Re Ian Bremmer 'Could third-party candidates upend the 2024 US election?' 3 April The current political movement in the USA…

Global Economy & Trade 2016-18

Written by Diana Thebaud Nicholson // December 9, 2018 // Global economy, Trade & Tariffs // Comments Off on Global Economy & Trade 2016-18

WTO 2012-2015

More on Trade & Tariffs

9 December

Southeast Asia faces ‘long list’ of risks in 2019, banks say

Trade war and rate hikes expected to push down growth in multiple countries

(Nikkei Asia Review) The 90-day pause in the trade war agreed between U.S. President Donald Trump and his Chinese counterpart, Xi Jinping, was greeted with relief around the world, but the dispute remains among the biggest risks to Southeast Asia’s economy next year, according to forecasts from banks in Asia, the U.S. and Europe.

Gross domestic product grew more slowly in most regional economies during the July to September quarter as the trade war began taking a toll on exports; Combined GDP growth for the five large Southeast Asian economies fell to 4.5% from 5.5% in the previous quarter.

Bank of America Merrill Lynch has forecast the slowdown will continue for the five countries — Indonesia, Malaysia, the Philippines, Singapore and Thailand — with growth falling to 4.8% in 2019, down from 5.0% in 2018 and 5.1% in 2017.

“The list of risk factors is just too long to mention,” Mohamed Faiz Nagutha, the bank’s Southeast Asia economist, told reporters Thursday

1 December

G-20 leaders agree on trade, Trump bucks others on climate

(The Hill) Leaders of the Group of 20 (G-20) nations on Saturday signed off on a final statement pledging to fix the world trading system, with all but President Trump also expressing support for the Paris climate agreement.

The statement finalized after the two-day summit in Buenos Aires, Argentina, calls for reforming the World Trade Organization but does not mention protectionism because the U.S. resisted those discussions, according to The Associated Press.

The statement also says that 19 leaders reaffirmed their commitment to fighting climate change through the Paris agreement, with Trump being the sole holdout.

30 November

The Atlantic: G20: World leaders are performing their own delicate dances at the annual G20 meeting in Buenos Aires. With converging controversies hanging over Saudi Arabia, the country’s crown prince, Mohammed bin Salman, arrived at the summit, sharing a high five with Russian President Vladimir Putin and a reportedly tense moment with France’s Emmanuel Macron. Who will President Donald Trump meet with in Argentina—and whom might he avoid?

With the killing of Jamal Khashoggi hanging over the start of the G20, how leaders interacted with the Saudi crown prince revealed their relative positions of power.

… By contrast, Trump appeared to enjoy his conversations with Macron, who strongly criticized Trump’s vision of nationalism at an event this month marking the end of World War I, and Japanese Prime Minister Shinzo Abe, who has tried to forge a close alliance with the American president despite tensions over Japanese car exports to the United States.

All this, even before the G20 leaders take on contentious issues such as global trade and climate change on Saturday. How the leaders conduct themselves when the cameras are rolling will certainly be worth watching. MORE

27 November

Ukraine, trade crises stalk G20’s 10th anniversary

(Digital Journal) G20 leaders, wrestling with the US-China trade war and ascendant populism at their 10th summit this week, face a new crisis following Russia’s naval confrontation with Ukraine.

In November 2008, countries representing four fifths of the world’s economic output came together to forge a collective front against the financial panic then engulfing the West.

A decade on, that unity has vanished as US President Donald Trump shreds the consensus underpinning international trade.

Other G20 countries such as Brazil, Italy and Mexico have turned to populist leaders, or, in Britain’s case, are grappling with a fractious electorate’s decision to file for divorce from the European Union.

And this year’s G20 host Argentina is enduring its own economic crisis, necessitating the deployment of more than 22,000 police against the threat of mass protests when the heads of government convene on Friday and Saturday.

For the G20 as a whole, Argentine Foreign Minister Jorge Faurie told AFP that the summit should stress the importance of trade itself.

But given the dysfunction at those other summits, the G20 leaders are expected to stop short of repeating their vows to fight protectionism, which were a founding principle in 2008.

Given US objections, analysts also dismiss any notion that the group can replicate its past consensus on the need to confront climate change, just ahead of a UN summit on the planetary threat in Poland.

25 November

Investors hope for trade war ceasefire at G20 summit

Presidents Trump and Xi will meet in Buenos Aires this week, but it seems neither China nor the US is in conciliatory mood

(The Guardian) Much of the attention at the G20 summit in Argentina this week will be focused on the sidelines, rather than the main events. It is there that, after the expected smile and handshake for the cameras, US president Donald Trump will meet Chinese premier Xi Jinping, as the trade war between the two countries grows increasingly rancorous.

There are hopes, however limited, that the meeting between the two leaders in Buenos Aires will result in a calming of tensions which have so far resulted in huge share price drops, most notably in US tech stocks.

.. “China has not fundamentally altered its unfair, unreasonable and market-distorting practices,” said US trade representative Robert Lighthizer. That came after Asia-Pacific leaders had failed to bridge gaping divisions over trade at the Apec summit in Papua New Guinea. For the first time, leaders were unable to agree on a formal written declaration, amid sharp differences between the world’s top two economies over the rules of global trade.

Vice-president Mike Pence said the president was prepared to more than double the tariffs, and that the US’s strategy would not change until China changed its practices.

20 November

U.S. sanction waivers provided relief, but global economy still fragile: IEA’s Birol

(Reuters) – Waivers on Iranian sanctions granted by the United States provided some relief to oil markets but the global economy is still very fragile, the head of the International Energy Agency told Reuters on Tuesday.

“The U.S. decision on the Iranian sanction waivers took some of the players in the market by surprise and, as a result, what we see today are that markets are well supplied and the price went down by $20,” Fatih Birol said on the margins of an energy conference.

24-25 October

China-Japan relationship thaws, but elephants remain in the room

(Business Times) WHEN Shinzo Abe took office six years ago, it would have been unthinkable for China’s leaders to roll out the red carpet for him. The Japanese premier can thank US President Donald Trump for the turnaround.

Mr Abe heads to Beijing this week to celebrate the 40th anniversary of a peace-and-friendship treaty between the Asian powerhouses, which have a long history of bad blood due in part to Japan’s colonial invasions of China and atrocities committed during World War II. He will meet Chinese President Xi Jinping on Friday as part of the first bilateral visit by a Japanese leader in seven years.

The slow warming of ties between the neighbours has sped up since Mr Trump attacked them both on trade. Although Japan’s alliance with the US keeps the nation in lockstep with Washington on most geopolitical issues, Mr Abe has moved to shore up economic ties with China – its biggest trading partner.

Mr Xi, in turn, sees Japan as a way to mitigate the risk of a trade war with the US.

SEE ALSO: Japan PM heads to China looking for economic common ground

The two sides will look to revive a currency swap framework dormant since 2013, and possibly progress toward an agreement on loans of giant pandas, said media reports.

They are also both pushing for a quick conclusion to Regional Comprehensive Economic Agreement, a trade deal involving 16 countries in the Asia-Pacific. The South China Morning Post reported this month that Beijing was also looking into joining the successor to the Trans-Pacific Partnership, which Japan pushed to complete after the US pulled out.

Trump pushes Japan into China’s arms

(Deutsche Welle) Japan and China are economic, political and military rivals vying for influence in the Asia Pacific. But Donald Trump’s contentious policies are forcing them to put their rivalry aside and cooperate.

Abe’s three-day China trip is the culmination of a rapid rapprochement between the two sides that began in the spring with the resumption of their economic dialogue.

Read more: Japan commits to China’s ‘One Belt, One Road’ initiative

China is Japan’s biggest trading partner and many Japanese companies have invested large sums in China.

Eyeing economic benefits, Abe has long sought to improve Tokyo’s relations with Beijing. But the Chinese leadership for years spurned these overtures and showed little interest in revitalizing the relationship between the world’s second and third-largest economies.

16 July

IMF warns Trump trade war could cost global economy $430bn

US could find itself ‘focus of global retaliation’ in tariff dispute, says WEO report

(The Guardian) Rising trade tensions between the United States and the rest of the world could cost the global economy $430bn (£324bn), with America “especially vulnerable” to an escalating tariff war, the International Monetary Fund has warned.

Delivering a sharp rebuke for Donald Trump, the Washington-based organisation said the current threats made by the US and its trading partners risked lowering global growth by as much as 0.5% by 2020, or about $430bn in lost GDP worldwide.

Although all economies would suffer from further escalation, the US would find itself “as the focus of global retaliation” with a relatively higher share of its exports taxed in global markets. “It is therefore especially vulnerable,” the fund said.

The US president also rattled European leaders by labelling the EU one of his greatest “foes” over trade, while leaving behind a trail of political chaos in Britain from his visit last week.

Issuing its latest World Economic Outlook report on Monday amid the rising tensions, the IMF said there were greater risks emerging for the global economy since its last assessment in the spring. Although world growth remains strong, the expansion is “becoming less even, and risks to the outlook are mounting”, it said.

21 June

Europe Strikes Back Against Trump Tariffs as Global Trade War Escalates

The European counterattack on $3.2 billion of goods, a response to the administration’s measures on steel and aluminum imports, adds another front to a trade war that has engulfed allies and adversaries around the world. China and Mexico have already retaliated with their own tariffs, and Canada, Japan and Turkey are readying similar offensives.

The risk of escalation is high since Mr. Trump has promised even more tariffs.

… in a trade war no sides are left unscathed. Although Mr. Trump has sought to exert pressure on other countries, the global nature of supply chains means the tit-for-tat tariffs are ricocheting in unexpected ways and may ultimately cost jobs in the United States. Sales of Mercedes S.U.V.s, made in Alabama by the German automaker Daimler, could be hit by the American trade dispute with China. The Swedish manufacturer Volvo faces rising prices on the imported steel it uses at its Mack Truck factory outside Allentown, Pa.

16 June

Just the Fear of a Trade War Is Straining the Global Economy

(NYT) Only a few months ago, the global economy appeared to be humming, with all major nations growing in unison. Now, the world’s fortunes are imperiled by an unfolding trade war.

As the Trump administration imposes tariffs on allies and rivals alike, provoking broad retaliation, global commerce is suffering disruption, flashing signs of strains that could hamper economic growth. The latest escalation came on Friday, when President Trump announced fresh tariffs on $50 billion in Chinese goods, prompting swift retribution from Beijing.

As the conflict broadens, shipments are slowing at ports and airfreight terminals around the world. Prices for crucial raw materials are rising. At factories from Germany to Mexico, orders are being cut and investments delayed. American farmers are losing sales as trading partners hit back with duties of their own.

Mr. Trump’s offensive may yet prove to be a negotiating tactic that threatens economic pain to force deals, rather than a move to a full-blown trade war. Americans appear to be better insulated than most from the consequences of trade hostilities. As a large economy in relatively strong shape, the United States can find domestic buyers for its goods and services when export opportunities shrink.

Even so, history has proved that trade wars are costly while escalating risks of broader hostilities. Fears are deepening that the current outbreak of antagonism could drag down the rest of the world.

11 April

IMF boss says world trade system in danger of being torn apart

Lagarde says ‘darker clouds looming’ for global economy amid US-China tensions

(The Guardian) Christine Lagarde said the current system for world trade was “in danger of being torn apart”, with the potential to upset the present global economic upswing and make consumers poorer.

Speaking in Hong Kong amid signs the standoff could be abating, Lagarde said it would be an “inexcusable, collective policy failure” for world trade to break down with nations erecting punitive tariff systems against their rivals.

… the standoff is still likely to dominate the agenda at the IMF’s spring meeting in Washington next week, when world leaders and central bankers are due to gather to discuss the state of the world economy.

Using language that could be interpreted as a veiled attack on Trump in the speech ahead of the meeting, Lagarde said nations could make domestic policy changes to address trade imbalances and use international forums to settle disputes. “We can all do more – but we cannot do it alone,” she said.

6 April

Mohamed A. El-Erian: The Global Trade Game

(Project Syndicate) The rapid expansion of trade in recent decades has given rise to a web of cross-border inter-dependencies in production and consumption. Supply chains now can have as many significant international links as domestic ones, and a substantial share of internal demand is being met by products partly or wholly produced abroad. As technological innovation further reduces entry barriers for both producers and consumers, the proliferation of these linkages becomes even easier, amplifying what already is essentially a spaghetti bowl of cross-border relationships and dependencies.

… As currently set up, the international economic order needs to function as a cooperative game, in which each participant commits to free and fair trade; the commitments are credible and verifiable; mechanisms are in place to facilitate and monitor collaboration; and cheaters face effective penalties. . ..

For starters, systemically important but not sufficiently open countries – beginning with China – should liberalize their economies more rapidly (particularly by reducing non-tariff barriers) and adhere to internationally accepted norms on intellectual property. Moreover, existing trade arrangements should be modernized as needed, so that they better reflect current and future realities, while companies and others that benefit disproportionately from trade should intensify their pursuit of socially responsible activities. Multilateral surveillance and reconciliation mechanisms – not just at the WTO, but also at the International Monetary Fund and the World Bank – should be revamped, and the functioning of the G-20 should be improved, including through the establishment of a small secretariat that facilitates greater policy continuity from year to year.

Given how many countries have an interest in maintaining a cooperative game, such policy actions are not just desirable; they may be feasible. As they help to create a stronger cooperative foundation for fairer trade, these measures would also constitute a necessary (though not sufficient) step toward countering the alienation and marginalization of certain segments of the population in both advanced and emerging economies.

21 March

Most of Africa’s Leaders Sign On to Continent-Wide Free Trade Pact

(NYT) More than 40 African countries signed a free trade pact on Wednesday that the nations hope will fulfill a long-held dream of greater economic integration on the continent.

But among the holdouts are two of Africa’s biggest economies, Nigeria and South Africa, raising concerns about whether the agreement can make good on its promises.

The African Continental Free Trade Area, which has been in the works for two years, aims to unite participating countries into a single trading market that would be one of the largest free trade zones in the world since the World Trade Organization was created in 1995.

Of Africa’s 55 countries, 44 signed the pact.

13 March

There’s a New Secretary of State. Who Cares?

Sorry, Washington. The world doesn’t need you anymore.

By Parag Khanna, senior fellow at the Lee Kuan Yew School of Public Policy at the National University of Singapore

(Politico) What if the world is capably transitioning from unipolarity to multipolarity, a new structure gradually being matched by new institutions that will guide the next geopolitical era?

Just last week, all the original members of the Trans-Pacific Partnership trade agreement convened in Chile to sign the deal—except the United States. The trade zone America once supported as a means of boosting exports and liberalizing economies will now move forward and boost exports and liberalize economies, all without American support.

TPP isn’t even the most important trade deal now underway. The Regional Comprehensive Economic Partnership—which includes every country in the India-Japan-Australia triangle, with China at the center—captures the largest share of global gross domestic product of any economic zone. It’s being driven forward by Asians from the inside-out.

We live in a tripolar regional order in which no continent can fully dictate to the others, and new alignments can emerge among them. Take the Asian Infrastructure Investment Bank, surely the fastest-growing multilateral organization in the history of the world. It was founded in 2014 and now has 80 members, mostly countries spanning the breadth of Eurasia, the world’s largest landmass. European countries enthusiastically joined this new Chinese-sponsored institution despite American objections, accelerating the construction of a Euro-Asian Silk Road axis that now represents nearly $2 trillion in annual trade, far larger than the $1.1 trillion in annual trans-Atlantic trade.

Mapping the Top Export of Every Country

12 March

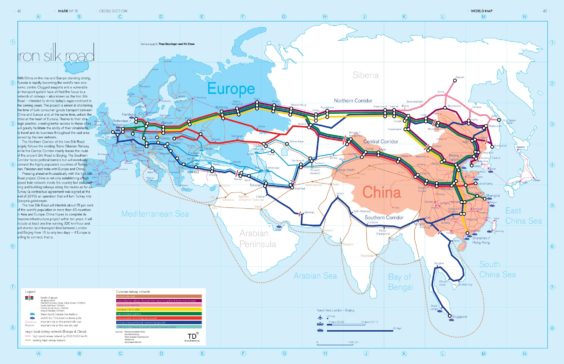

Marco Polo in reverse: how Italy fits in the New Silk Roads

Italian engineers and Chinese traders are looking to transform Venice into a key hub with an offshore-onshore port system, known as Voops, to rival northern European ports such as Rotterdam

(Asia Times) In 2016 Cosco bought 51% of the port of Piraeus – the privileged entry point of Chinese products in Europe. Chinese companies scour for made-in-Europe top-end technologies able to be transposed to an integrated China boasting the largest high-speed rail network in the world; over 20,000 km built in only a few years.

In 2016 Cosco bought 51% of the port of Piraeus – the privileged entry point of Chinese products in Europe. Chinese companies scour for made-in-Europe top-end technologies able to be transposed to an integrated China boasting the largest high-speed rail network in the world; over 20,000 km built in only a few years.

The beauty of the New Silk Roads, or the Belt and Road Initiative (BRI), is that each player is free to choose how it will position itself along and across myriad connectivity belts, roads, nodes and arcs.

Chinese and European companies interface on all these connectivity nodes. For instance, City Railway Platform and China Railway Container Transport work with Swiss Hupac on the Yiwu-Madrid link. Wuhan Asia Europe (WAE) is involved in the Wuhan-Lyon link while French Geodis is active on the Chengdu-Rotterdam link.

All these links feature on the nine-corridor Trans-European Network – Transport (Ten-T), which is due to be finished by 2030. One of Ten-T’s key corridors constitutes an absolute Chinese strategic priority; the high-speed rail line tying Budapest-Belgrade-Skopje-Piraeus, which benefited from a special $3-billion Beijing-facilitated line of credit.

Comment from a friend in Spain: “What I haven’t seen is any Chinese involvement in the super port being built in Morocco not far from Tangiers. That has southern Spanish ports very concerned because it can handle much larger ships than most Spanish sea ports. Also huge container ships won’t have to transit the Gibraltar straits”

2 March

World hurtling toward all-out trade war over Trump tariffs, threats of retaliation

Such a confrontation threatens to pit the United States against allies and rivals alike, hitting global supply chains, jacking up prices for consumers, complicating the renegotiation of the North American free-trade agreement and setting up a fight at the World Trade Organization.

On Friday morning, Mr. Trump said he would welcome a trade war if America’s trading partners fought back against the tariffs.

1 March

Trump Says Trade Wars Are ‘Good, and Easy to Win

By Joe Deaux, Andrew Mayeda, Toluse Olorunnipa, and Jeff Black

(Bloomberg) The planned tariffs, justified on the basis that cut-price metals imports hurt both American producers and national security, now raise the prospect of tit-for-tat curbs on American exports and higher prices for domestic users. While the practical impact may yet turn out to be limited, the political environment for global trade has just taken a turn for the worse.

Trump Roars, China Yawns, U.S. Shoots Itself in Foot: Gadfly

25 January

U.S. not starting trade war, but sees China tech threat: Ross

(Reuters) – The United States is not starting a trade war but trying to level the playing field of global commerce and fend off Chinese protectionism, including a “direct threat” in high-tech goods, U.S. Commerce Secretary Wilbur Ross said on Wednesday.

Ross was speaking at the World Economic Forum in Davos, alongside business leaders and World Trade Organization chief Roberto Azevedo, who said he expected China to dispute Trump’s trade challenges.

But [Ross] steered away from suggestions that the United States was giving up on the WTO, saying that the world still needed an arbiter and needed to avoid “a total free-for-all”, even if it did not agree with every aspect.

22 January

Battered in 2017, trade may face Trump’s full wrath in 2018

By Joshua P. Meltzer

(Brookings) Trump’s inauguration speech outlined his harsh zero-sum view of international trade, stating that “protection will lead to great prosperity and strength.”

In his first week in office, Trump withdrew the U.S. from the Trans-Pacific Partnership (TPP) agreement. At the G-2O, the administration’s position on trade meant that the G-20 broke from its usual stance of committing to a standstill and rollback of protectionist measures.

Yet, leaders at a November Asia-Pacific Economic Cooperation (APEC) session collectively pledged support for a standstill until the end of 2020 and reaffirmed the goal of a Free Trade Area of the Asia-Pacific (FTAAP).

At the same time, other anticipated trade actions by team Trump did not materialize. For instance, the U.S. Treasury did not label China a currency manipulator, nor were tariffs imposed on China and Mexico. … Trump also did not pull the U.S. out of the WTO, NAFTA, or any other trade agreement, despite threats to do so.

However, risks of trade actions are higher this year for three reasons. First, various political considerations that stayed Trump’s hand on trade no longer exist, in particular the focus on repealing the Affordable Care Act and passing corporate tax cuts.

Second, the Section 232 process has been finalized, and the Section 301 process will conclude shortly, creating a legal basis for action. Third, there is a growing political imperative for Trump to show more aggressive trade action.

11 January

World Economic Outlook Update, January 2018

(IMF) Risks

Over the medium term, a potential buildup of vulnerabilities if financial conditions remain easy, the possible adoption of inward-looking policies, and non-economic factors pose notable downside risks.

Inward-looking policies. Important long‑standing commercial agreements, such as NAFTA and the economic arrangements between the United Kingdom and rest of the European Union, are under renegotiation. An increase in trade barriers and regulatory realignments, in the context of these negotiations or elsewhere, would weigh on global investment and reduce production efficiency, exerting a drag on potential growth in advanced, emerging market, and developing economies. A failure to make growth more inclusive and the widening of external imbalances in some countries, including the United States, could increase pressures for inward-looking policies.

2017

25 November

Europe eats Trump’s lunch

The EU’s disputed system of geographical indications is taking over the planet.

(Politico EU) Armed with Champagne and Parmesan, Europe is trouncing the U.S. in the multibillion-dollar battle to set the global gold standard in gourmet foods.

Brussels is accelerating international trade agreements to impose a new world order in protected delicacies, while an increasingly introverted U.S. administration under President Donald Trump retreats from global dealmaking. With even Mexico and Canada turning toward the European model, the U.S. is being outflanked by the EU at the lucrative end of the food business.

Europe’s quest for supremacy in the gastronomic Great Game hinges on intellectual property rights. Each time the EU signs a trade deal, it pushes to lock its partners into its ecosystem of geographical indications, or GIs, which protect food names traditionally tied to a certain region, such as Bordeaux wines and Parma ham. …

Brussels does not always achieve full protection — especially in countries with strong European diaspora communities such as Canada. Discussions surrounding feta were particularly tense, owing to the country’s roughly 250,000-strong population of Greek descent. In the end, both parties agreed to allow existing Canadian feta producers to continue marketing their products, but blocked any new market entrants — a process known as “grandfathering.”

G20 closes with rebuke to Trump’s climate change stance

(CNN) German Chancellor Angela Merkel closed the G20 summit in Hamburg with a rebuke to US President Donald Trump’s stance on climate change, but the group appeared to make a concession on his protectionist trade policies.

World leaders had been at an impasse over an increasingly isolationist United States and Trump’s climate change and trade policies for most of the summit, and Merkel had made it clear that the US had made talks difficult.

… In her remarks, Merkel appeared to come down hard on Trump’s protectionist trade policies, saying she was glad that leaders agreed that “markets need to be kept open.” “This is all about fighting protectionism and also unfair trade practices.”

But the declaration made concessions for “the role of legitimate trade defense instruments,” in a sign that leaders had given into the US.

Robert Reich comments:

It’s official. The United States is no longer the world leader – at least on trade, the environment, immigration, refugee policy, and everything else other than military might — at least not as long as Trump is president.

Today’s final G20 communiqué represents a victory for the G19 and the isolation of the US within the G20. Language was found that all countries could agree with, thereby avoiding an ugly public quarrel. But on the central issues of protectionism and climate change, the U.S. views were not accepted.

German Chancellor Angela Merkel closed the G20 summit with a rebuke to Trump’s stance on climate change, saying she deplored the US decision to pull out of the Paris climate change agreement and that all other 19 nations in the G20 remained committed to it. She also rebuked Trump’s protectionism, saying she was glad that leaders agreed that “markets need to be kept open… This is all about fighting protectionism and also unfair trade practices.”

Meanwhile, Trump’s threat to impose new tariffs on steel imports from Europe prompted European Commission President Jean-Claude Juncker to threaten the same in return, giving early warning signs of a trade war.

Message to other nations of the world: Trump doesn’t represent most of us here in America. Please try to be patient. We’re doing everything we can.

7 July

Angela Merkel, the G-Zero chancellor

Germany does not lead the world. But it exemplifies the future of international relations

(The Economist) Who knows what the next years will bring? Perhaps China will start taking the lead. Perhaps America will suddenly abandon Trumpism in favour of old-school, Rooseveltian internationalism. Perhaps Europe will get its act together and start acting as one on the world stage. Perhaps some new coalition of Asian dragons will emerge as a new locus of power. But in the absence of such developments, G-Zero is here to stay. Journalists looking for a new superpower will still cast around for examples, including Germany, which will continue to fall short of the excitable billing. But for better or worse, others may increasingly emulate Berlin’s distinctive blend of idealistic multilateralism and case-by-case pragmatism. Germany is less a leader than a foretaste

6 July

‘Marshall Plan’ for Africa

Strengthening free and fair trade is a perennial goal at these leaders’ summits.

By specifically putting Africa on the agenda of this summit, Merkel is hoping to build on the last two G20 meetings, which also focused on the continent.

The dual approach includes a kind of “Marshall Plan” that aims to promote infrastructure development such as roads, ports and railroads. Then there’s the G20 Compact with Africa, where member nations are expected to pair up with African nations with the goal of attracting private investors on a whole host of development projects.

Canada stands apart from its G20 counterparts when it comes to Africa — but not in a good way.

According to the United Nations Conference on Trade and Development, Canada ranks last on foreign direct investment in Africa.

“All of the attention has been focused in the new markets in Europe, across the Pacific in China,” said Kirton. “So Africa has been left out … abandoned even under the current Canadian government.”

The Africa focus will include the movement of migrants and refugees who are fleeing conflict, human rights violations or problems associated with climate change or globalization.

EU-Japan trade: JEEPA hit

(The Economist) Today Japan and the European Union signed the Japan-EU Economic Partnership Agreement (JEEPA), a trade deal that has been four years in the making. On the eve of the G20 meeting in Hamburg both sides want to show that they can fill the vacuum left by America’s withdrawal from its role as the world’s trade leader. But given the significant tariff cuts, the deal is more than just political symbolism, writes our trade correspondent

EU and Japan hit back at protectionism with trade deal

Deal is seen as counterblast to US President Trump’s ‘America First’ strategy.

By Hans von der Burchard and Jakob Hanke

(Politico Eu) Japan and the European Union delivered a significant riposte to the protectionist agenda of U.S. President Donald Trump on Wednesday by striking the world’s biggest trade agreement.

A political deal covers more than 90 percent of the issues under discussion, and a senior EU official said the whole accord could be wrapped up by the end of the year, with 99 percent of goods on course to be traded tariff-free. The official acknowledged that growing global resistance to Trump had helped push the deal over the line and said the accord “was probably helped by what we both see as a deterioration of the international climate” on trade and investment. “A political agreement means we have a deal on market access, which is important, but we still don’t have a final text. There are some technical and legal issues that remain to be resolved. And we haven’t come closer on agreeing on an investment protection mechanism,” [said Pedro Silva Pereira, the European Parliament’s rapporteur on the deal with Japan].

The timing of Thursday’s EU summit is highly significant as it will come on the eve of a summit of the G20 group of the world’s leading economies in Hamburg, with Trump in attendance.

5 July

Christine Lagarde – No Time To Stand Still: Strengthening Global Growth And Building Inclusive Economies

The G20 summit opens with a sense of optimism, but it should be cautious optimism that prevails.

(HuffPost) … as our most recent G20 Surveillance Note explains, the regional composition of growth has shifted. In the United States — where the expansion is in its ninth year and cyclical unemployment has all but disappeared — a soft patch in early 2017 and policy uncertainty have tempered our outlook. The euro area — led by monetary stimulus and domestic demand — has exceeded expectations, and conditions in emerging economies have been boosted by robust growth in China and stabilizing conditions in Russia and Brazil.

So yes, we have momentum. But we cannot rest easy — both old and new risks threaten our goal of creating higher growth that is shared by all.

Above all, we need to focus on building inclusive economies. This calls for structural reforms to lift incomes and for more support to those who face disadvantages from technological changes and global economic integration.

It also calls for new efforts to empower women and close gender gaps.

In the G20 advanced economies, the difference between the number of men and women in the paid workforce is about 15 percentage points. The gap is even wider in the G20 emerging economies.

3 July

Refugees, trade and climate are top issues at upcoming G20 summit

(PBS Newshour) Much of the uncertainty surrounding the 2017 summit stems from President Trump’s reorientation of U.S. foreign policy, which has placed the United States at odds with much of the rest of the G20, and especially with its host, Germany.

On trade, the Trump administration has pushed back against the G20 consensus; during preparatory talks, it forced the group to drop its usual commitment to “resist all kinds of protectionism.” In addition to pulling out of the Asia-Pacific Trans-Pacific Partnership (TPP) trade deal that included several G20 members, Trump is considering raising tariffs on steel and other goods, raising alarm in Europe and Canada. Merkel spoke out strongly against protectionism in a speech to her parliament just days before the summit, saying it cannot be an option because it “harms everyone concerned.”

Paul Krugman: Oh! What a Lovely Trade War

According to the news site Axios, Trump, supported by his inner circle of America Firsters, is “hell-bent” on imposing punitive tariffs on imports of steel and possibly other products, despite opposition from most of his cabinet. After all, claims that other countries are taking advantage of America were a central theme of his campaign.

International trade is governed by rules — rules America helped put in place. If we start breaking those rules, others will too, both in retaliation and in simple emulation. That’s what people mean when they talk about a trade war.

And it’s foolish to imagine that America would “win” such a war. For one thing, we are far from being a dominant superpower in world trade — the European Union is just as big a player, and capable of effective retaliation (as the Bush administration learned when it put tariffs on steel back in 2002). Anyway, trade isn’t about winning and losing: it generally makes both sides of the deal richer, and a trade war usually hurts all the countries involved.

… globalization has already happened, and U.S. industries are now embedded in a web of international transactions. So a trade war would disrupt communities the same way that rising trade did in the past. Also, the tariffs now being proposed would boost capital-intensive industries that employ relatively few workers per dollar of sales; these tariffs would, if anything, further tilt the distribution of income against labor.

Meanwhile

(Quartz) Xi Jinping and Vladimir Putin meet. The leaders of China and Russia will meet in Moscow, where they’ll talk about containing North Korea and improving military cooperation. Also up for discussion: linking China’s “One Belt, One Road” initiative to Russia’s “Eurasian Economic Union,” a proposed trade group for Central Asia.

11 April

The New Silk Road’s first freight train from the UK has set off for China

(Quartz) A freight train filled with UK-made whiskey, vitamins, soft drinks, and other products set off for the first time yesterday, for China’s heralded “New Silk Road,” reports China’s state news agency Xinhua. In 18 days, it is expected to arrive at the city of Yiwu in eastern China.

The London-Yiwu line recreates the ancient “Silk Road” trade route that once connected Europe to China. This week’s cargo will journey 7,500-miles (12,070km) through France, Belgium, and Germany. It will pass from a DB World locomotive to the InterRail, and continue via Poland, Belarus, Russia and Kazahkstan, before arriving on April 27.

The New Silk Road is a contemporary overland and maritime trade network spearheaded by the Chinese government’s “One Belt, One Road” initiative, announced in 2013 to promote economic corporation between China and Europe, Middle East and Central Asia. With a $40 billion Silk Road Fund, China aims to invest in an infrastructure network of rail links, high ways, shipping routes and also oil and gas pipelines across the Eurasian continent.

Three months ago, the first freight train from China to the UK ran along the same route. As early as Nov. 2014, freight trains had already started running between Spain and China along an old cargo route passing through Germany. While New Silk Road is a much faster connection than the usual 30-day trip at sea between Western Europe and China, marine shipping remains much cheaper. Spanish olive and wine producers have criticized the new train route for its costliness.

31 March

President’s Growing Trade Gap: A Gulf Between Talk and Action

Increasingly, when it comes to foreign trade, the Trump administration is talking loudly and brandishing a small stick.

(NYT) The widening gap between President Trump’s bellicose talk and the modest actions of his administration was again on display Friday afternoon as he presided at the ceremonial signing of two executive orders. They would, he said, “set the stage for a great revival of American manufacturing.”

“Under my administration, the theft of American prosperity will end,” he said.

But the new orders, authorizing a large research study and strengthened enforcement of an existing law, are unlikely to effect a major change in the nation’s fortunes. Instead, the ceremony highlighted an emerging pattern on trade.

Mr. Trump blasted the Trans-Pacific Partnership as a “potential disaster” and made a great show of removing the United States from the ratification process. On Friday, one of Mr. Trump’s top advisers on trade said the Trump administration planned to use the scorned agreement as a “starting point” for its own deals.

2016

Anti-Trade Backlash: Ignorance & Abdication Of Business ‘Elites

There is on the part of too many business executives a desire to profit from globalization, but no evidence of a desire to learn, share or explain. We live in a truly amazing period and in many respects, overall progress and improvements have been unprecedented. In a highly stimulating, indeed challenging book, Age of Discovery, authors Ian Goldin and Chris Kutarna argue that this current era is the New Renaissance, reminiscent in many fundamentals to the Renaissance of half-a-millennium ago. There are, as was the case in the 16th century, great potential rewards, but also great risks.

Conclusion

As things stand in the summer of 2016, the risks seem to be overwhelming the rewards. There are fractions within societies – illustrated by the rise of populism and the Trump syndromes – there are fractions within regions – illustrated by Brexit in Europe – there are global systemic fractions, eg conflict between the established hegemon, the US, and the rising global power, China – and the growing chasm between those developing countries that have been integrated in the global market (eg Vietnam) and those that remain on seemingly perpetual periphery (most of Sub-Saharan Africa). Business executives have a key role to play in mitigating the risks and enhancing the rewards in a truly globally inclusive manner.

If globalization is not to fail, as it has so dramatically and indeed tragically in the past, business elites need to be less ignorant, more educated, and assume leadership responsibilities. The first half of the 21st century must not be a repeat of the first half of the 20th century. For the rewards of the New Renaissance to be reaped and spread, the business elites need to be Renaissance men and women. Nothing less is required for ensuring an inclusive, equitable, sustainable and dynamic globalization (Forbes, 28 July 2016)

20 November

Opinion: Trump, free trade, and the way forward

Will Donald Trump be the grave-digger of NAFTA, TPP, TTIP and other free trade agreements? He says he will pull out of TPP as soon as he takes office. But perhaps this presents an opportunity, argues DW’s Henrik Böhme..

(Deutsche Welle) Fear is spreading amongst business people and mainstream economists around the world that Donald Trump really is what he said he was during the election campaign: An arch anti-free-trader.

In my view, if his plans were put into action, the world would quickly find itself in a trade war, and from there, it would spiral into ruin. So let me propose another plan for the new man in the White House. First step: Away with all bilateral and regional free trade agreements! Because such agreements, including TPP, TTIP, NAFTA and others, have one thing in common: They always discriminate against the countries that are not members. TTP excludes the Chinese, RCEP excludes the Americans, and all these deals exclude African countries.

What’s needed is a global trade agreement. The UN World Trade Organization (WTO), which was charged with convening such a world-wide agreement, had nearly succeeded in achieving one, before the effort stalled in 2008.

APEC Delegates Push Back Against Protectionism

Leaders of the Asia-Pacific Economic Cooperation forum in Lima vowed to continue strengthening economic ties

Facing a backlash over free trade, leaders of Pacific Rim nations meeting here on Sunday are pushing back against creeping protectionism in the U.S. and elsewhere, promising to continue strengthening economic ties.

In doing so, leaders from the Asia-Pacific Economic Cooperation forum, which accounts for almost 60% of global gross domestic product, sent a message to president-elect Donald Trump that they would move forward with trade pacts with or without the U.S.

Peru and Chile, two other TPP members, said they were interested in joining the Regional Comprehensive Economic Partnership, a Chinese-led pact of 16 countries known as RCEP. Peru is also expected to start trade negotiations with Indonesia and hopes to increase ties with Russia, government officials said.

China, which is excluded from TPP, will further embrace a globalized economy by promoting RCEP and a Free Trade Area of the Asia-Pacific, President Xi Jinping said in a speech.

“The U.S. being seen as pulling back does create a void that China is willing to fill,” said U.S. Trade Representative Michael Froman. “You are beginning to see that.”

APEC nations grapple with the Trump effect in Lima

Some leaders want to forge ahead on trade without the Americans, others not so sure

(CBC) The Trump effect permeates every discussion here in Lima, where the leaders of 21 nations with more than half of the world’s wealth between them have gathered.

The two nations most targeted by president-elect Donald Trump’s election rhetoric — Mexico and China — appear to be taking very different approaches.

Mexico seeks mainly to minimize the damage, while China, feeling its position to be much stronger, is not only defiant but sees the rise of Trump as an opportunity.

- ‘We need to think beyond the United States’: Trudeau sees trade opportunities with Latin America

- Is Trump’s tough talk on trade all bluster? Business leaders shouldn’t wait to find out

President Xi Jinping seemed anxious to position himself as the anti-Trump on Saturday as he gave a full-throated paean to the idea of free trade. “We are going to give greater access to foreign investment and we are going to continue establishing high standards, pilot zones for free trade in China. We are going to create an environment in line with international standards. We are going to guarantee the existence of an equal playing field for all businesses in China, both domestic and foreign ones,” he said.

13 November

TRUMP’S WAR ON TRADE

President-elect Donald Trump won over millions of voters with pledges to renegotiate or rip up free-trade deals – a staunchly protectionist stand that could dismantle decades of progress. James Bradshaw reports from California, ground zero for U.S. trade, on the high-stakes battle that is sparking worries of a global trade war

“Most manufacturers depend on inputs or imports of material that is at competitive pricing to be able to build products that they currently have… .So if you go and do some sort of a draconian measure of making great changes to the rules of import and the tariff structure, it will imbalance the whole economy in the United States as far as manufacturing is concerned.”

(Globe & Mail) Mr. Trump made trade a punching bag for an angry electorate, but his pitch to a frustrated base was oversimplified at best, crafted for stump speeches and soundbites. In the Trump assessment of the American economy, factories have been emptied out by “disastrous” trade deals cut by Washington insiders for their own benefit.

He has pledged to renegotiate those agreements and rip up the terms of the existing trade relationship with China to make them more favourable to the U.S. Failing that, he’ll walk away from existing pacts altogether and boost tariffs. His campaign advertising promised to halt “the destruction of our factories and our jobs as they flee to Mexico, China and other countries,” and allow Americans to manufacture their own destiny once again. …

It might surprise many of his supporters to learn that the United States is still one of the most successful countries at making things and selling them to the rest of the world. In September, U.S. real goods exports hit $123.6-billion (in 2009 dollars) – a record. Industrial production is also rising, up 29 per cent since 2009, when the U.S. economy was emerging from a global recession.

That’s one reason trade experts are aghast at a Trump presidency and the prospect that he could spark a trade war if he doesn’t get his way. There’s a lot to lose – not only for America’s trading partners, but for … the U.S. as a whole.

12 November

TPP seen as doomed after Trump victory

Departing U.S President Barack Obama had been determined to win an uphill fight to get congressional approval of the deal during the lame-duck session in the final weeks of 2016. That was before Donald Trump, a fierce opponent of the TPP, won the presidential election Nov. 8.

New York Senator Chuck Schumer, soon to be the senior Democrat in the U.S. Senate, told labour leaders this week the Trans-Pacific accord will not be ratified by the U.S. Congress. The Washington Post reported that Mr. Schumer was relaying statements made to him by Republican Congressional leaders in the wake of the Trump victory.

3 November

Trade ministers from 16 countries gather in the Philippines. India, China, Australia, Japan, and ASEAN countries are meeting to discuss a free-trade alternative to the US-led Trans-Pacific Partnership.

White House study: China trade deal worsens damage from TPP failure

(Reuters) The Obama administration issued a fresh warning on Thursday about the dangers of Congress failing to pass its Asian trade deal, saying that millions of U.S. jobs could be at risk if a rival China-led trade pact is enacted.

As they gear up for one last push to persuade Congress to pass the Trans-Pacific Partnership (TPP)in the two months following Tuesday’s elections, senior administration officials said 35 U.S. industrial sectors would lose substantial ground to Chinese competitors in the Japanese market alone.

In a new study, the White House Council of Economic Advisers estimated that China’s Regional Comprehensive Economic Partnership (RECAP) trade deal would likely lower Japanese tariffs on Chinese goods by five to 10 percentage points. If TPP is shelved, U.S. companies would be stuck with Japanese tariffs averaging twice as high as their Chinese competitors.

Obama administration officials have long argued that China would seize economic leadership in Asia and write lower-standard trading rules for the region if TPP fails. The White House study seeks to quantify the argument by examining the effect of likely RCEP tariff cuts by Japan.

30 October

(Quartz) Wallonia was once an economic powerhouse. Its vast coal reserves fueled one of the earliest industrialized regions in continental Europe. But the French-speaking part of Belgium has since fallen on hard times.

Before this week, few beyond Belgium cared much. But then the Walloons nearly torpedoed a free-trade deal, seven years in the making, between the EU and Canada. Belgium’s quirky constitution grants its regional parliaments extensive powers, including—it turns out—the ability to veto trade deals affecting half a billion people.

That highlights the fragile state of global trade, under attack from all sides. US presidential frontrunner Hillary Clinton reversed her previous support for a major deal between the US and several Asian countries. Huge protests in Europe, especially in export-dependent Germany, have put off politicians negotiating a similar US-EU deal. Post-Brexit Britain, as ever, is a little confused—it is quitting a large free-trade area so it can do deals with countries elsewhere (that’s been going so well, after all). Donald Trump, of course, never saw a trade deal that wasn’t a “rip off.”

Against this backdrop, it’s no surprise that protectionist trade measures have been rising much faster than liberalizing ones, and global trade growth has slowed to post-crisis lows. But this isn’t simply a blanket rejection of free trade by populists on the left and right.

The UK is giving a Japanese-owned car plant special treatment to ensure its exports remain competitive if tariffs go up after Brexit. Back in Wallonia, the administration opposes free trade in chocolate with Canada on ethical grounds, but happily sells weapons to Libya and Saudi Arabia.

So while the post-war preoccupation with big multilateral trade deals is fading, a narrower, opportunistic approach is back in fashion, favoring intervention on behalf of favored industries instead of putting faith in free markets. The business barons of Wallonia’s 19th century heyday would feel right at home.— Jason Karaian

22 October

Free Trade in Chains

(Project Syndicate) The growing political backlash against trade in the advanced economies has raised a crucial question: does globalization need to be rolled back in order to preserve an open world economy? If policymakers don’t address it now, they are likely to answer for it later.

Chatham House’s Paola Subacchi examines the causes and consequences of today’s anti-globalization backlash, guided by insights from Stephen Roach, Dani Rodrik, Joseph Stiglitz, and other Project Syndicate commentators.

21 October

Bjørn Lomborg: The Free-Trade Miracle

the strongest argument [for free trade] is a moral one. Cost-benefit analysis shows that freer trade is the single most powerful way to help the world’s poorest citizens.

(Project Syndicate) Global free trade provides the greatest opportunity to improve human welfare over the next decade and a half. It has already helped lift more than a billion people out of poverty over the past quarter-century. Lowering trade barriers even more could double average incomes in the poorest parts of the world over the next 15 years.

Yes, there are costs to free trade that must be better addressed; but the costs are vastly outweighed by the benefits. Yet, in rich countries today, the mood has turned against free trade. That is a tragedy.

… the Transatlantic Trade and Investment Partnership (TTIP) between the US and the European Union, is all but dead, crippled by opposition on both continents and by the UK’s Brexit referendum result, widely interpreted as a vote for protectionism.

Meanwhile, protests opposing free-trade deals are drawing political support and crowds in Germany, Belgium, Canada, Sweden, New Zealand, Australia, and elsewhere.

More than rhetoric has shifted. One study found the use of protectionist policies up 50% in 2015, outnumbering trade-liberalization measures by three to one. Members of the G20 – the world’s major advanced and emerging economies, representing more than four-fifths of global GDP and three-quarters of trade – were responsible for 81% of the punitive measures.

14 October

Dani Rodrik: No Time for Trade Fundamentalism

(Project Syndicate) The problem then [1980s] was stagflation in the advanced countries. And it was Japan, rather than China, that was the trade bogeyman, stalking – and taking over – global markets. The United States and Europe had responded by erecting trade barriers and imposing “voluntary export restrictions” (VERs) on Japanese cars and steel. Talk about the creeping “new protectionism” was rife.

What took place subsequently would belie such pessimism about the trade regime. Instead of heading south, global trade exploded in the 1990s and 2000s, driven by the creation of the World Trade Organization, the proliferation of bilateral and regional trade and investment agreements, and the rise of China. A new age of globalization – in fact something more like hyper-globalization – was launched.

In hindsight, the “new protectionism” of the 1980s … was more a case of regime maintenance than regime disruption. The import “safeguards” and VERs of the time were ad hoc, but they were necessary responses to the distributional and adjustment challenges posed by the emergence of new trade relationships.

The economists and trade specialists who cried wolf at the time were wrong. Had governments listened to their advice and not responded to their constituents, they would have possibly made things worse. What looked to contemporaries like damaging protectionism was in fact a way of letting off steam to prevent an excessive buildup of political pressure.

So far, however, there are few signs that governments are moving decidedly away from an open economy. …

The difference this time is that populist political forces seem much more powerful and closer to winning elections – partly a response to the advanced stage of globalization achieved since the 1980s. Not so long ago, it would have been unimaginable to contemplate a British exit from the European Union, or a Republican presidential candidate in the United States promising to renege on trade agreements, build a wall against Mexican immigrants, and punish companies that move offshore. The nation-state seems intent on reasserting itself.

… As I have frequently argued, we need a better balance between national autonomy and globalization. In particular, we need to place the requirements of liberal democracy ahead of those of international trade and investment. Such a rebalancing would leave plenty of room for an open global economy; in fact, it would enable and sustain it.

1 August

From Brexit to CANZUK: A call from Britain to team up with Canada, Australia and New Zealand

Canada, Australia and New Zealand are more like Britain than any EU member

By Dr. Andrew Lilico, executive director and principal of Europe Economics, a fellow of the Institute of Economic Affairs, and chairman of the IEA/Sunday Times Monetary Policy Committee.

(Financial Post) … some close geopolitical alliance between these “CANZUK” countries could obviously work in terms of culture, constitutions, income and mutual regard. But would it be worth it in other terms, such as trade or defence? Well, in brute terms these four countries would obviously constitute a big global player. Between them they would control a surface area of more than 18 million square kilometres, the largest in the world, exceeding even Russia’s 17 million. Their combined population, at 128 million, would be the world’s 10th largest, just ahead of Japan. Their combined military spending of around US$110 billion would be the world’s third largest, behind the U.S. and China but well ahead of Russia.

The first step might be a new trade deal, perhaps encompassing all four countries .