Re Ian Bremmer 'Could third-party candidates upend the 2024 US election?' 3 April The current political movement in the USA…

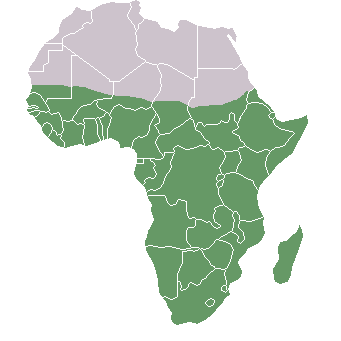

Africa: economy 2014

Written by Diana Thebaud Nicholson // August 19, 2014 // Africa, Economy // 1 Comment

Sacrificing Africa for Climate Change

Western policies seem more interested in carbon-dioxide levels than in life expectancy.

(WSJ) Every year environmental groups celebrate a night when institutions in developed countries (including my own university) turn off their lights as a protest against fossil fuels. They say their goal is to get America and Europe to look from space like Africa: dark, because of minimal energy use.

But that is the opposite of what’s desired by Africans I know. They want Africa at night to look like the developed world, with lights in every little village and with healthy people, living longer lives, sitting by those lights. Real years added to real lives should trump the minimal impact that African carbon emissions could have on a theoretical catastrophe. …

it as an Africanist, rather than a statistician, that I object most strongly to “climate justice.” Where is the justice for Africans when universities divest from energy companies and thus weaken their ability to explore for resources in Africa? Where is the justice when the U.S. discourages World Bank funding for electricity-generation projects in Africa that involve fossil fuels, and when the European Union places a “global warming” tax on cargo flights importing perishable African goods?

With 15% of the world’s people, Africa produces less than 5% of carbon-dioxide emissions. … Why should Africa, which needs electricity for the sort of income-producing enterprises and infrastructure that help improve life expectancy? The average in Africa is 59 years—in America it’s 79. Increased access to electricity was crucial in China’s growth, which raised life expectancy to 75 today from 59 in 1968.

According to the World Bank, 24% of Africans have access to electricity and the typical business loses power for 56 days each year. Faced with unreliable power, businesses turn to diesel generators, which are three times as expensive as the electricity grid. Diesel also produces black soot, a respiratory health hazard. By comparison, bringing more-reliable electricity to more Africans would power the cleaning of water in villages, where much of the population still lives, and replace wood and dung fires as the source of heat and lighting in shacks and huts, removing major sources of disease and death. In the cities, reliable electricity would encourage businesses to invest and reinvest rather than send their profits abroad.

Mindful of the benefits, the Obama administration’s Power Africa proposal and the World Bank are trying to double African access to electricity. But they have been hamstrung by the opposition of their political base to fossil fuels—even though off-grid and renewable power from the sun, tides and wind is still too unreliable, too hard to transmit, and way too expensive for Africa to build and maintain as its primary source of power. — Caleb Rossiter directs the American Exceptionalism Media Project. He is an adjunct professor at American University and an associate fellow at the Institute for Policy Studies. (5 May 2014)

Forecast 2014: Africa

(Geopolitical Monitor) Africa is discovering a new spirit of optimism, reminiscent of the first decade of its post-colonial era. Despite inadequate infrastructure and at times even poorer governance, the continent has been attracting more and more interest from American and European investors, as well as Chinese, targeting such countries as Kenya, Nigeria, South Africa, Angola, Tanzania, and Rwanda to name a few. Today, half of the world’s 30 fastest-growing countries are in Africa, which is quickly losing its image of hopelessness and despair. Unfortunately, economic growth, while significant, rarely benefits the impoverished majority, even amid scenes of bustling business taking place from Dakar to Nairobi, and statistics indicating an emerging African middle class of some 150 million – which could quickly rise to 300 million by 2015, barring any ‘black swan’ events. Politically, there is optimism as almost all 55 African countries have some kind of constitution with an active civil society that is contributing to more democratic or pluralistic political engagement. The continent’s two longest lasting internal conflicts (Somalia and Congo) persist; even if at a lower intensity, while two newer ones (Mali, Central African Republic) continue unabated. However, considering that from 1998-2003, the conflict in the Democratic Republic of Congo and its neighbors left some three million dead, the 2,000 registered ‘military’ deaths recorded in 2013 suggests that 2014 could be one of Africa’s most peaceful in recent history.

Ebola Wreaking Havoc on African Economy

(Foreign Policy) The death toll in the worst Ebola outbreak in history topped more than 1,200 as of Tuesday, according to the World Health Organization. The good news is that, for now, new cases appear to be limited to Guinea, Liberia, Sierra Leone, and Nigeria. The bad news is that even if the outbreak doesn’t spread beyond West Africa, the economic and political fallout in this fragile part of the world will likely last years, experts said.

The World Bank estimates that Guinea’s GDP will shrink between 3.5 and 4.5 percent this year as Ebola roils the agricultural sector and discourages regional trade. Liberia’s finance minister, Amara Konneh, lowered the country’s GDP estimates by 5.9 percent because of the outbreak. Bismarck Rewane, CEO of the Financial Derivatives Company, a Lagos-based financial advisory and research firm that manages $18 million in assets, told CNBC Africa on Monday, Aug. 18, that Nigeria could lose at least $3.5 billion of its $510 billion GDP. Moody’s has already warned that the virus could hinder the region’s energy sector.

8 August

Ebola outbreak: it’s not the virus but Africa that’s changed

Why do health-care workers in West Africa find this current Ebola outbreak, the worst ever, so difficult to control? The strain of the virus, the Zaire, is the same one behind most of the previous outbreaks. … at least part of the explanation for the current dilemma may be found in how Africa has changed since the first known outbreaks of Ebola in 1976 in the Democratic Republic of Congo and in Sudan.

For one, this outbreak is taking place in parts of Africa that are “much more densely populated, much more urban in their nature and those populations are much more mobile,” says Olds. Also, “these were populations that had never seen Ebola before.”

Urbanization, travel and the personal connections that come with economic development appear to have helped the virus spread. At the same time, a more formidable health-care infrastructure that could go a long way to stopping Ebola before it reaches outbreak status has not kept pace.

5 August

Turning a narrative of struggle into success story in Africa

(PBS Newshour) President Obama announced billions of dollars in new public and private investment in Africa’s rapidly growing markets — on everything from construction to banking to clean energy infrastructure — at the U.S.-Africa Leaders Summit in Washington. Gwen Ifill talks to Chris Fomunyoh of the National Democratic Institute and Torek Farhadi International Trade Centre about the growing partnership.

16 June

Boko Haram insurgency exposes Nigeria’s extreme economic inequality

(Globe & Mail) This was supposed to be Nigeria’s year to celebrate its brand-new status as Africa’s biggest economy. By the end of the century, the former “sleeping giant” of Africa will overtake the United States as the third-biggest country in the world by population. Its fate could be crucial to the future of the African economy. Yet the rapidly escalating Boko Haram rebellion is exposing the deep dysfunction in Nigeria, putting Nigeria on the path to potential “failed state” status, and contributing to the spread of Islamist extremism across West Africa.

Nigeria’s futile search for the kidnapped schoolgirls is now entering its third month, despite military support from the United States, Britain, Canada and others, while the expanding Boko Haram insurgency is killing hundreds of people in cities and villages across the north and centre of the country. An estimated 12,000 people have died in the five-year insurgency so far.

Nigeria has the resources to beat Boko Haram if it was determined to do so. But most of its staggering oil wealth – up to $70-billion (U.S.) annually – is held by a small politically connected elite, who remain insulated from Boko Haram’s terror tactics and seem almost indifferent to the war.

Nigeria has lost about $400-billion in oil revenue as a result of corruption since 1960, according to former World Bank vice-president Obiageli Ezekwesili, a leader of the protest campaign to bring back the kidnapped schoolgirls. A further $20-billion in oil money has disappeared from Nigeria’s treasury in the past two years, former central bank governor Lamido Sanusi has charged.

23 May

A first: New China-AfDB fund

(Devex) The African Development Bank and China launched on Thursday a new fund that could be seen as a milestone in China-AfDB relations, and the start of a partnership that is worth watching out for — even after the institution wraps up its annual meetings in Kigali this week.

The Africa Growing Together Fund will have an initial investment of $2 billion, which will be disbursed over a 10-year period, according to a news release.

For AfDB, the new fund means an additional $2 million a year for “more or larger-sized projects,” Charles Boamah, the bank’s vice president for finance, said. This could translate to more transport corridors or renewable energy and hydropower plants across the continent. Spending on these two sectors accounted for 32.2 percent and 16 percent of bank operations in 2013, respectively.

It’s unclear how big or little China’s influence will be on how the money will be used. Although the Asian behemoth has shares in the bank, it is not among the top shareholders, which currently include traditional donors such as the United States and Japan, and African member states like Nigeria and South Africa.

AfDB President Donald Kaberuka said the fund’s operations will adhere “within the strategic framework, policies and procedures of the AfDB, including its integrated safeguards,” emphasizing how China conducts business in the continent. Devex earlier reported that China approaches aid differently from traditional donors, but several issues remain, such as the need to consider environmental and social issues.

Nevertheless, this initiative provides a huge opportunity for the two to work together — rather than separately or compete — and leverage each other’s strengths: the bulk of Chinese aid money and AfDB’s vast experience and best practices

16 May

Chinedu Moghalu: Benefits of the 24th World Economic Forum on Africa on Africa and Benefits to Nigeria

(The Sun|Nigeria) The 24th edition of the World Economic Forum on Africa (24th WEFA) which took place from May 7 – 9 under the theme, ““Forging Inclusive Growth, Creating Jobs” has been greeted as the most successful of the Forum meetings thus far. The Abuja Forum brought leaders from politics, business and civil society together to debate ways to tackle Africa’s biggest challenge, namely how to create a continent of increased prosperity and strong communities; of strong governments delivering quality services and leaving no one behind. …

In tangible terms, the WEFA attracted over 68 billion dollars (about N12.9 trillion) in investment to the African continent in the form of Foreign Direct Investments (FDI) as well as private and public investments targeted at projects that would foster the agriculture sector, improve infrastructure such as roads, railways, hospitals, education, skill development and ICT across African countries. Remarkably, the meeting birthed an institutionalised response to the abduction of over 200 schoolgirls in Chibok, with the creation of a $20billion ‘Safe School Initiative Fund’ by the UN Special Envoy for Global Education, Mr. Gordon Brown, to develop and enhance education in the terrorism-ravaged areas of Nigeria. The Nigerian Government has committed US10b to this Fund while the other half comes from the UN.

Moghalu is Head, Corporate Communications, NEXIM Bank

8 May

Africa’s Richest Man To Invest $2.3 Billion In Plan To Fight Boko Haram

(Forbes) Africa’s richest man, Aliko Dangote, has announced plans to invest $2.3 billion in rice and sugar production in Nigeria’s northern region in a bid to combat poverty and insurgency.

Dangote, who was speaking today during a plenary session at the World Economic Forum currently being held in Abuja, Nigeria, said that creating jobs was a crucial way of putting an end to the insurgency that has plagued the northern region in the last few years. … Dangote, who is worth $24.5 billion also announced to the forum that his company would invest $16 billion in Africa over the next four years, with the bulk of the money -$12 billion to be invested in Nigeria. … In a related development, Chinese Premier Li Keqiang has promised further investment in Africa. Speaking during a keynote address during the forum earlier today, Kegiang announced that China had set aside $2bn for an African Development Fund and promised delegates that China’s support for Africa was non-conditional, stating that the country would not interfere in the internal affairs of African countries.

Annan: Economic equality needs to be aim of African governments

Annan: Economic equality needs to be aim of African governments

African governments need to spread the benefits of economic growth and rein in the plundering of resources, says a report by the Africa Progress Panel. “[I]t is time to ask why so much growth has done so little to lift people out of poverty and why so much of Africa’s resource wealth is squandered through corrupt practices and unscrupulous investment activities,” says Kofi Annan, chairman of the panel and former United Nations secretary-general.

Africa must work harder to reduce inequality: Annan

(Reuters) African governments should work harder to reduce inequality that has prevented the benefits of a decade of economic growth from being spread equitably, according to a report by former U.N. Secretary-General Kofi Annan released on Thursday.

The plunder by foreign investors and corrupt officials of the continent’s fishing and timber resources is a clear example of the failure to harness natural resources for the common good, according to the annual Africa Progress Report.

5 May

Faltering economy hits S Africa election

(FT) A prolonged strike in South Africa’s crucial platinum mining sector and slowing economic growth present a gloomy backdrop for this week’s election

16 April

Avoiding Africa’s Oil Curse

What East Africa Can Learn From Past Booms

(Foreign Affairs) East Africa is the global oil and gas industry’s hottest frontier. Barely a month goes by, it seems, without a major discovery in Mozambique, Tanzania, Uganda, or the eastern Democratic Republic of the Congo.

This new African windfall is hardly without precedent. Several west and central African states — most notably Angola and Nigeria — have already experienced petroleum booms of their own. Over the last decade, they benefited from a spectacular jump in oil prices, which rose from $22 per barrel in 2003 to $147 per barrel in 2008 and remained high, for the most part, until recently. The spoils were enormous: from 2002 to 2012, Angola’s GDP jumped from $11 billion to $114 billion and Nigeria’s went from $59 billion to $243 billion.

The opportunity afforded by this extraordinary decade was unprecedented and is unlikely to recur. Sadly, however, decision-makers have mostly squandered it. If the new east African producers are not to repeat the mistakes of the established ones, then, they should heed the lessons of Africa’s last oil boom.

10 January

Japan and China criticise each other’s Africa policies as each country pledges more money for the continent.

2013

African Arguments

African Development Bank

African economic outlook

Africa development indicators 2008-2009

Kenya

SciDevNet Sub-Saharan Africa

(CSM) Africa Monitor, a weekly look at business, investment, and development trends.

World Economic Forum on Africa 2011

2010 Annual Report-Investing in Infrastructure (AfDB)

See also China’s trade with Africa carries a price tag

Jeffrey Sachs: Aid Ironies and Dambisa Moyo Aid Ironies: A Response to Jeffrey Sachs

The Effectiveness of Remittances and Foreign Aid in promoting Savings and Investment in Sub-Saharan Africa (PDF)

Two brilliant bits of satire:

How to Write about Africa and It’s Africans’ turn to help Norwegians

+++++++++++++

30 November

Africa’s Aid Mess

Renowned author Paul Theroux discusses why the philanthropy of Bill Gates, Bill Clinton, Bono, and Jeffrey Sachs largely fails. Here’s what works.

(Barron’s) The desire of distant outsiders to fix Africa may be heartfelt, but it is also age-old and even quaint. Curiously repetitive in nature, renewed and revised every decade or so, it is an impulse Charles Dickens described, in a wickedly accurate phrase, as “telescopic philanthropy.” That is, a focus from afar to uplift the continent: New York squinting compassionately at Nairobi.

8 September

Financing is the key to making Africa self-reliant for food

African farmers are seeking private funding to help improve crop yields and possibly make the continent self-sufficient when it comes to food. “In the next 10 years, African countries should not rely on food aid, but should produce their own food and buy from within Africa when they run out of food,” says Mandivamba Rukuni of the Barefoot Education for Africa Trust. Inter Press Service (9/8)

5 September

Kofi Annan: G20 — how global tax reform could transform Africa’s fortunes

(The Guardian) Africa has lost its tolerance for being exploited. I urge G20 leaders to tackle issues such as transfer mispricing

Global tax reform would seem an unlikely issue to excite and unite the world. Yet as public anger grows over the unconscionable scale of tax avoidance by multinational companies, such reform has become a low-hanging political fruit. Who could challenge the need?

When G20 leaders discuss global tax reform at their summit in St Petersburg this week, they will be building on excellent work, including an Action Plan by the OECD.

I urge them to take the sub-Saharan perspective into account.

Africa may have only one seat at the G20 table but it accounts for 14% of the global population. With a young and rapidly growing population, Africa represents not just the world’s largest untapped source of oil, gas, and minerals, but also a high potential consumer market.

In May this year, the Africa Progress Panel, which I chair, published a report – Equity in Extractives – that shows how tax avoidance and evasion prevent Africa from enjoying its fair share of oil, gas, and mining revenues.

3 September

G20 tax reform must benefit Africa too, says Africa Progress Panel

The international tax system is not working and needs reform. Africa loses more to tax avoidance and evasion than it receives in international aid or foreign direct investment.

The Africa Progress Panel welcomes G20 action on tax avoidance and evasion, but urges G20 leaders meeting in Russia this week to ensure that international tax reforms benefit Africa too.

In Africa, tax avoidance and evasion cost billions of dollars every year. One single technique – transfer mispricing – costs the continent more than it receives in either international aid or foreign direct investment. Transfer mispricing includes the undervaluing exports in order to understate tax liability. Africa loses precious opportunities to invest in health, education, energy, and infrastructure.

4 June

As Africa Pursues Development Goals, Some Countries Lag While Others Lead

(International Business Times) A recent report from One, a grassroots advocacy organization dedicated to the global fight against poverty, focused mostly on Africa and found that MDG progress depended heavily on governments’ allocations of funds. The data, most of which was compiled by the Organization for Economic Cooperation and Development, suggests that a failure to meet financing commitments has been a major stumbling block for some of Africa’s poorest countries.

Overall, the news is good; countries around the world, and especially in Africa specifically, are showing positive development growth on average. Among sub-Saharan African countries, Mali and Rwanda tied for first place when it came to the pace of progress. … Rwanda has actually recovered well economically over the past two decades, and governance has been stable. As for Mali, the report simply notes that current turmoil hasn’t yet had an impact on the development ratings.

30 May

Can you hear me now? Swaziland, August 2010

(Reuters / Siphiwe Sibeko)

Africa’s Economic Boom

Why the Pessimists and the Optimists Are Both Right

(Foreign Affairs May/June 2013) Talk to experts, academics, or businesspeople about the economies of sub-Saharan Africa and you are likely to hear one of two narratives. The first is optimistic: Africa’s moment is just around the corner, or has already arrived. Reasons for hope abound. Despite the global economic crisis, the region’s GDP has grown rapidly, averaging almost five percent a year since 2000, and is expected to rise even faster in the years ahead. Many countries, not just the resource-rich ones, have participated in the boom: indeed, 20 states in sub-Saharan Africa that do not produce oil managed average GDP growth rates of four percent or higher between 1998 and 2008. Meanwhile, the region has begun attracting serious amounts of private capital; at $50 billion a year, such flows now exceed foreign aid.

At the same time, poverty is declining. Since 1996, the average poverty rate in sub-Saharan African countries has fallen by about one percentage point a year, and between 2005 and 2008, the portion of Africans in the region living on less than $1.25 a day fell for the first time, from 52 percent to 48 percent. If the region’s stable countries continue growing at the average rates they have enjoyed for the last decade, most of them will reach a per capita gross national income of $1,000 by 2025, which the World Bank classifies as “middle income.” The region has also made great strides in education and health care. Between 2000 and 2008, secondary school enrollment increased by nearly 50 percent, and over the past decade, life expectancy has increased by about ten percent.

The second narrative is more pessimistic. It casts doubt on the durability of Africa’s growth and notes the depressing persistence of its economic troubles. Like the first view, this one is also justified by compelling evidence. For one thing, Africa’s recent growth has largely followed rising commodity prices, and commodities make up the overwhelming share of its exports — never a stable prospect. Indeed, the pessimists argue that Africa is simply riding a commodities wave that is bound to crest and fall and that the region has not yet made the kind of fundamental economic changes that would protect it when the downturn arrives. The manufacturing sector in sub-Saharan Africa, for example, currently accounts for the same small share of overall GDP that it did in the 1970s. What’s more, despite the overall decline in poverty, some rapidly growing countries, such as Burkina Faso, Mozambique, and Tanzania, have barely managed to reduce their poverty rates. And although most of Africa’s civil wars have ended, political instability remains widespread: in the past year alone, Guinea-Bissau and Mali suffered coups d’état, renewed violence rocked the eastern Democratic Republic of the Congo, and fighting flared on the border between South Sudan and Sudan. At present, about a third of sub-Saharan African countries are in the throes of violent conflict.

23 May

President Ellen Johnson Sirleaf of Liberia joins discussion on this year’s Africa Progress Report

President Ellen Johnson Sirleaf and Carlos Lopes, head of the UN Economic Commission for Africa, helped present this year’s Africa Progress Report on May 23 to African policy makers and leaders on the sidelines of the African Union summit in Addis Ababa.

Africa suffers tremendous losses via transfer pricing, shell companies, and other means of tax avoidance, said President Johnson Sirleaf, who said nations must work together to resolve this problem.

Publication and discussion of the report is timely, not only for G8 discussions on tax avoidance and evasion, but also because it can influence debates in Africa, including the shaping of Vision 2063, the African Union’s growth strategy for the next 50 years, according to Dr Lopes.

10 May

Annan calls for end to ‘unconscionable’ exploitation of Africa’s resources

Former UN secretary-general urges David Cameron to use Britain’s G8 chairmanship to push for change

(The Guardian) Annan said he would be sending him a copy of the annual Africa Progress Report, which shows how the economic benefits of extracting natural resources such as oil and iron ore often fail to flow through to the local population.

“Africa loses twice as much in illicit financial outflows as it receives in international aid,” said Annan, in his foreword to the 120-page report. “It is unconscionable that some companies, often supported by dishonest officials, are using unethical tax avoidance, transfer pricing and anonymous company ownership to maximize their profits, while millions of Africans go without adequate nutrition, health and education.”

Launch of the 2013 Africa Progress Report

Africa’s leaders increasingly recognize that the manner in which the continent’s resources are overseen and exploited is fundamental to their ability to enhance both state and human security; to contribute to sustainable development; as well as to their achievement of the UN Millennium Development Goals. Given the importance of natural resources as an engine of economic growth, both the positive and negative effects of resource exploitation have significant impact on political stability and social cohesion.

On May 9 and 10, 2013, The North-South Institute will hold a two-day international forum on Governing Natural Resources for Africa’s Development. The NSI Ottawa Forum will distill from the growing body of knowledge and experience associated with natural resource extraction, policies and practices that can best produce positive outcomes for all key stakeholders – local communities, extractive sector investors, civil society groups, international organizations, multilateral donor agencies and host governments.

17 April

Economic growth buoys sub-Sahara

Several African economies south of the Sahara are growing strongly, according to reports from the International Monetary Fund and World Bank. But “worries remain over governments’ failure to tackle poverty and inequality,” writes David Smith. The Guardian (London) (4/17)

25 March

Why Nigeria Isn’t Ready To Lead

(OpenCanada.org) There has been a great deal of attention paid to the rise of Nigeria as of late. Indeed, it is hard to ignore the impressive economic growth rates being posted at a time when most economies are on the decline. The government appears focused on improving government services and investing in high potential growth areas of the economy. President Goodluck Jonathan’s recent Transformation Agenda is an impressive document that many economists and analysts believe is setting the conditions for Nigeria to become the dominant economy on the African continent. The agenda emerged in 2011 out of a belief by President Jonathan that the government needed a sense of direction and a way to ensure the country’s development priorities were applied with continuity, consistency, and commitment – the so-called “3Cs”. …

Nigeria remains rife with corruption despite efforts by the government to address it. Continentally, Nigeria is ranked 27 out of 53 states in terms of being a non-corrupt environment; internationally it is ranked 139 out of 176 countries, according to Transparency International. In contrast, South Africa ranks seventh within the region and 69th globally for non-corruption. Corruption in Nigeria is really a systemic issue and the challenge of tackling it cannot be underestimated; to do so would require sustained support from continental and international partners.

19 March

BRICS see opportunity in Africa

Chinese President Xi Jinping is pledging support for Africa’s development efforts and will visit multiple countries there this week, writes Ryan Lenora Brown. Meanwhile, BRICS countries may be setting up a World Bank-like financing arm to assist development of the global south. The Christian Science Monitor (3/19)

11 March

Africa told to view China as competitor

(Financial Times) Africa must shake off its romantic view of China and accept Beijing is a competitor as much as a partner and capable of the same exploitative practices as the old colonial powers, Nigeria’s central bank governor has warned.

Reflecting the shifting views of a growing number of senior African officials who fear the continent’s anaemic industrial sector is being battered by cheap Chinese imports, Lamido Sanusi cautions that Africa is “opening itself up to a new form of imperialism”.

China In Africa: ‘Imperial Power’ Or ‘Altruist’? – OpEd

Pambazuka Newsvia Eurasia review) Contrary to the claims of critics, China’s partnership with Africa is based on sincere friendship, equality and mutual respect for the sovereignty through non-interference in domestic affairs and the offer of loans and grants

9 March

The Chinese-Congo Sicomine Project: New Analysis

(China in Africa: The Real Story) … A year ago, I interviewed one of the early participants in the negotiations over this project, an expert in project finance and coordination who was then working for the China Railway Engineering Corporation (CREC), one of the major participants in the Sicomines project. His observations add new light to the origins of this project. It appears to go back further than we had thought. In around 2004, he said, the Chinese focus in Africa shifted toward infrastructure for resources packages.

15 February

If Africa Is the Future, the U.S. Share of It Is Diminishing

By Stephen Hayes, president and CEO of the Corporate Council on Africa.

(US News) … the Chinese aren’t alone in Africa. Turkey, India, Malaysia, Russia, Israel, Brazil, the Gulf States, and South Africa have all become major players on the continent. Turkish-built hotels are going up especially in North and East Africa. Dubai is building ports, Malaysia is investing in textile plants, the Saudis in agriculture, the South Africans in banking, shopping malls, and many other things, and the list just goes on. In fact, the non-OECD members are doing quite well in Africa, thank you. The rules and the playing fields are changing and the old order is not adapting. In America, we find ourselves saddled with our own cumbersome procedures and rules, and worst of all, our belief in the superiority of our own empire, just as the British and French once believed in the eternity of their own Empires. If Africa is the future, our place in that future is shrinking.

Yes, it is true that we cannot compete with the Chinese in the same way that China does business. We don’t have the top down approach in planning and the private and public sectors don’t work closely together beyond lip service to the genius of both. However, Africa is changing too. A middle class is beginning to develop in some countries, and a middle class is one with a growing private sector. The Chinese power lies in their relationship with the political leadership. The future in Africa belongs to those who develop a middle class filled with merchants, entrepreneurs, and consumers.

11 January

Charles Robertson, Michael Moran: Sorry, But Africa’s Rise is Real

Africa growth skeptics have got it wrong. The continent’s rise is very real.

(Foreign Policy) In The Fastest Billion: The Story Behind Africa’s Economic Revolution, we and our co-authors endeavor to show that sub-Saharan Africa — or at least a great many of its 48 countries — will make impressive advances in living standards, economic performance, health, education, and governance over the next thirty years.

Like a growing number of economists, development specialists, health, and agricultural scientists, we have watched as the gap between popular depictions and reality on the ground in sub-Saharan Africa has widened. We set out, with detailed sectoral, geopolitical and econometric analysis, to lay out what we feel is a more accurate picture of sub-Saharan Africa today — and the dramatic changes we expect to see in the coming decades.

2012

24 December

Africa Cashes in on Mineral Wealth

(IPS) – Many of the fastest-growing countries in the world are in Africa, the poorest continent on the planet, but the potential for recently-discovered resources to generate broad-based inclusive development opportunities is massive and remains under-exploited.

“I don’t believe that African nations are even close to understanding the enormous wealth that is their natural resource endowment,” David Doepel, chair of the Africa Research Group at Australia’s Murdoch University, told IPS.

African countries preparing to cash in on mineral wealth in East Africa include Tanzania, Uganda, Mozambique and Ethiopia, based on recent discoveries of oil and gas.

In 2010, Guinea alone represented over eight percent of total world bauxite production, Zambia and the Democratic Republic of Congo have a combined share of 6.7 percent of the total world copper production, and Ghana and Mali together account for 5.8 percent of the total world gold production, while Ethiopia also accounts for one-sixth of the world’s tantalum production.

A World Bank report issued in October claimed consistent high commodity prices and strong export growth show that African countries need to value the economic importance of their unexploited natural resources.

10 December

ICTs Delivering Home-Grown Development Solutions in Africa

Information and Communication Technology (ICT) innovations are delivering home-grown solutions in Africa, transforming businesses and driving entrepreneurship and economic growth, says a joint report by the World Bank and African Development Bank, with support from the African Union.

(The World Bank) In just the past five years, Africa’s mobile phone market has rapidly expanded to become larger than either the EU or the United States with some 650 million subscribers. At the same time, Internet bandwidth has grown 20-fold as hundreds of thousands of kilometers of new cables have been laid across the continent to serve an increasing number of its 1 billion citizens.

The new access is quickly changing lives, driving entrepreneurship fueled in part by collaborative technology hubs, and delivering innovation and home-grown solutions for Africa.

The report emphasizes the need to build a competitive ICT industry to promote innovation, job creation, and boost the export potential of African companies.

In the new report Transform Africa: The Transformational Use of Information and Communication Technologies in Africa, the authors follow that growth, documenting innovations in ICTs and advances in access for the population.

Aviation in Africa — Skies wide shut

(The Economist) DELEGATES attending an aviation conference in Johannesburg last month were stunned when Titus Naikuni, the chief executive of Kenya Airways and a keynote speaker, mooted the possibility of a three-way merger between Ethiopian Airlines, South African Airways and his own carrier. Combined, the three companies would be Africa’s biggest airline, offering about 650,000 seats per week. …

Mr Naikuni’s merger strategy is unlikely to succeed in the near term, since Ethiopian and South African belong to Star Alliance, an air alliance that rivals Kenya Airways’ SkyTeam. In any case, his plan seems misguided. Although consolidation has worked in Europe, where Lufthansa Group, AirFrance-KLM and IAG (the holding company of British Airways and Iberia) dominate, this is only because there are also dozens of smaller airlines willing to undercut each other and drive down fares. In Africa, though, competition is scarce, and on many routes there is only one operator. Merging the continent’s three largest carriers will simply worsen the problem and lead to increases in fares which, on a per-kilometre basis, are already the highest in the world.

The best solution is in government hands. At a summit in Yamoussoukro, the capital of Côte d’Ivoire, in 1999 ministers from 44 African countries agreed to work towards a so-called “open sky”, under which an airline based in any African country would be allowed to operate to, from or between any combination of cities in any other African country. Thirteen years later, many governments—particularly those in eastern and southern Africa—are still dragging their heels, seeking to shield their own national carriers from competitors based in adjacent countries.

The delay has been calamitous. Dependent predominantly on local demand, which is limited, airlines in smaller African countries have either collapsed or consumed vast amounts of government cash that might have been better spent on more urgent projects. Many, like now-defunct Air Nigeria, rested on their laurels and allowed costs to spiral as fares soared.

25 October

Escaping the resource curse: Will Africa invest?

Over-reliance on mineral resources and political corruption threatens to mire African countries in a cycle of the “resource curse,” making them highly vulnerable to market forces, according to a paper from the European Centre for Development Policy Management. Angola and Nigeria are cited, as each has less than 3% of the world’s oil and gas but garner nearly all export revenue from the resources. The Guardian (London) (10/25)

African Economies Resilient But Vulnerable

(Other News) (IDN) – A new report by the World Bank highlights the resilience of African economies despite global slowdown caused by the Euro-zone crisis and decline in growth in emerging economies, particularly China – an important market for the continent’s mineral exports.

In fact, new oil, gas and mineral wealth offer an opportunity for inclusive development. But strong growth rates could yet be vulnerable to deteriorating market conditions in the Euro-zone, the report warns.

So far, consistently high commodity prices and strong export growth in those countries which have made mineral discoveries in recent years, have powered economic activity and are expected to buttress Africa’s economic growth for the rest of 2012, according to the World Bank’s new Africa’s Pulse. African countries’ share in global reserves and annual production of some minerals is sizeable.

23 September

Africa next: With investment outpacing aid, is this a new golden age for the poorest continent?

(Globe & Mail) As investors and traders pour in, some of the poorest corners of the continent are being transformed. “Tomorrow’s Africa is going to be an economic force,” says a report from Goldman Sachs. KPMG trumpets the Africa story as “the rise of the phoenix.”

Many factors have made this possible. After decades of stagnation, in recent years most African countries began to reform their economies. Wars, coups, political instability and disease have declined since the late 1990s. And rising commodity prices have lured investment in African resources.

Mobile technology is leapfrogging ahead (Africa has become one of the fastest-growing markets for Canadian firm Research in Motion’s BlackBerry) and a new consumer class has been born. Multinational retailers are leaping in, and even Wal-Mart recently acquired a chain with nearly 300 stores in 14 African countries.

The prosperity of China has been a particular spark, with about 2,000 Chinese companies investing $32-billion in Africa by the end of 2010. Beijing’s trade with Africa has soared from $2-billion to an incredible $166-billion in the past dozen years.

… As foreign investment mounts, it often brings with it traumatic social dislocation and a distorted economy. The money often disappears into the pockets of a corrupt elite, while ordinary Africans see fewer benefits. Oil-rich countries such as Nigeria and Angola are the most extreme examples, where billions of dollars in oil revenue have gone into the foreign bank accounts of top officials, leaving most of their citizens poorer than ever.

It does not have to be this way. A few African countries, such as Botswana and Ghana, have carefully managed their resource revenue and transformed themselves into middle-income countries. Botswana has capitalized on its diamond mines by creating a fledgling industry in diamond sorting and processing, and it is increasingly seen as a model for the continent.

18 July

M-euro, a lesson in money supply from Kenya

(Financial Times/alphaville) According to the World Bank, there are now more phones in Kenya than adults, with more than 80 per cent of those with a cell phone utilising ‘mobile money’. And just in case you were tempted to say, “mobile banking, what’s so innovative and amazing about that?”, we should point out that ‘mobile money’ or ‘M-Pesa’ as Safaricom, Kenya’s largest mobile operator, calls the service, is quite different to just moving money around conventional accounts by phone.

There’s actually an element of money creation here. Its origins come from shrewd cell phone users realising there was value in the pre-paid airtime credit they purchased on their phones. So say you bought 60 minutes of airtime on your phone, rather than redeem it you could use it to pay for goods and services elsewhere simply by transferring the credits via the mobile network.

17 July

East Africa’s Financial Integration Slow off the Starting Blocks

(IPS) – For months now East Africans have been expectantly waiting for an economic revolution to begin as they anticipate the launch of a new standardised payment system that will integrate the electronic transfer of money in the region. But continued delays in the launch of the system have economists fearing that the weak financial infrastructure here is hindering its implementation.

The system, a replica of the Single Euro European Payments Area (SEPA), will make all electronic payments in the East African Community (EAC) domestic ones through harmonised laws, policies and regulations within the region.

Although people still make electronic payments across the region, it is often insecure. Currently, cross border transfers in East Africa also take a number of days to be processed.

But when finally launched, the system will be unprecedented in Africa. Not even the Southern African Custom Union, the world’s oldest union, has a common electronic payment system in place. Sources say that it will eventually lead to the creation of one central bank for Kenya, Uganda, Tanzania, Rwanda and Burundi, the countries involved in the formation of the system.

6 July

(Spiegel) Africa’s growing middle class is fueling development across the continent. Ambitious entrepreneurs are creating growth with companies focusing on everything from fashion to pharmaceuticals. But poor infrastructure, corruption and political conflict are hampering their efforts.

Africa’s economy is developing at a pace similar to that of Asian countries, including Japan. Five of the 10 faster growing countries in the world this year are south of the Sahara. Commodities like oil, natural gas, lumber, ores, gold and diamonds make up a shrinking share of economic output. In many up-and-coming countries, mineral resources no longer play the decisive role, as the service sector and manufacturing expand. Read more

5 July

Africa Rising: when will the West join Africa?

By Eliot Pence & Bright Simons

(African Arguments) Discussions about Africa’s evolution tend to measure the continent’s ‘gradual’ assimilation into the global mainstream. This may have been understandable in the mid-1980s when by every indicator African economies were seen as hopelessly distorted and needed to be salvaged with what became known as ‘structural adjustment’. But African countries today appear more aligned with the Washington Consensus and Globalization’s ‘best practices’ than the West. On many of the macroeconomic indicators used to judge conformity with the mainstream – debt to GDP ratio, current account balance, fiscal balance, inflation – Africa is situated closer to the mainstream, while key OECD countries drift away. Data tracking other kinds of flows – in cultural, innovation, and labour flows – point to a continent becoming a key player in the Global South – not just assimilating into the global mainstream, but helping to shape it.

2 July

China in Africa: Dambisa Moyo fails to uncover a more complex situation

(African Arguments) In June 27’s New York Times, well-known African aid sceptic Dambisa Moyo attempted a corrective analysis. I will leave the reader to make their own minds up on her statement, in the context of legitimacy issues, that ‘despite all the scaremongering, China’s motives for investing in Africa are actually quite pure’.

Moyo has made her points on the negative effects of Western aid on Africa previously and fairly well. Her op-ed last week is useful in pointing out, if it needed to be repeated, that the China-in-Africa investment story is, indeed, not all bad news for the continent and its people. Chinese firms aren’t necessarily less well behaved in Africa than Western ones, nor are Beijing’s motives necessarily less salutary than those of Paris, London or Washington (although it is five years — and a certain US presidential change — since the Pew data she cites on comparative African attitudes to US and Chinese investors was compiled).

But before one can say that Beijing is overall a ‘boon for Africa’, someone like Moyo should acknowledge there are other, more complex, calculations involved in making that judgment. She could easily have made her ‘correcting the negative narrative’ point while still mentioning some structural problems that Chinese investment alone will not address, and which it may only exacerbate and distort.

30 June

Nicholas D. Kristof: Africa on the rise

(NYT) So here’s another way to think of Africa: an economic dynamo. Is it time to prepare for the African tiger economy? Six of the world’s 10 fastest-growing economies between 2001 and 2010 were in Africa, according to The Economist. The International Monetary Fund says that between 2011 and 2015, African countries will account for 7 of the top 10 spots.

Africa isn’t just a place for safaris or humanitarian aid. It’s also a place to make money. Global companies are expanding in Africa; vast deposits of oil, gas and minerals are being discovered; and Goldman Sachs recently issued a report, “Africa’s Turn,” comparing business opportunities in Africa with those in China in the early 1990s.

27 June

This $6,000 Car Aims to Transform Africa’s Economy

This $6,000 Car Aims to Transform Africa’s Economy

(Mashable.com) Mobius Motors CEO Joel Jackson estimates there are 320 million people in Africa cut off from transportation, a problem that impedes education, health and the economy. Jackson’s company is looking to address that with a car that costs only $6,000, can transport up to eight people and navigates the often difficult terrain of the continent. Because the Mobius Two is designed to be able to haul heavy loads and transport up to 8 people, Jackson sees it becoming a platform for small businesses to emerge in areas like transport, deliveries and medicine. “It creates a platform for mobility,” a reference to both the car’s ability to physically move people but also advance their socioeconomic standing.

Some 313 million are now middle-class in Africa

The rise of a middle class in Africa — which the African Development Bank says comprises one-third of the population, or 313 million people — is reflected in the life of Zimbabwean mother Samkeliso Moyo, who escaped poverty for work in South Africa and is returning home. “For most … the grinding haul out of poverty is a story of ordinary people doing extraordinary things,” writes Robyn Dixon. Los Angeles Times (tiered subscription model) (6/26)

7 June

Brazil competes with China, India to invest in Africa

(CNN) Last month, Brazil’s top investment bank BTG Pactual unveiled plans to raise $1 billion to create the world’s biggest investment fund for Africa, focusing on areas such as infrastructure, energy and agriculture.

The independent bank’s fund, which comes amid a government drive to establish a strategic partnership with Africa, is one of the latest moves signaling Brazil’s increasing interest to extend its economic footprint on the continent — trade between Brazil and Africa jumped from around $4 billion in 2000 to about $20 billion in 2010.

24 May

China Keen to Reverse Negative Image in Africa

China and India have caused an explosion of trade and investment in Africa in the past decade. Yet they are perceived quite differently: China has a reputation for economic ruthlessness, while India’s business interests are generally seen as beneficial to Africa.

But their investment in Africa needs to be viewed in the context of broader investment trends on the continent, trade experts said at the “Money, Power and Sex: the Paradox of Unequal Growth” conference organised by the Open Society Institute of Southern Africa, which is taking place from May 22 to 24 in Cape Town, South Africa.

15 May

UNDP: Africa Human Development Report 2012

UNDP: Africa Human Development Report 2012

If African countries are to realize their long-term potential, the report says, they must boost agricultural productivity to both improve the availability of food and reduce poverty. Policies to enhance nutrition are central to ensuring that access to food translates into human development.

The report argues further that local populations must have the resources and decision-making power to produce and consume nutritious food throughout the year, overcoming the risks represented by continuing conflict, climate change and variations in food prices.

These drivers of change, by ending the ravages of hunger and malnourishment, will nurture capabilities and conditions for human development. A well-nourished and empowered population, in turn, is more likely to seek education, participate in society and expand its productive and human potential. With the right policies and institutions Africa can sustain this virtuous cycle of higher human development and enhanced food security.

2011

30 December

In an African Dynamo’s Expansion, the Perils of Prosperity

In Africa’s fastest-growing economy, there is a lot to drink to. The hiccup? How to brew enough beer.

(WSJ) Guinness Ghana Brewery Ltd., in a rush to keep pace with a booming middle class, wants to double the amount of stout it bottles over the next five years.

What is happening at Guinness illustrates the conundrum of Ghana, a west African nation whose runaway prosperity is both enriching and suffocating its capital, Accra.

In 2011, Ghana’s economy is forecast to grow 13.5%, a clip that exceeds every other country in the world except Qatar, according to the International Monetary Fund. Big oil finds pumped growth beyond 2010’s 7.7%.

As growth stagnates in the U.S. and Europe, Ghana’s robust multiparty democracy has turned its capital into a hub for companies chasing business—on a continent that grew 5.5% this year, according to the IMF.

Sub-Saharan African economies show resilience

Recent economic gains in the countries of sub-Saharan Africa faced threats in 2011, but most still managed to post GDP growth. Improvements in governance and crisis response helped keep the average GDP growth at 5%. The Guardian (London)/Poverty Matters blog (12/21)

12 December

Uganda’s fledgling oil industry could undermine development progress

The discovery of oil has been billed as good news for Ugandans, but many people in one district are alarmed by events so far

(The Guardian) The discovery of oil in western Uganda could spell an end to poverty in the country within decades, according to President Yoweri Museveni. Exports are predicted to provide $2bn annually, and have the potential to transform the lives of the 40% of Ugandans who live on less than $1.25 per day.

But in Hoima district, plans for a new refinery that will displace 30,000 residents are causing concern rather than celebration.

Indigenous trees provide wealth of benefits for Africa

Five types of trees indigenous to Africa can help alleviate hunger and poverty while helping protect the environment. The black plum, ebony, marula, dika and moringa all provide valuable food supply and constitute a vital component to agroforestry efforts on the continent, this article says. The Christian Science Monitor (8/18)

The Queensway syndicate and the Africa trade

(The Economist) China’s oil trade with Africa is dominated by an opaque syndicate. Ordinary Africans appear to do badly out of its hugely lucrative deals.

South Sudan sees future in agriculture

The United Nations will deploy up to 7,000 peacekeepers in South Sudan, plus an additional 900 civilian police, to help the newly-independent state get on its feet as it tries to limit conflict while diversifying its economy, which is 98% dependent on oil revenue. Initial investment will be steered into developing the country’s fertile agricultural sector. The Observer (London) (7/10), The Wall Street Journal (tiered subscription model) (7/11), Reuters (7/9)

African farmers are plugging in to mobile banking

A burgeoning mobile money network is helping African farmers in rural areas access information and funds via cellular telephone to improve their agricultural efforts. Proponents laud the system as a means to overcome infrastructure deficiencies and promote sustainability in places such as Zambia where only about 20% of people have bank accounts. The Christian Science Monitor (7/5)

Clinton: African economies are dependent upon women

In speeches this month, U.S. Secretary of State Hillary Clinton urged the overwhelmingly male leadership of the African Union to provide women with equal access to technology and vocational training — a change that reportedly could boost the continent’s economy by at least 40%. “Women are holding up half the economy already,” said Clinton, who regularly meets with women in impoverished countries. Bloomberg (6/28)

UN calls for African trade diversification

African countries should develop closer ties with both traditional and emerging partners, to boost sustainable and inclusive growth, according to a United Nations-backed report released Tuesday.

The report, African Economic Outlook 2011, … co-authored by the UN Development Programme (UNDP), the African Development Bank (AfDB), the Organisation for Economic Cooperation and Development (OECD), and the UN Economic Commission for Africa (UNECA), said that “Africa is becoming more integrated in the world economy and its partnerships are diversifying, revealing unprecedented economic opportunities.” [It] also said that governments’ efforts need to include measures to create jobs, invest in basic social services and promote gender equality.

9 June

New African oil giants told to avoid ‘Dutch disease’

(Emerging Markets) New oil producers in Africa must ensure they maintain diverse economies and do not become overly reliant on commodity production, policymakers warned on Thursday … “Dutch disease has been with us all the time, even if people don’t discuss it so much now,” AfDB president Donald Kaberuka told Emerging Markets. “We need the political will to mobilize now.”

8 June

Hedge funds ‘grabbing land’ in Africa

(BBC) Hedge funds are behind “land grabs” in Africa to boost their profits in the food and biofuel sectors, a US think-tank says.

In a report, the Oakland Institute said hedge funds and other foreign firms had acquired large swathes of African land, often without proper contracts.

US universities in Africa ‘land grab’

Institutions including Harvard and Vanderbilt reportedly use hedge funds to buy land in deals that may force farmers out.

(The Guardian) Harvard and other major American universities are working through British hedge funds and European financial speculators to buy or lease vast areas of African farmland in deals, some of which may force many thousands of people off their land, according to a new study.

Researchers say foreign investors are profiting from “land grabs” that often fail to deliver the promised benefits of jobs and economic development, and can lead to environmental and social problems in the poorest countries in the world.

7 June

Hope eternal

(Emerging Markets) Sub-Saharan Africa has rebounded vigorously following the global crisis, reinforcing a belief that the region’s economic gains will endure. But a darkening global picture once again threatens to expose the chinks in its armour

3 June

Is the world’s retail giant about to swallow Africa?

South Africa’s Competition Tribunal gave the go-ahead for Walmart’s takeover of Massmart, a South African retailer with operations in 14 African countries. Approval for the deal was in some doubt because of union opposition, but the retailers have agreed to keep current staffing levels for two years and to retain working arrangements for three years. The unions have warned, however, that they also want to renegotiate the terms for local suppliers. … South Africa is the continent’s most vibrant consumer market and forecasters say that the 59 million Africans who earn at least £5,000 a year will have doubled in number by 2014.

6 May

Africa Investors Lose ‘Lunatic’ Tab as Rising Wealth Attracts Mainstream

(Bloomberg) Booming demand for its minerals and improved governance mean Africa is beginning to attract mainstream investors, delegates to the World Economic Forum in Africa said this week, highlighting a turnaround in the continent’s fortunes.

The three-day meeting, the 21st held by the Geneva-based World Economic Forum on Africa, brought together more than 900 business and government leaders. The International Monetary Fund estimates sub-Saharan Africa’s economy will expand 5.5 percent this year and 5.9 percent in 2012, and that seven of the world’s 10 fastest-growing economies over the next five years will come from the region.

Annan: African leaders are wasting economic growth

The rapid economic growth across Africa is at risk of being squandered by leaders who are more intent on clinging to power than promoting the health and welfare of their people, Kofi Annan, former UN secretary-general, said at a World Economic Forum meeting in South Africa. Growth across the continent is averaging 5.5%, he said, but too little is being done to create jobs for young people, or invest in manufacturing and infrastructure. BBC (5/5)

12 March

Sub-Saharan Africa’s big move up

(Financial Post) Once the undisputed worst economic region in the world, sub-Saharan Africa is now one of the fastest-growing areas on the planet and despite the turmoil in North Africa, has become one of the most incredible success stories of the global economy.

10 February

Spread the wealth The impressive growth figures of resource-rich African countries are not all good news

(The Economist) The failure is about more than just predictable corruption. Africa suffers from the resource curse, which blights countries nature made rich. Corrupt states become more powerful because revenues from natural resources flow straight to them. Health and education suffer as poorly paid doctors and teachers take jobs in oil firms. Fighting over resource-rich areas like the Niger Delta frightens investors.

The effects of the resource curse are painfully clear in Africa. Insiders and profiteers are increasingly using oil revenues to take over service industries. They crowd out entrepreneurs and create their own monopolies. At first glance, countries like Angola (see article) look as if they have thriving private sectors, but those firms are really loose cartels run by the oil-rich elite. Some governments are also using resource cash to maintain control. Cronies buy independent media and foreign leaders hear that access to oil depends on turning a blind eye to the brutal silencing of domestic critics.

8 February

Latin American leaders bolster ties to Africa at World Social Forum

As economies boom on both sides of the South Atlantic, analysts say new lines are being sketched between Africa and Latin America.

The people of Latin America and Africa have shared cash crops, symmetrical coastlines, and mirror histories of European conquest followed by military rule. But they’ve shared little else in terms of 21st century trade or global diplomatic ties.

The economic and geopolitical interests of both continents have remained strictly parallel, formed along longitudinal lines that go directly north to the US and Europe, respectively. But as economies boom on both sides of the South Atlantic, analysts say new lines are being sketched between the two continents, particularly between the chunks that jut closer to each other: Brazil and West Africa.

6 February

Foreign investment and food security in Africa

Africa could be a breadbasket to the world, with its fertile land, winding rivers and cheap farm labor. But most African countries import the majority of their food staples, spurring dozens of major foreign corporations and national governments to invest in African land in order to grow food and crops that could be turned into biofuels for export — a trend that could make the continent more food and trade self-sufficient, yet also could lead to unrest. The Christian Science Monitor (2/6)

13 January

Africa’s informal economy can boost innovation

(SciDevNet) For half a century, science and technology (S&T) have promised to bring prosperity to Sub-Saharan Africa, but little progress has been made. This is in part because the African way of making and trading is largely informal, and Western industrialisation has failed to respect informality.

The word ‘informal’ may conjure images of illicit black market activity or harmful ritualistic practice — the darker, rarer side of informality.

But the informal economy — legal businesses that are largely unregistered and unprotected — comprises a much broader spectrum of activity, from piecing together scrap materials in makeshift workshops to extending credit to loyal customers.

2010

9 December

Zambia wrestles with China investment, labor problems

Zambia is struggling to balance the need for Chinese investment to support economic development with concerns from domestic workers over employment conditions and legal protection. China has poured $1.2 billion into Zambia over the past year, according to government figures, with Chinese-run enterprises providing salaried employment to 25,000 Zambians. Workers complain of long hours, harsh conditions and Chinese bosses ignoring deals with labor unions. The New York Times (free registration) (11/20)

16 November

China’s Africa resource hunt lacks transparency – WB

By David Stanway and Lucy Hornby

(Reuters) Chinese companies eying African mineral resources must stop making closed-door deals and become more transparent in their investments, a senior World Bank executive said on Tuesday.

Ngozi Okonjo-Iweala, the World Bank’s managing director, told Reuters on the sidelines of one of China’s biggest mining conferences that investors in Africa needed to work more with local communities in order to avoid conflicts and eventually even reduce costs.

15 August

African air travel nightmare blocks trade, tourism

… the nightmare of making connecting flights, surprise stopovers and poor scheduling … is strangling trade and tourism on the continent. While major international carriers are flocking to Africa for a slice of a vibrant and fast-growing market, local airlines are still hamstrung by complex restrictions between states and government interference 20 years after the ‘Yamoussoukro Agreement’ was supposed to open up the skies.

18 July

World Cup Lends South Africa Confidence to Unite Continent

(WSJ) … the paltry level of trade among African countries—now only about 12% of total African trade—could be in for a big boost. The catalyst isn’t a new sea port or a highway system. It’s a soccer tournament. Hosting the World Cup has given the continent’s largest economy a huge shot of confidence, which the government and South African companies are expected to parlay into a bigger role reshaping trade and investment across the continent.

South Africa’s trade ministry is now promoting an Africa trade zone that will stretch from Cape Town to Cairo, with the goal of knitting together three different regional trade groups over the next year. The Johannesburg Stock Exchange, by far the largest on the continent, is targeting company listings from other African countries rather than those from Europe and the U.S. And South African companies have ramped up investment in other African countries as an alternative to the traditional expansion route outside the continent.

2 July

G20 ignores looming energy and African trade crises

Integrating Africa into the global trading system is seen by some anti-poverty organizations and governments as an economic panacea for Africa.

For example, One, an advocacy group co-founded by Bono, states that economic growth “driven by trade and investment is the critical engine that will end poverty in sub-Saharan Africa.” The group advocates the dismantling of tariffs that caused Africa’s share of world trade to shrink from 6% in 1980 to 3.5% in 2008. The Harper government also supports, in theory, the elimination of trade barriers.

East African countries launch a common market

Kenya, Tanzania, Uganda, Rwanda and Burundi formed a common market Thursday to afford people, commodities, capital and business operations greater freedom of movement, and to promote development. The East African Community plans to expand the cross-border cooperation to include a common currency by 2015 and a political federation. The New York Times(7/1)

24 June

Better G20 representation for Africa sought

(Globe & Mail) The new G20 brought more of the world into the club that steers global economic policies, but the emerging group must better represent Africa, says the President of Nigeria, the continent’s biggest nation.

3 March

Egypt courts China for Suez special zone

(FT) One of China’s premier investment zones is expected soon to replicate its successful development model near the southern approaches to the Suez canal, according to Egypt’s investment minister

The extractive nature of Chinese state companies’ involvement in sub-Saharan Africa and the Middle East, where they seek natural resources in return for infrastructure investments, has courted controversy. Critics fear that China is more concerned with fuelling its own fast-growing economy than fostering development in the region.

19 February

Economist online debate: Africa and China

This house believes that China’s growing involvement in Africa is to be welcomed.

Defending the motion

Calestous Juma, Professor of the Practice of International Development, The Belfer Center, Harvard

The question of whether Africa can negotiate better terms with China will depend largely on the growing competence among Africans in defining their needs and the flexibility accorded to the continent by the changing global development diplomacy landscape.

Against the motion

George Ayittey, Distinguished Economist, American University

In my view, China’s growing engagement with Africa is just old wine in a new bottle with a “Made in China” label stamped on it. It should have been a mutually beneficial relationship but that is not what it is turning out to be.

Commercial farms, conservationists a threat to nomadic herders

Conservationists and commercial farmers are encroaching on lands used by nomadic herders throughout Africa, threatening a tradition that is vital to Africa’s economic prosperity. Domestic herders in Ethiopia, Senegal, Chad, Kenya and elsewhere in east Africa have found that national parks, game reserves and hunting blocks take up large parcels of land once used for moving cattle. The Guardian (London) (2/7)

26 January

Davos Special Report: Africa rising

(Reuters) Africa’s tales of war and diamonds, tribal rivalries and secret Swiss bank accounts have made it too risky for investors. That may be changing.

8 November 2009

China Pledges $10 Billion to African Nations

(NYT) China offered African governments a multibillion-dollar package of financial and technical assistance on Sunday, stepping up a courtship that already has gained Beijing wide access to oil and minerals across perhaps the most resource-rich continent in the world.

Prime Minister Wen Jiabao pledged to grant African countries $10 billion in low-interest development loans over the next three years, establish a $1 billion loan program for small and medium-size businesses, and forgive the remaining debt on certain interest-free loans that China has granted less-developed African nations in the past.

19 October

Nigeria offers ‘revolutionary’ delta deal

Nigeria plans to transfer 10 per cent of all its oil and gas ventures to the inhabitants of the oil-producing Niger Delta, in an attempt to end a rebellion that has hampered production in sub-Saharan Africa’s leading energy supplier

30 September

Africa Analysis: Can donors prove aid works?

(SciDevNet) Aid agencies, under pressure to prove their worth, should seize the opportunity to make spending more accountable, says Linda Nordling.

Does development research make a difference in Africa? It may sound like a strange question for this website, but it is one donors are increasingly asking. It is easy to see why. Having spent billions on stimulus packages to kick-start their stricken economies, rich governments are querying why, with unemployment rising at home and people foreclosing on loans, billions of taxpayers’ money still goes overseas. It is not just avarice at play. Some voices — the most publicised is Zambian economist Dambisa Moyo, writing in her recent book Dead Aid — are saying that aid makes poverty worse, not better.

13 August

Think Again: A Marshall Plan for Africa

(Foreign Policy) America brought Europe back to life a half-century ago. Why not give Africa the same chance?

The Marshall Plan was fundamentally different from the aid that Africa has received over the past four decades. The Marshall Plan made loans to European businesses, which repaid them to their local governments, which in turn used that revenue for commercial infrastructure — ports, roads, railways — to serve those same businesses. Aid to Africa has instead funded government and NGO development projects, without any involvement of the local business sector. The Marshall Plan worked. Aid to Africa has not. An African Marshall Plan is long, long overdue.

31 July

Africa’s Crisis

(Foreign Policy) As U.S. Secretary of State Hillary Clinton heads to Africa, the continent is in far better shape than most experts think.

It’s true that some countries in the region are as poor as England under William the Conqueror, but that doesn’t mean Africa’s on the verge of doomsday. How many serfs had a cellphone? More than 63 million Nigerians do. Millions travel on buses and trucks across the continent each year, even if the average African road is still fairly bumpy. The list of modern technologies now ubiquitous in the region also includes cement, corrugated iron, steel wire, piping, plastic sheeting and containers, synthetic and cheap cotton clothing, rubber-soled shoes, bicycles, butane, paraffin candles, pens, paper, books, radios, televisions, vaccines, antibiotics, and bed nets.

The spread of these technologies has helped expand economies, improve quality of life, and extend health. About 10 percent of infants die in their first year of life in Africa — still shockingly high, but considerably lower than the European average less than 100 years ago, let alone 800 years past. And about two thirds of Africans are literate — a level achieved in Spain only in the 1920s.

30 May

Dambisa Moyo: Why aid to Africa must stop

“We have years of evidence that the aid strategy doesn’t work. It boils down to incentive. We have to ask ourselves: Are African governments incentivized to do what governments all around the world are expected to do, that is, deliver public goods: education, health care, infrastructure and security? Unfortunately an aid system has allowed African governments to abdicate their responsibilities…. So until African governments live or die based on job creation and providing goods to Africans and not rely just on getting aid money, we will continue to see a situation where the private sector has not developed and Africans do not have job opportunities. The billion dollars that go from government to government … can make African governments lazy with respect to doing what they are supposed to be doing. It also fuels corruption, can fuel civil wars, inflation, the debt burden, and so on.” (article in NP no longer available)

29 May

Nicholas Kristof: The Most Soporific Word in the World… is “governance.” It sounds jargony and boring, which is why I didn’t use the first headline above that occurred to me (”Africa and Governance”). That said, governance is one of the keys to development, and Mo Ibrahim has an excellent op-ed in the Financial Times today on the subject.

Africa Should Seize Control Over its Development, By Annelise Sander

GENEVA (IPS) – Colonisation can be blamed for Africa’s underdevelopment but today Africans must take their fate in their own hands and become ambitious. The continent badly needs industrialisation but it has fallen back into the trap of merely exporting commodities because of booming prices.

27 May

“Mud-Wrestling on African Aid” from the Economist’s view, an interesting blog owned by Professor Mark Thoma of the University of Oregon; includes links to replies to Jeffrey Sachs’ “Aid Ironies” by William Easterly and Dambisa Moyo.

24 May

Africa giving away land ‘almost for free’

(Irish Times) AFRICAN COUNTRIES are giving away vast tracts of farmland to other countries and investors almost for free, with the only benefits consisting of vague promises of jobs and infrastructure, according to a report published today. “Most of the land deals documented by this study involved no or minimal land fees,” it says. Although the deals promise jobs and infrastructure development, it warns that “these commitments tend to lack teeth” on the contracts. The report – Land grab or development opportunity? – is written jointly by two United Nations bodies – the Food and Agriculture Organisation and the International Fund for Agricultural Development – and the International Institute for Environment and Development, a London-based think tank.

Jeffrey Sachs: Aid Ironies

Here are some of the most effective kinds of aid efforts: support for peasant farmers to help them grow more food, childhood vaccines, malaria control with bed nets and medicines, de-worming, mid-day school meals, training and salaries for community health workers, all-weather roads, electricity supplies, safe drinking water, treadle pumps for small-scale irrigation, directly observed therapy for tuberculosis, antiretroviral medicines for AIDS sufferers, clean low-cost cook stoves to prevent respiratory disease of young children. Shipment of food from the US is a kind of aid that should be cut back, with more attention on growing local food in Africa.

21 May

The Chinese and Arabs are buying poor countries’ farms on a colossal scale. Be wary of the results

OVER the past two years, as much as 20m hectares of farmland—an area as big as France’s sprawling farmland and worth $20 billion-30 billion—has been quietly handed over to capital-exporting countries such as Saudi Arabia, Kuwait and China. They buy or lease millions of acres, grow staple crops or biofuels on it, and ship them home. The countries doing the selling are some of the world’s poorest and least stable ones: Sudan, Ethiopia, Congo, Pakistan.

Protectionism or efficiency?

It would be graceless to write off in advance foreign investment in some of the most miserable places on earth. The potential benefits of new seeds, drip-feed irrigation and farm credit are vast. Most other things seem to have failed African agriculture—domestic investment, foreign aid, international loans—so it is worth trying something new. Bear in mind, too, that worldwide economic efficiency will rise if (as is happening) Saudi Arabia abandons mind-bogglingly expensive wheat farms in the desert and buys up land in east Africa.

China looks to U.K. for Africa experience

China is developing a number of joint projects with Britain in Africa in hopes of avoiding the former colonial power’s mistakes as it pursues increased economic involvement across the continent. China invested $4.5 billion in African development in 2007, more than the G-8 nations combined. The Guardian (London) (5/21)

12 May

On Aid to Africa