the efforts that have gone into preparing for these meetings suggest that there is a will to move forward.

But the right program is key. The world needs a well-designed and far-reaching strategy to stimulate industrialization, modeled after the European Recovery Program – the American initiative that enabled Europe to rebuild after World War II. The Marshall Plan, as it is better known, entailed a massive infusion of US aid to support national development efforts in Europe, and is still viewed by many Europeans as America’s finest hour. …

Marshall’s vision offers important lessons for world leaders seeking to accelerate development today, beginning with the need to reverse the effects of the Washington Consensus on developing and transition economies – effects that resemble those of the Morgenthau Plan. Some countries – including large economies like China and India, which have long protected domestic industry – have been in a better position to benefit from economic globalization. Others have experienced a decline in economic growth and real per capita income, as their industry and agricultural capacity have fallen, especially over the last two decades of the last century.

It is time to increase poor economies’ productive capacity and purchasing power, as occurred in Europe in the decade after Marshall’s speech. Marshall’s insight that such shared economic development is the only way to create a lasting peace remains as true as ever.

17 April

The US is naming and shaming economic allies for relying too much on American demand

(Quartz) At a meeting of the top global economic institutions, US Treasury secretary Jack Lew warned a number of countries, including close US allies, that they are freeloading too much off of America’s growing economy.

“We are concerned that the global economy is reverting to the pre-crisis pattern of heavy reliance on US demand for growth,” Lew said in his remarks at the International Monetary Fund’s annual governance meeting. “Significantly, economies projected to record rising current account surpluses, including Korea, Germany, China, and Japan, should move expeditiously to pursue domestic-demand boosting policies.”

(Quartz) The International Monetary Fund and the World Bank meet. The institutions kick off a three-day confab to discuss euro zone growth, Greece, Ukraine, and China’s new Asia Infrastructure Investment Bank. The AIIB is seen as a direct challenge to the US-led World Bank’s pre-eminence, and it has signed up many US allies in Europe and Asia. Half of the EU and all of ASEAN are now members of China’s alternative to the World Bank

How The World Bank Broke Its Promise To Protect The Poor

ICIJ and The Huffington Post estimate that 3.4 million people have been physically or economically displaced by World Bank-backed projects since 2004.

The World Bank and IFC have also been boosting support for mega-projects, such as oil pipelines and dams, that the lenders acknowledge are most likely to cause “irreversible” social or environmental harm.

Since 2004, World Bank estimates indicate that at least a dozen bank-supported projects physically or economically displaced more than 50,000 people each.

For more than three decades, the lender has maintained a set of “safeguard” policies that it claims have brought about a more humane and democratic system of economic development. Governments that borrow money from the bank can’t force people from their homes without warning. Families evicted to make way for dams, power plants or other big projects must be resettled and their livelihoods restored. …

Most World Bank investments do not require evictions or damage people’s ability to earn a living or feed their families. But the percentage of those that do has increased sharply in recent years.

A 2012 internal audit found that projects in the bank’s pipeline triggered the bank’s resettlement policy 40 percent of the time — twice as often as projects the bank had already completed.

18 March

US Urges Allies To Think Twice Before Joining China-Led Bank

(Reuters) – The United States has urged countries to think twice before signing up to a new China-led Asian development bank that Washington sees as a rival to the World Bank, after Germany, France and Italy followed Britain in saying they would join.

The concerted move by U.S. allies to participate in Beijing’s flagship economic outreach project is a diplomatic blow to the United States and its efforts to counter the fast-growing economic and diplomatic influence of China.

Europe’s participation reflects the eagerness to partner with China’s economy, the world’s second largest, and comes amid prickly trade negotiations between Brussels and Washington.

European Union and Asian governments are frustrated that the U.S. Congress has held up a reform of voting rights in the International Monetary Fund that would give China and other emerging powers more say in global economic governance.

27 February

Changing Global Financial Governance: International Financial Standards and Emerging Economies since the Global Financial Crisis

By: Hyoung-kyu Chey

(CIGI) This paper provides an alternative — and more positive — view of the increased representation of emerging economies in global financial governance related to international financial regulation, by offering a direct and systematic analysis of its effects on the role of emerging economies in the international standard-setting process and on their compliance with these standards, arguing that emerging economies are now meaningful, but still constrained, rule makers.

11 February

Brett House: It’s the US that has the most to lose if Congress keeps blocking IMF reform

(Quartz) Through the IMF, the US gets to decide how to spend other people’s money. The IMF amplifies Washington’s influence. A deal to expand the IMF further is about as close to a free lunch for America as it gets. But now the Fund is signalling that after years of waiting, it will move ahead with or without US support. This is just the latest sign that the rest of the world isn’t waiting for America’s dysfunctional government to get its act together.

9 February

Kimon Valaskakis introduces Paul Krugman’s recent column with these observations. The obsession with debt has caused some learned observers such McKinsey to sound the alarm lamenting ‘that the whole world is awash with debt.’ This lament is actually quite absurd because its symmetrical opposite -the whole world is awash with receivables- is by definition, equally true. Unless we owe our debt to the Planet Mars, we owe the money to ourselves. For every debtor there must, inevitably be a creditor. The balance must always be zero. The exception is ecological debt (pollution, climate change etc.) which hurts us all. But normal indebtedness is a purely accounting problem.

Paul Krugman in his, as usual, brilliant fashion exposed the absurdity of an obsession with global debt in Nobody understands Debt. I myself, in my recent book Buffets and Breadlines have a chapter with the exact same title. In it I outline five parameters to determine whether debt is good or bad: (1) Who are the debtors (2) Who are the creditors (3) What is the maturity of the debt (4) What is the rate of interest and (5) what is the debt for. Bear in mind, that economic growth and capitalism itself are rooted in intelligent borrowing for investment.

Because of this blind obsession with debt, without looking at the five parameters, untold suffering has been visited on innocent populations under the name of austerity. It may be time to be more nuanced and perceptive in our public policies. The debate in Europe sparked by the recent Greek election may lead to such a reexamination.

5 February

Janine R. Wedel This is why Piketty matters: Davos and the real story about economists and the 1 percent

Economists take heat for failing to predict crises, but not disclosing financial ties is a bigger problem

(Salon) … they were not consistently disclosing their own affiliations outside academe that could compromise their impartiality. And this, as I argue in my book “Unaccountable,” is a violation of public trust that has helped sour the public on the economics profession. Davos, too, has this element: We, the public, get to receive that group’s public pronouncements, but we hardly know what motives might be at play in making those pronouncements.

Capitalism’s unlikely heroes

Why activist investors are good for the public company

(The Economist) … activists fill a governance void that afflicts today’s public companies. A rising chunk of the stockmarket sits in the hands of lazy investors. Index funds and exchange-traded funds mimic the market’s movements, and typically take little interest in how firms are run; conventional mutual funds and pension funds that oversee diversified portfolios dislike becoming deeply involved in firms’ management. In the face of Wall Street’s provocateurs, America’s lazy money is waking up. Whether their ideas are barmy or brilliant, the activists make it harder for investors to stay on the sidelines. Mutual funds and pension funds are being forced to take a view, and hence become more active and forward-looking.

4 February

Malcolm D. Knight: Completing the G20’s Program to Reform Global Financial Regulation

(CIGI) The measures regulators have largely agreed on for a strengthened and internationally harmonized financial regulatory regime, which were endorsed at the 2014 G20 leaders summit in Brisbane, are a major step toward achieving a robust and less crisis-prone global financial system. There are, however, a number of specific measures that need to receive closer attention in order for the G20 leaders to declare their reform program a success. This paper discusses what policy makers and regulators should focus on in 2015 and why closer international cooperation in implementing regulatory reforms will be essential for success.

1 February

Ricardo Hausmann: Redistribution or Inclusion?

(Project Syndicate) The issue of rising income inequality loomed large at this year’s World Economic Forum in Davos. As is well known, the United States’ economy has grown significantly over the past three decades, but the median family’s income has not. The top 1% (indeed, the top .01%) have captured most of the gains, something that societies are unlikely to tolerate for long.

It is crucial to distinguish inequality in productivity among firms from unequal distribution of income within firms. The traditional battle between labor and capital has been about the latter, with workers and owners fighting over their share of the pie. But there is surprisingly deep inequality in firms’ productivity, which means that the size of the pie varies radically. This is especially true in developing countries, where it is common to find differences in productivity of a factor of ten at the provincial or state level and many times higher at the municipal level.

Bold ideas for a better world from Davos and beyond

The world’s challenges are huge, numerous and looming, and many innovative ideas will be needed to meet them. Contribute yours to our growing list

Businesses should act in the interest of seven generations

–Unilever CEO says the company is considering becoming a B Corp

–Public trust in business hits a five-year low

Still Waiting for Davos Woman

The Alpine retreat is both absurd and worthy — but can’t achieve its goals as long as it is primarily a guy thing

(Foreign Policy Magazine) how high-profile global gatherings like the World Economic Forum choose to act does. It matters a lot. Bringing greater gender balance here would not only improve the discussion and the outcomes it produces, but it would send a powerful message. But it is clear that change will not happen without a concomitant effort to produce it from the event’s sponsors, its paying customers, and its keynote speakers. Companies that recognize a need for fair hiring practices and equal opportunity should send their female leaders here. Sponsors promoting great values should walk the talk. Explain that the failure to fix this issue, the failure to show real progress over the past few years, and the failure to make real balance the goal is inconsistent with who they are and sends a terrible message, and that they simply can’t be associated with this event unless change takes place. Speakers should say they won’t be on panels unless there is balance. Otherwise all are complicit — and with the attention the issue has gotten, they have to be viewed as not only being complicit, but intentionally so.

22 January

The Davos oligarchs are right to fear the world they’ve made

Escalating inequality is the work of a global elite that will resist every challenge to its vested interests

21 January

OPEC, oil companies clash at Davos over price collapse

(Reuters) – OPEC defended on Wednesday its decision not to intervene to halt the oil price collapse, shrugging off warnings by top energy firms that the cartel’s policy could lead to a huge supply shortage as investments dry up.

The strain the halving of oil prices since June is putting on producers was laid bare when non-member Oman voiced its first direct, public criticism of the Organization of the Petroleum Exporting Countries’ November decision not to cut production but instead to focus on market share.

Speaking at the World Economic Forum in Davos, Switzerland, the heads of two of the world’s largest oil firms warned that the decline in investments in future production could lead to a supply shortage and a dramatic price increase.

20 January

Joseph Stiglitz: The Politics of Economic Stupidity

For the past six years, the West has believed that monetary policy can save the day. The crisis led to huge budget deficits and rising debt, and the need for deleveraging, the thinking goes, means that fiscal policy must be shunted aside.

The problem is that low interest rates will not motivate firms to invest if there is no demand for their products. Nor will low rates inspire individuals to borrow to consume if they are anxious about their future (which they should be). What monetary policy can do is create asset-price bubbles. It might even prop up the price of government bonds in Europe, thereby forestalling a sovereign-debt crisis. But it is important to be clear: the likelihood that loose monetary policies will restore global prosperity is nil.

This brings us back to politics and policies. Demand is what the world needs most. The private sector – even with the generous support of monetary authorities – will not supply it. But fiscal policy can. We have an ample choice of public investments that would yield high returns – far higher than the real cost of capital – and that would strengthen the balance sheets of the countries undertaking them.

The big problem facing the world in 2015 is not economic. We know how to escape our current malaise. The problem is our stupid politics.

IMF cuts global growth outlook, calls for accommodative policy

(Reuters) – The International Monetary Fund lowered its forecast for global economic growth in 2015, and called on Tuesday for governments and central banks to pursue accommodative monetary policies and structural reforms to support growth.

Global growth is projected at 3.5 percent for 2015 and 3.7 percent for 2016, the IMF said in its latest World Economic Outlook report, lowering its forecast by 0.3 percentage points for both years.

“New factors supporting growth, lower oil prices, but also depreciation of euro and yen, are more than offset by persistent negative forces, including the lingering legacies of the crisis and lower potential growth in many countries,” Olivier Blanchard, the IMF’s chief economist, said in a statement.

19 January

Oil prices slip on Chinese data, record Iraq output

(Reuters) – Brent crude oil prices fell below $50 a barrel on Monday after the global economic outlook darkened and Iraq announced record oil production.

The world’s biggest energy consumer, China, faces significant downward pressure on its economy, its premier Li Keqiang was quoted by state radio as saying on Monday.

18 January

Seven themes that will dominate Davos 2015

World leaders, top business people and campaigners will be debating issues from climate change to political instability at the World Economic Forum this week

(The Guardian) Conflict is the number-one issue for the political and business elite this year. The rise of Islamic State has awoken fears over failures of national governance and the collapse of nation states. … On Wednesday, the former UK prime minister Tony Blair will take part in a session examining whether religion is a pretext for conflict.

Sir Tim Berners-Lee, the inventor of the world wide web, is among those speaking on the topic of “In Tech We Trust”. Eric Schmidt, the boss of Google, is one of this year’s co-chairs while Sheryl Sandberg of Facebook and Satya Nadella of Microsoft will also be involved in a debate on the future of the digital economy.

Cyber-security should be high on the agenda too, following David Cameron’s controversial suggestion that governments should be given access to encrypted data.

Central banks will be a major topic of conversation in the meeting rooms, coffee shops and bars of Davos this week, as monetary policy in Europe and the US continues to diverge and inflation falls across the global economy.

The shock abolition of Switzerland’s currency gap last week has left many financial firms nursing losses, and reminded us all that 2015 could be a turbulent year in the markets. Thomas Jordan, the Swiss central bank chief who sparked the turmoil, can expect a lively reception. At least seven other central bank chiefs are also attending, including the Bank of England governor, Mark Carney.

17 January

Absolutely everything you need to understand what happened to the Swiss franc this week

(Quartz) five years after the worst of the global financial crisis and Great Recession, the world still seems to be tip-toeing toward a deflationary vortex. It will take serious political efforts from governments and central banks to move against the tide. The ECB finally shows signs of joining the fight, which is a good thing. But the SNB’s decision suggests that some governments are giving up and just letting the current carry them away.

Central banks are losing their superhero status

Since the start of the financial crisis in 2008, the world has relied on central banks to prevent the world from following a script inspired by a Hollywood disaster flick. Banks everywhere were saved, at the cost of trillions of dollars, to prevent global financial collapse, and quantitative easing was launched to prop up economies, inflate asset values and create jobs.

That confidence might be on the verge of evaporating, especially in Europe, where it is dawning on families and investors that the central banks’ ability to control broad economic events can be severely limited or virtually non-existent.

Worse, central banks are capable of missteps, in spite of their best intentions, that can compound the very damage they strove to prevent. That became abundantly apparent in a flash, on Thursday, when the Swiss National Bank (SNB) ended its three-year currency peg against the euro. The move, entirely unexpected, was a shocker, sending the Swiss franc soaring as much as 39 per cent while the Swiss stock market galloped off in the opposite direction. Currency traders around the world got walloped. Alpari, a retail currency broker in Britain, declared insolvency after the losses in clients’ accounts exceeded their equity.

15 January

Ahead of ECB meeting, Swiss National Bank scraps euro currency cap

The Swiss National Bank has pulled the plug on its costly strategy of tying the franc to the euro, plunging already anxious currency markets into a tizzy and threatening to undermine the fraying credibility of central banks.

Thursday’s move sent the franc soaring and Swiss stocks plunging. Gold prices shot up as a fresh wave of volatility washed over nervous markets in the wake of the policy reversal, which came without warning

What Good Are Economists?

By Robert J. Shiller

… the economics profession has produced an enormous amount of extremely valuable work, characterized by a serious effort to provide genuine evidence. Yes, most economists fail to predict financial crises – just as doctors fail to predict disease. But, like doctors, they have made life manifestly better for everyone.

(Project Syndicate) Since the global financial crisis and recession of 2007-2009, criticism of the economics profession has intensified. The failure of all but a few professional economists to forecast the episode – the aftereffects of which still linger – has led many to question whether the economics profession contributes anything significant to society. If they were unable to foresee something so important to people’s wellbeing, what good are they?

Indeed, economists failed to forecast most of the major crises in the last century, including the severe 1920-21 slump, the 1980-82 back-to-back recessions, and the worst of them all, the Great Depression after the 1929 stock-market crash. In searching news archives for the year before the start of these recessions, I found virtually no warning from economists of a severe crisis ahead.

One Comment on "Global Economy 2015"

Re: Rodrigue Tremblay: Pitfalls of Economic Globalization

RT’s paper opens the door on a large topic, obviously. I thought it a good summary of what might be called a centre-left consensus on globalisation. I thought he might have gone a good deal further, actually.

The EU crisis reveals I think, the danger of creating a permanent underclass of countries which will always find themselves at the bottom of the productivity tables and will never be able to improve their relative situation because of global financial restrictions.

Another issue he raises by implication is whether economic destruction by competition is always on balance creative. Much of it is just destructive, especially in states that lack the political structure to organize national adjustment – or which are forestalled by corporate power and trade rules.

He echoes the general acceptance of the global digital revolution – mainly I suspect because it has made things easier for people who communicate ideas. But if it is just another tool for universal surveillance and cultural trivialization, or a new nail in the coffin of traditional ways of knowing – in particular of indigenous people whose adaptability is already shaken by modernity – then we may be hastening our own hubristic demise.

Interesting that he begins with a quote from Le Baron Secondat de M: His great contribution to political theory is to emphasize that political and accompanying legal order rests on nothing more substantial than the social customs and mores of peoples. If they are severely destabilized, if the markers of virtue, of moderation and reason become scrambled by the challenge of change, the result may be devastating. Hannah Arendt’s analysis of 20th century totalitarianism took this line in some of her work.

One may think RT pessimistic. I’m inclined to think he may be optimistic in that he foresees that resistance is still possible. (Margaret Thatcher used to say TINA – There is no alternative – to the process RT describes.) Instead, RT might have warned of what might become a return of totalitarianism, this time with Authority offering subscriptions to CNN & Netflix in one hand, while the other controls a swarm of drones overhead for those whose resistance becomes conspicuous. Guy Stanley