Re Ian Bremmer 'Could third-party candidates upend the 2024 US election?' 3 April The current political movement in the USA…

Trump administration: U.S. Economy 2017 Chapter I

Written by Diana Thebaud Nicholson // August 29, 2017 // Economy, U.S. // 2 Comments

29 August

Martin Feldstein: Tax Reform and Budget Deficits in America

(Project Syndicate) There is an important legislative reason why the projected budget will return to surplus in the future. The Republicans have only a very small majority in the Senate, where the filibuster rule requires a three-fifths majority to pass most legislation, giving the Democrats the ability to block the Republican tax agenda. But an exception allows tax and spending bills to be passed with a simple majority if the resulting budget returns to surplus after ten years. By designing the tax and spending rules accordingly and phasing in future revenue increases, the Republicans can achieve the needed long-term surpluses.

As a result, I am optimistic that a tax reform serving to increase capital formation and growth will be enacted, and that any resulting increase in the budget deficit will be only temporary.

(NYT) The president turns his attention to taxes on Wednesday.

His plan’s architects are Gary Cohn, director of the National Economic Council, and Steven Mnuchin, the Treasury secretary. Our Washington reporters offer a detailed portrait of this somewhat odd couple, who’ve been rivals since their days as new partners at Goldman Sachs.

They’re trying to overcome their lack of experience in political negotiations, and hoping not to repeat the mistakes of the White House’s push on health care.

19 August

Carl Icahn’s Failed Raid on Washington

Was President Trump’s richest adviser focussed on helping the country—or his own bottom line?

(The New Yorker Magazine, 28 August edition) Icahn’s role was novel. He would be an adviser with a formal title, but he would not receive a salary, and he would not be required to divest himself of any of his holdings, or to make any disclosures about potential conflicts of interest.

In the months after the election, the stock price of CVR, Icahn’s refiner, nearly doubled—a surge that is difficult to explain without acknowledging the appointment of the company’s lead shareholder to a White House position. The rally meant a personal benefit for Icahn, at least on paper, of half a billion dollars. … with no constraint on his license to counsel the President on regulations that might help his businesses, he was poised to become much richer.

16 August

Trump disbands economic councils as CEOs flee

(The Hill) President Donald Trump on Wednesday disbanded two of his economic councils after a wave of defections from high-profile CEOs.

All in all, eleven business leaders and CEOs had quit Trump’s councils, eight of them this week alone in response to his controversial comments on race and white supremacy.

Trump’s decision to disband the councils is a surprising retreat for the combative president, who has touted his business acumen, negotiating skills and economic policy as central strengths.

(Quartz) Another influential person quit Trump’s manufacturing council. Richard Trumka, head of the AFL-CIO, the country’s largest group of labor unions, quit the council after the president backtracked, blaming “both sides” for the Charlottesville violence. That brings the tally of CEOs who’ve left the council (paywall) over the president’s remarks to five.

4-5 August

Is Trump’s Turmoil Slowing Economic Growth?

By Neil Gross, professor of sociology at Colby College

(NYT) At the end of last month, the International Monetary Fund downgraded its forecast for economic growth in the United States. Where the I.M.F. previously predicted the economy would grow at a rate of 2.3 percent in 2017 and 2.5 percent in 2018, it now expects 2.1 percent growth in both years.

Yes, the stock market has been strong and unemployment is down. But Donald Trump, friend of business, may be costing us growth, a key indicator of economic health.

… instability is thought to hinder growth by generating uncertainty that scares off investors and makes firms risk-averse. Instability also gives politicians a short-term view of things: If they can’t be sure they or their parties will be involved in governance in the future, they won’t commit to economic policies with long-term yield.

(Brookings) Nearly a decade after the start of the Great Recession, U.S. employment has returned to its demographically adjusted pre-recession level. A new analysis from The Hamilton Project examines the effects an uneven recovery has had on the labor market by state, gender, education, and race.

The U.S. economy is solid, but there’s no ‘Trump bump’

(WaPost) More than 1 million jobs have been added since Trump took office. The stock market is at record highs. The Dow crossed 22,000 for the first time ever. Hiring surged in July. Trump took a victory lap Friday, dubbing it an “excellent” economy.

The reality is the U.S. economy is solid. It’s not booming.

Every president talks up the economy. It’s the president’s job to be America’s cheerleader-in-chief. To see how the Trump economy is really doing, look at growth, jobs, wages and business spending. All of those factors are showing no change since the days of President Barack Obama.

Nouriel Rubini: A Dim Outlook for Trumponomics

(Project Syndicate) Lower long-term interest rates and a weaker dollar are good news for US stock markets, and Trump’s pro-business agenda is still good for individual stocks in principle, even if the air has been let out of the so-called Trump reflation trade. And there is now less reason to worry that a massive fiscal-stimulus program will push up the dollar and force the Fed to raise rates. In view of the Trump administration’s political ineffectiveness, it is safe to assume that if there is any stimulus at all, it will be smaller than expected.

The administration’s inability to execute on the economic-policy front is unlikely to change.

The Trump administration is now moving on to tax reform. Earlier tax-reform proposals had anticipated savings from the repeal of Obamacare, and from a proposed “border adjustment tax” that has since been abandoned.

That leaves congressional Republicans with little room for maneuver.

What’s behind the Dow’s stunning rise to 22,000

The surprisingly persistent gains this year have come courtesy of robust profits at big companies, low interest rates and a rare alignment of developed economies in good or improving health at the same time. So far, those have been more powerful forces on stocks than world events such as North Korean nuclear missile tests, Venezuela’s economic and political meltdown, or legislative gridlock in Washington.

13 July

Big Money: One of Trump’s key campaign promises was repealing Dodd-Frank, the Wall Street reform act that he claims is a threat to the U.S. economy. In a new video for our series “Unpresidented,” Gillian B. White explains what the 2010 law does and whether Trump’s right about its effects. One drawback to a different kind of deregulation: Because the U.S. allows for the anonymous creation of shell companies, the country has become a haven for bad actors to hide their wealth.

12 July

America’s Aging Infrastructure: Waterways Face Critical Juncture:

A network of dams and locks that make commercial river traffic possible is at risk of failure after decades of underinvestment, potentially causing significant economic damage. (paywall)

(WSJ) More than a million tons of commodities normally pass through the lock on the Monongahela River here every month. But on a recent day, the giant steel gates that hold back the river didn’t budge.

The 85-year-old structure is undergoing a long-delayed $2.7 billion makeover, and the lock is closed to river traffic during the week

The construction south of Pittsburgh is one of several major projects across the U.S. aimed at improving the nation’s vital waterways network of dams and locks that make commercial river traffic possible, enabling more than $70 billion worth of cargo to be shipped annually, according to the U.S. Army Corps of Engineers. An example of the looming threats from the nation’s crumbling infrastructure, the often unseen system of more than 230 locks along 12,000 miles of river is at risk of failing in places like Pittsburgh from decades of underinvestment.

The Lower Monongahela River Project in southwest Pennsylvania will upgrade locks near the towns of Charleroi and Braddock and remove a third lock in Elizabeth that was built 110 years ago. The system of dams and locks were first put in place to ensure that the entire length of the river was deep enough for boats to traverse it year-round.

President Donald Trump has promised $1 trillion worth of investments in the country’s infrastructure, but his proposed 2018 budget didn’t include funding for the Monongahela River locks project.

9 July

GOP faces critical month for budget

(The Hill) When the Republican-controlled Congress returns to Washington this week, it will face a political and procedural Gordian knot to advance its agenda, the heart of which centers around the budget.

Congress has just three legislative weeks before the August recess and one month after that before an impending government shutdown and debt ceiling breach — not to mention the small matters of healthcare and tax reform, which are all tied in some way to the budget.

13 June

(WSJ Capital Journal) The Trump administration is proposing a broad rethink of financial rules. Mr. Trump’s team said some rules, including many that are part of the 2010 Dodd-Frank financial law, have become overly restrictive, unnecessarily preventing banks from activities that help the economy function and grow. Plus: “Markets don’t want us to wait. The sooner we do this, the better,” Treasury Secretary Steven Mnuchin said Monday, urging Congress to lift the debt ceiling before their August recess.

12 June

Trumping the Dollar

By Jim O’Neill, a former chairman of Goldman Sachs Asset Management and former Commercial Secretary to the UK Treasury

(Project Syndicate) One of the more fascinating developments in the seven months since US President Donald Trump was elected has been the trajectory of the US dollar, relative to other major currencies. After soaring in the wake of Trump’s victory, the dollar’s value began to slide in April.

There are various explanations for this. One is that Trump’s much-anticipated economic-growth agenda has not materialized, and stands no chance of making it through Congress. Another is that the rest of the world, not least the eurozone, has performed better than expected since Trump’s election. … a third explanation has become increasingly clear: markets have built in a risk premium for the dollar, to account for the uncertainties that Trump’s presidency has introduced.

11 June

Economy emerges as bright spot for Trump

The economy is emerging as a bright spot for President Trump as he struggles to move his congressional agenda amid a series of controversies.

The S&P 500 is up more than 12 percent since Election Day, unemployment has reached a 16-year low and economic growth in the coming year is expected to reach 2.3 percent, more robust growth than the 1.6 percent it grew in 2016.

9 June

Trump praises House vote to dismantle Dodd-Frank

The House on Thursday passed the Financial Creating Hope and Opportunity for Investors, Consumers and Entrepreneurs (CHOICE) Act, a bill that replaces much of the Dodd-Frank post-2008 crisis financial regulations. The bill, sponsored by Hensarling, passed 233 to 186, with all but one Republican, Rep. Walter Jones (N.C.), backing it and every Democrat opposing it.

The CHOICE Act is the most ambitious Republican effort to roll back parts of the law fiercely defended by Democrats under former President Barack Obama. It would give banks that reach certain cash thresholds an off-ramp from Dodd-Frank, reduce the frequency of federal stress tests and restrain oversight powers of several federal agencies that the 2010 law expanded.

Hensarling’s bill would also eliminate orderly liquidation authority — the process through which the federal government takes over and dismantles a major bank before it collapses — and place strict limits on the Consumer Financial Protection Bureau (CFPB).

The CHOICE Act would turn the CFPB, which Republicans consider abusive and unaccountable, into the Consumer Law Enforcement Agency. It would no longer control its own budget, its director would be appointed by the president, and it would lose its authority to crack down on “unfair, abusive and deceptive practices.”

1 June

Bucking Trump, These Cities, States and Companies Commit to Paris Accord

(NYT) The unnamed group — which, so far, includes 30 mayors, three governors, more than 80 university presidents and more than 100 businesses — is negotiating with the United Nations to have its submission accepted alongside contributions to the Paris climate deal by other nations.

“We’re going to do everything America would have done if it had stayed committed,” Michael Bloomberg, the former New York City mayor who is coordinating the effort, said in an interview.

Trump Just Said Some Truly Crazy Things During His Paris Exit Announcement

(IFL) We’ve just been going through his speech and, unsurprisingly, the President made some rather extraordinary claims. Here’s a selection of the strangest, along with a smattering of corrections.

“The world went crazy when the Paris agreement was signed. They went wild. This was because it placed America at a serious economic disadvantage.”

Sean Silcoff: America will eventually come around, but by then the rest of the world will be 10 years ahead and creating serious economic value from the technologies they develop to harness alternative energy sources, that’s my guess. The Chinese are already furiously filing cleantech patents and leading related global standards-setting committees that will position the country for an economic windfall as their homegrown technologies eventually make it easier and cheaper to generate energy from sources other than oil and coal. the rest of the world can lament America’s move here, but behind the scenes, I’ll bet there are some people in other countries quietly wondering if they’ve just been handed a giant competitive advantage in one of the most significant technology development races yet to come.

30 May

Why There Is No ‘Trump Slump’ on Wall Street

The stock market is best understood not as a presidential poll but as a barometer of the nation’s current economic mood, and it remains buoyant now for reasons unconnected to the White House.

(NYT) Despite Mr. Trump’s criticism of “globalists,” the more internationally oriented companies have outperformed their domestic peers significantly since Inauguration Day. The global forces lifting the United States market have in the meantime been lifting foreign stock markets even faster this year.

Similarly, the American dollar has given up all the gains it recorded in the immediate aftermath of the November election, and the Mexican peso has clawed back most of the losses it incurred when the markets were taking President Trump’s threats against the North American Free Trade Agreement more seriously.

Juan Williams: Trump’s budget hurts his voters

Juan Williams is an author, and a political analyst for Fox News Channel

(The Hill) Trump voters, what thrilling message are you getting from a president whose budget reduces funding for programs that benefit you? I refer to cuts to programs to feed children; help student with school loans; and to help seniors and the disabled get to the doctor.

Last week, an analysis from The Atlantic magazine concluded that core Trump backers — older, white voters without a college education — will be hurt by this budget. Those are the blue-collar voters in Ohio, Michigan, Pennsylvania, Wisconsin and Iowa who made the electoral college map turn red across the Midwest for Trump.

These same voters “represent a majority of those receiving benefits” from federal government programs such as food stamps and Social Security Disability payments, Ron Brownstein wrote in The Atlantic. And those programs are “targeted for large cutbacks” in the Trump budget.

Trump’s budget comes as the Congressional Budget Office announces that the House GOP plan to replace ObamaCare will leave 23 million more people without health insurance by 2026.

23 May

Trump Budget Based on $2 Trillion Math Error [Updated]

(New York Magazine) One of the ways Donald Trump’s budget claims to balance the budget over a decade, without cutting defense or retirement spending, is to assume a $2 trillion increase in revenue through economic growth. This is the magic of the still-to-be-designed Trump tax cuts. But wait — if you recall, the magic of the Trump tax cuts is also supposed to pay for the Trump tax cuts. So the $2 trillion is a double-counting error.

Divided Republicans May Find It Hard to Pass Any Budget

(NYT) Congressional Republicans greeted President Trump’s first full budget on Tuesday with open hesitation or outright hostility. But it was not clear that they could come up with an alternative that could win over conservatives and moderates while clearing a path for the tax cuts and policies they have promised for years.

The budget battle ahead mirrors the continuing health care fight, in which concessions to Republican moderates alienate conservatives, while overtures to conservatives lose moderate votes. But with Republicans in full charge of the government, the onus is on their leaders to reach a budget agreement in a matter of weeks that would ease passage of the president’s promised tax cuts as well as a new spending plan that would reshape the government in a Republican mold.

Mr. Trump’s $4.1 trillion budget, with its deep cuts to poverty programs, biomedical research, student loans and foreign aid, will not pass, as Republicans on Capitol Hill have freely acknowledged and even the White House is aware. Republicans on Capitol Hill parted ways with the president not only on many of his deepest cuts but also on some of his smaller proposals, like resurrecting a national nuclear waste repository in Nevada and ending the Great Lakes cleanup program.

Trump releases budget that slashes government programs

(The Hill) The Trump administration on Tuesday unveiled a budget seeking $1.5 trillion in non-defense discretionary cuts and $1.4 trillion in Medicaid cuts over the course of a decade, while adding nearly half a trillion dollars to defense spending.

The plan, titled “A New Foundation for American Greatness,” would dramatically reshape federal spending, cutting anti-poverty and safety net programs, but leaving Medicare and the retirement portion of Social Security untouched.

Congress is expected to reject many of the proposals as it takes up the budget in the coming weeks and months. … The budget would cut 31.4 percent from the Environmental Protection Agency, 29.1 percent from the State Department, 20.5 percent from the Department of Agriculture and 10.7 percent from the National Science Foundation. It would make Pell grants available year-round, but raise monthly student loan payments.

Besides the cuts to Medicaid, the budget finds $274 billion in savings over 10 years from spending cuts to anti-poverty programs. These would include $193 billion in cuts to the Supplemental Nutrition Assistance Program (SNAP), $21 billion from Temporary Assistance for Needy Families (TANF).

It also scales back Disability Insurance offered through Social Security, a step critics say breaks Trump’s campaign promise to leave Social Security untouched.

Already, budget leaders in Congress are pushing back on the budget.

“The President’s budget is a suggestion,” Senate Budget Committee Chairman Sen. Mike Enzi (R-Wyo.) wrote in a statement. “We will take a close look at his budget, but Congress is mandated by the Constitution with key spending responsibilities and will ultimately decide what the nation’s fiscal priorities will be.”

Here are the 66 programs eliminated in Trump’s budget

(The Hill) President Trump’s fiscal 2018 budget proposal would completely eliminate 66 federal programs, for a savings of $26.7 billion.

Some of the programs would receive funding for 2018 as part of a phasing-out plan.

Here are the programs the administration wants on the chopping block.

11 May

The three biggest economic errors in Donald Trump’s interview with The Economist

(Quartz) US president Donald Trump sat down for a discussion about economics with editors from The Economist. It revealed that “Trumponomics” is not entirely grounded in reality. In the course of a wide-ranging interview which touched on trade, immigration, and tax reform, and health care, Trump made three particularly strange statements—not counting curious asides about the quality of roses in the White House garden vis-a-vis infrastructure spending, and migratory bird patterns by way of tax deductions—that belies his claims to understand economics.

2 May

(The Atlantic Daily) Trump vs. Congress: As lawmakers prepare to vote on a budget deal that rejects many of his proposed cuts, President Trump voiced his displeasure on Twitter, calling for a government shutdown in September—though if he doesn’t sign the bill, he could shut down the government himself this week. GOP leaders aren’t following Trump’s instructions on taxes either: They’re drafting a plan that’s designed not to add to the long-term deficit, which means they’ll have to ignore the sweeping cuts he’s recommended. And Congress has refused to fund Trump’s wall on the Mexican border; even so, the White House just announced a plan to improve the existing fence.

2 May

Trump Says He’ll Sign Congress Spending Deal That Jettisons His Goals

President Donald Trump said he’ll sign a bipartisan $1.1 trillion spending bill that largely tracks Democratic priorities and rejects most of his wish list, including funds for a wall on the U.S.-Mexico border.

“We’re very happy with it,” the president said Monday in an interview with Bloomberg News. The plan would allocate some new funding for border security, though the funds couldn’t be used to build his promised wall on the U.S.-Mexico border. The president said he will sign the bill if it remains “as we discussed.”

1 May

(LATimes) Congressional leaders reached an agreement Sunday night on $1 trillion in funding for the federal government, but rebuffed President Trump’s requested cuts to federal agencies and provided no money for his border wall. Details of a final deal to fund the government through September, when the federal fiscal year ends, started to come out Sunday night. … the dealincludes increased military spending, $1.5 billion for border security and $295 million to help Puerto Rico pay for its Medicaid burden. It also includes more funding for for the National Institutes of Health, opioid addiction treatment, and money to reimburse New York City and other cities for protecting Trump’s properties. Republicans need Democratic support to pass the spending bill, so it does not include a number of Republican priorities, including stripping funding from Planned Parenthood and agencies like the Department of Health and Human Services.

29 April

Almost everything Republicans get wrong about the economy started with a cocktail napkin in 1974

Almost everything Republicans get wrong about the economy started with a cocktail napkin in 1974

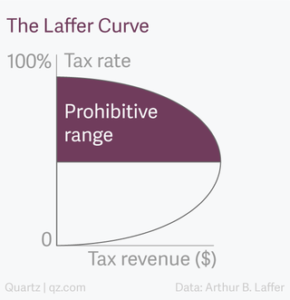

Gwynn Guilford on the napkin doodle that changed the course of American history. “This moment remains one of the most famous legends of modern economic history. Its message—that tax cuts pay for themselves—endures too. (Look no further than president Donald Trump’s budget plan for proof.) This is even more remarkable when you consider that, except in its very vague suggestion that tax rates alone do not dictate tax revenue, Laffer’s curve is wrong.”

28 April

G.D.P. Report Shows U.S. Economy Off to Slow Start in 2017

By NELSON D. SCHWARTZ

The government said gross domestic product grew at an annual rate of 0.7 percent in the first quarter, a three-year low, as consumer spending let up.

Americans say they feel more optimistic about the economy since President Trump was elected. But they certainly are not acting that way, and that is shaping up to be a challenge for his administration.

Consumers pulled back sharply on spending in early 2017, the Commerce Department said on Friday, reducing the economy’s quarterly growth to its lowest level in three years. In fact, the 0.7 percent annual growth rate for the period is far below the 2.5 percent pace in President Barack Obama’s final three months in office, let alone Mr. Trump’s 4 percent target. … Other indicators were stronger — businesses invested at a healthy pace — but that was not enough to offset the headwinds from feeble retail sales and falling inventories.

26-27 April

(The Economist) The Trump tax plan: Under audit

Yesterday the Trump administration unveiled its plans for tax reform, which is sorely needed. As just the opening round in a negotiation, the announcement could yet lead to something decent. But it is far from clear that these plans will deliver it. America may end up with revenue-neutral changes that help middle earners. But a more probable result is a tax cut that benefits the rich and is paid for with more borrowing

Trump’s Plan for Tax Reform Includes Deep Cuts in Business Taxes

(The Street) The White House unveiled in broad strokes its priorities for tax reform on Wednesday, taking a first step in delivering to investors the corporate tax cuts they’ve been banking on for months, even if there’s still a long way to go before the proposals become law.

President Trump proposed slashing the corporate tax rate to 15% from 35%, as anticipated, and instituting a one-time repatriation tax without specifying the amount. He proposed taxing pass-through businesses at the corporate rate instead of the individual as a measure to help small businesses and called for the individual tax code to be cut down from seven brackets to three.

But a 15% corporate tax rate is likely to be hard to sell on Capitol Hill. Such a rate would strip away trillions of dollars in federal revenue and blow an enormous hole in the deficit, analysts say.

Most observers agree that a corporate rate of between 22% and 28% is ultimately what will end up in any legislation. But even so, it would be a major win for investors. An analysis from S&P Global Market Intelligence determined even a 10% decrease in the corporate tax rate could drive the S&P 500 up by 15% over the course of the year.

White House Proposes Slashing Tax Rates, Significantly Aiding Wealthy

(NYT) President Trump on Wednesday proposed sharp reductions in individual and business income tax rates and a radical reordering of the tax code that would significantly benefit the wealthy, but he offered no explanation of how the plan would be financed as he rushed to show progress before the 100-day mark of his presidency.

Mr. Trump’s skeletal outline of a tax package, unveiled at the White House in a single-page statement filled with bullet points, was less a plan than a wish list.

Trump’s Tax Plan Is a Reckoning for Republican Deficit Hawks

As President Trump’s top economic advisers faced a barrage of questions on Wednesday about the tax plan they had just unfurled, there was one that they struggled most to answer: how to keep the “massive tax cuts” they proposed from ballooning the federal deficit.

The White House insists that economic growth will cover the cost, which could be as high as $7 trillion over a decade. But the question will dog Republicans and could fracture their party as they face the prospect of endorsing a plan that many economists and budget analysts warn will increase the deficit. After years of fiscal hawkishness, conservatives now face a moment of truth about whether they truly believe America’s economy is drowning in debt.

25 April

Martin Feldstein: Inconvenient Truths About the US Trade Deficit

(Project Syndicate) … foreign import barriers and exports subsidies are not the reason for the US trade deficit. The real reason is that Americans are spending more than they produce. The overall trade deficit is the result of the saving and investment decisions of US households and businesses. The policies of foreign governments affect only how that deficit is divided among America’s trading partners.

The reason why Americans’ saving and investment decisions drive the overall trade deficit is straightforward: If a country saves more of total output than it invests in business equipment and structures, it has extra output to sell to the rest of the world. In other words, saving minus investment equals exports minus imports – a fundamental accounting identity that is true for every country in every year. … if foreigners as a whole reduced their demand for US financial assets, the prices of those assets would decline, and the resulting interest rates would rise. Higher US interest rates would discourage domestic investment and increase domestic saving, causing the trade deficit to shrink.

Arthur Laffer’s Theory on Tax Cuts Comes to Life Once More

20 April

Jeffrey Sachs: Will Economic Illiteracy Trigger a Trade War?

Americans should not allow themselves to be fooled. The emperor has no clothes, imported or domestic; and, apparently, he has no competent economic advisers, either.

(Project Syndicate) Donald Trump and his commerce secretary, Wilbur Ross, continue to commit an economic fallacy that first-year economics students learn to avoid. They claim that America’s current-account deficit (or trade deficit), which is in fact the result of America’s low and falling saving rate, is an indicator of unfair trade practices by Germany and China, two current-account surplus countries. Their embrace of economic ignorance could lead to disaster.

6 April

Cutting Off ‘Fly-Over’ States, Trump to Axe Amtrak for 220 Cities

President’s so-called “skinny budget” will eliminate all federal funding for Amtrak’s national train network

(Common Dreams) “It’s ironic that President Trump’s first budget proposal undermines the very communities whose economic hardship and sense of isolation from the rest of the country helped propel him into office,” said NARP president Jim Mathews.

“These working class communities—many of them located in the Midwest and the South—were tired of being treated like ‘flyover country,'” Mathews continued. “But by proposing the elimination of Amtrak’s long distance trains, the Trump administration does them one worse, cutting a vital service that connects these small town economies to the rest of the U.S..”

28 March

Trump signs bill that kills Obama-era rule targeting wage theft, unsafe working conditions

President Donald Trump signed a bill Monday that killed an Obama-era worker safety rule that required businesses competing for large federal contracts to disclose and correct serious safety and other labor law violations.

Earlier this month, the Senate voted to eliminate the Fair Pay and Safe Workplaces rule, which applied to contracts valued at $500,000 or more. Votes on the bill in both the House and Senate divided along party lines.

The Fair Pay and Safe Workplaces regulation was finalized in August but most of it was never implemented. Within days of it being finalized, the Associated Builders and Contractors (ABC) sued, securing a temporary injunction that prohibited the federal government from implementing it.

In a last-minute effort to fight for the rule earlier this month, Sen. Elizabeth Warren, D-Mass., released a staff report that showed that 66 of the federal government’s 100 largest contractors have at some point violated federal wage and hour laws. Since 2015, the report says, more than a third of the 100 largest OSHA penalties have been imposed on federal contractors.

23 March

Bill Gates meets with Donald Trump. The face-to-face comes after the Gates Foundation said it is “deeply troubled” by the US president’s 2018 budget proposal. An agenda hasn’t been released, but a statement from the Gates Foundation said it has “a long history of working with officials” on issues like domestic education and global health and development. Gates and Trump also met in December to discuss innovation.

Trump Tantrum looms on Wall Street if healthcare effort stalls

The Trump Trade could start looking more like a Trump Tantrum if the new U.S. administration’s healthcare bill stalls in Congress, prompting worries on Wall Street about tax cuts and other measures aimed at promoting economic growth.

Investors are dialing back hopes that U.S. President Donald Trump will swiftly enact his agenda, with a Thursday vote on a healthcare bill a litmus test which could give stock investors another reason to sell.

“If the vote doesn’t pass, or is postponed, it will cast a lot of doubt on the Trump trades,” said the influential bond investor Jeffrey Gundlach, chief executive at DoubleLine Capital.

U.S. stocks rallied after the November presidential election, with the S&P 500 posting a string of record highs up to earlier this month, on bets that the pro-growth Trump agenda would be quickly pushed by a Republican Party with majorities in both chambers of Congress.

The S&P 500 ended slightly higher on Wednesday, the day before a floor vote on Trump’s healthcare proposal scheduled in the House of Representatives.

On Tuesday, stocks had the biggest one-day drop since before Trump won the election, on concerns about opposition to the bill.

21 March

Is The Trump Trade Fading?

(Seeking Alpha opin – Ian Bezek) All politics aside, the simple fact is that Trump’s political honeymoon is fading more quickly than we might have expected based on historical precedent.

The Streak Has Ended: Markets Finally Drop

What does that mean for the market. Let me quote myself from my Weekend Digest on Sunday:

If Trump quickly loses popularity, the Republican Congress, which has always had mixed feelings about Trump being their standard-bearer, could quickly turn on him. A gridlocked Congress with the Republican Party working at odds with the President and the Democrats attacking both factions would hardly be good for the market’s Trump building prosperity narrative.

I know it’s early to judge Trump, there’s a good chance this initial downswing in popularity will right itself. But traditionally new presidents get a “honeymoon” period where people expect or at least hope for the best. Trump initially got this, with his net favorability being slightly positive, despite being negative from beginning to end of the campaign. However, that goodwill is fading unusually quickly, and the White House better start delivering on some expectations. Otherwise, look for the Trump Rally to find itself on shaky ground in a hurry.

If you think of the market as a gauge measuring the odds of Trump being able to stimulate the economy to a significant degree, then you better take his decline in popularity seriously.

17 March

Trump’s “America First” budget will leave the economy running behind

(Brookings) The proposed cuts to the nation’s economic development and scientific infrastructure would erode critical programs that help regions succeed in the global economy. These range from technical assistance for small manufacturers, to incentives for regional firms to solve shared technical problems, to research funding for innovations that will define tomorrow’s global economy.

In fact, many of the proposed program cuts would undercut the very goals on which President Trump campaigned. For example, while the president promised to reduce the trade deficit, the $5.8 billion cut from the National Institutes of Health’s budget surely won’t help decrease our $55.8 billion trade deficit in pharmaceutical products. NIH funds more than 300,000 researchers across the country and represents the nation’s feedstock of pharmaceutical research. The budget also eliminates the Overseas Private Investment Corporation and the U.S. Trade Development Agency, which help U.S. companies access foreign markets.

And there will be many more

Trump to spend 7th consecutive weekend at Trump-branded property, at enormous cost to taxpayers

Austerity for us, regular Florida vacations for the president.

(Think Progress) As Quartz reported on Friday, after this weekend, Trump will have already spent about $16.5 million on trips to Mar-a-Lago. For that amount, Meals on Wheels could feed 5,967 seniors for a year and after school programs could feed 114,583 children for a year.

16 March

This pretty well sums it up

Trump’s budget: the dream of a paranoid strongman and a vicious Scrooge

By Michael Paarlberg

It reflects a kind of banana republic militarism designed to fleece taxpayers, enrich defense contractors, disloyal agencies and screw the poor at every turn

(The Guardian) There are many other programs on the chopping block, most of which are economically insignificant: foreign aid, long targeted by Republicans despite its role in counterterrorism, is 1% of the federal budget. Trump’s plan to eliminate the National Endowment for the Arts entirely, for example, would pay for one F-35. Yet even if voters may not care about Sesame Street, or national parks, or finding a cure for cancer, there’s something deeply sadistic about eliminating a program that helps elderly poor people heat their homes in the winter – especially coming from a president who has charged taxpayers $10m and counting for weekend getaways to his Palm Beach mansion.

Trump’s budget isn’t about saving money – he’s said so himself, that military spending is “more important” than a balanced budget. And it isn’t about rebuilding a “depleted” military for a country that already spends more on defense than the next twelve countries combined. Trump’s plan is about catering to his base. Not the fabled white working class, who will soon lose their WIC, heating subsidies, and job training. No, his real base, those golfing buddies and board members at companies like Lockheed, who want lower taxes and access to the government spigot, and want poor people to pay for it all.

(The Atlantic) Deep Cuts: The budget proposal the White House released to Congress today is an aggressive demonstration of Trump’s campaign promises. To fund an increase in military spending, it makes deep cuts to education programs and funding for science, including the bipartisan-supported National Institutes of Health. It would eliminate funding for 19 independent agencies, including the National Endowment for the Arts. (Here’s a visual breakdown of the spending changes.) All these cuts could hurt low-income Americans, including some of Trump’s own supporters, not to mention slowing scientific and tech research that might otherwise help revive U.S. manufacturing. But don’t panic yet: Thanks to the complicated fiscal procedure known as sequestration, the budget needs bipartisan support, so it may not make it through Congress.

Charles P. Pierce: This Is the Ending Conservatives Always Wanted

You can draw a straight line from Reaganomics to Trump’s budget.

(Esquire) This proposed budget isn’t extreme. Reagan’s proposed budget in 1981 was extreme. This budget is short-sighted, cruel to the point of being sadistic, stupid to the point of pure philistinism, and shot through with the absolute and fundamentalist religious conviction that the only true functions of government are the ones that involve guns, and that the only true purpose of government is to serve the rich.

(The Atlantic) Deep Cuts: The budget proposal the White House released to Congress today is an aggressive demonstration of Trump’s campaign promises. To fund an increase in military spending, it makes deep cuts to education programs and funding for science, including the bipartisan-supported National Institutes of Health. It would eliminate funding for 19 independent agencies, including the National Endowment for the Arts. (Here’s a visual breakdown of the spending changes.) All these cuts could hurt low-income Americans, including some of Trump’s own supporters, not to mention slowing scientific and tech research that might otherwise help revive U.S. manufacturing. But don’t panic yet: Thanks to the complicated fiscal procedure known as sequestration, the budget needs bipartisan support, so it may not make it through Congress.

15 March

(The Atlantic) Economic Strengths: Just as analysts expected, the U.S. Federal Reserve voted to raise interest rates today, a move that reflects confidence in the strength of the still-recovering economy. Economic worries were among the strongest factors that brought Trump to the White House: His rhetoric—if not the specifics of his policies—gave voters a satisfying answer to their personal concerns by promising to put them first. Yet now that Trump is president, the populist ideals of his candidacy seem to be falling away—replaced by a much more traditional brand of conservatism. Meanwhile, a couple pages of his long-awaited tax returns were released last night—but they reveal much less than Trump’s critics expected

13 March

The Trump slump? Tourists say they’re scared to visit the United States

(LA Times) The fallout from President Trump’s executive orders limiting travel from some Middle Eastern and African countries is having far-reaching implications for U.S. tourism.

It is not just visitors from the countries targeted by the bans that are souring on U.S. travel. Rather, an atmosphere of fear at the nation’s airports — and well-publicized incidents of visitors being detained and interrogated — are scaring off people without the slightest connection to the Muslim world.

An economic consulting firm that has crunched the numbers from various airline and travel booking websites projects that the U.S. will lose 6.3 million visits by the end of next year, which translates into $10.8 billion in spending. What the firm, Tourism Economics of Wayne, Pa., is calling “Trump-induced losses” could affect an estimated 90,000 Americans whose jobs are directly or indirectly dependent on tourism

White House civil war breaks out over trade

(FT via CNBC) A civil war has broken out within the White House over trade, leading to what one official called “a fiery meeting” in the Oval Office pitting economic nationalists close to Donald Trump against pro-trade moderates from Wall Street.

According to more than half a dozen people inside the White House or dealing with it, the bitter fight has set a hardline group including senior adviser Steve Bannon and Trump trade adviser Peter Navarro against a faction led by Gary Cohn, the former Goldman Sachs executive who leads Mr Trump’s National Economic Council.

The battle over trade is emblematic of a broader fight on economic policy within the Trump administration. It comes ahead of a visit to Washington next week by Ms Merkel, the German chancellor, and amid preparations for a meeting of G20 finance ministers in Germany next week at which allies’ concerns over protectionism are likely to be high on the agenda.

10 March

Trump’s Economic Labyrinth

(Project Syndicate) US President Donald Trump is finally getting down to the hard work of trying to please his blue-collar supporters and his administration’s resident plutocrats. The results so far are as incoherent as the electoral coalition that brought him to power.

Donald Trump’s economic-policy agenda during the 2016 US presidential election campaign was a political Rorschach test: where his supporters saw a bold new design for robust growth and greater prosperity, many others in the United States and around the world saw only a cynical blob of dodgy proposals and crossed lines.

Now that Trump must deliver to Congress an outline of his 2018 fiscal-year budget priorities, he and his advisers have no choice but to trade in the campaign inkblot for a governing blueprint. And yet, in his first address to Congress, Trump offered few policy details, even as he called on the assembled representatives and senators to help him “restart the engine of the American economy.”

The Animal Spirits in the Jobs Report

(Bloomberg view) Has the presidential election of Donald Trump reawakened the animal spirits in the U.S. economy, giving businesses more confidence to create jobs? Judging from the latest data, it may have — particularly if you’re a miner, a machinist or a construction worker.

To be sure, these are early days: Trump has president only a few months, not enough time to implement an economic agenda. So far, some employers appear to be giving him the benefit of the doubt. For that confidence to spread, he’ll have to follow through successfully on policies — such as well-crafted infrastructure investment and sensible measures to make banks simpler and stronger — that could benefit the economy overall, rather than boosting specific sectors at the expense of the environment or financial stability.

9 March

The Most Underrated Story About the U.S. Economy

Income growth is faster at the bottom than at the top. Thank a growing economy, falling unemployment, and minimum-wage hikes across the country.

(The Atlantic) annual wage growth has been greater (as a percent) for the poor than for the rich in the last few years. A new report by the left-leaning Economic Policy Institute found that wages grew faster in 2016 for the poorest quintile than for the richest. The trend was particularly pronounced for white workers. The poorest 10 percent of white workers collectively saw a 5.1 percent raise in 2016, twice as faster (sic) as the 2 percent growth among the richest decile percent.

8 March

Mohamed A. El-Erian: Prepare for Market Beliefs to Be Challenged

(Bloomberg view) Deeply ingrained beliefs can be hard to dislodge — and especially in markets when they have led to high investment returns over a prolonged period. That can encourage certain behaviors to last even in the face of contradictory indicators; and it may take a very large set of inconsistent data for behaviors to change.

This tendency — underpinned by what behavioral finance calls “belief perseverance,” “confirmation bias” and “attitude polarization” — could be one of the reasons that financial markets have confidently brushed off what has been a growing list of developments that otherwise would have resulted in higher volatility. It includes just in the last couple of weeks:

White House’s cold shoulder slows economic agenda

(Reuters) David Nason, chief executive of GE Energy Financial Service, has withdrawn from the running to be vice chair of supervision at the Federal Reserve, the company confirmed on Wednesday. Administration officials declined to offer support after critics noted his role at the Treasury Department in arranging bailouts of the 2008 crisis.

The head of regulatory policy at the Fed is a key post considering the administration’s desire to cut red tape on banks. The position has been open since it was created by the 2010 Dodd-Frank Act. Daniel Tarullo has been doing the job unofficially but he is stepping down from the Board of Governors in April.

(Fiscal Times) The US Economy Is Humming Along, but a Big Jump in Growth Is Unlikely

In the near term, growth projections, at least by the top-line measurement of gross domestic product, are looking a whole lot more tepid than they did a few months ago. Related: How the New Trump Travel Ban Could Hurt the US Economy

7 March

Here’s What It Would Cost the U.S. Economy If Every American Woman Went on Strike Tomorrow

(New York Magazine) On Wednesday, women around the world will go on strike in observance of International Women’s Day as part of “A Day Without a Woman.” While not every woman has the luxury to take a day off from paid work, a new analysis from the Center for American Progress determined what it might cost the American economy if every working woman actually were able to strike tomorrow: around $21 billion in gross domestic product.

The Center for American Progress calculated that women’s labor contributes $7.6 trillion to America’s GDP each year — which is more than the entirety of the country of Japan’s GDP of $5.2 trillion. Moreover, women make up nearly half of the U.S. workforce, the analysis found, so women’s financial contributions have also become “increasingly important” to their individual families’ well-being.

3 March

(The Atlantic) Budget Battles: President Trump is due to send an official outline of his budget to the Senate within the next couple of weeks, and it’s not likely to go over well: Though he’ll need the support of some Dems plus the whole GOP to get his massive increase in defense spending approved, he’s already getting pushback even from some Republican leaders.

Yellen points to March rate hike as Fed signals end of easy money

(Reuters) Yellen capped off a seemingly coordinated push from the central bank on Friday when she cemented the view that the Fed will raise interest rates at its next meeting on March 14-15, and likely be able to move faster after that than it has in years.

The Fed has struggled for the past three years to raise interest rates off the zero lower bound as the U.S. economy slowly healed after the Great Recession. Issues from sluggish inflation globally to the dampening effect of a strong dollar and low energy prices blew them off course.

By contrast, 2017 may be the year the Fed is able to follow through on its forecast of three rate hikes.

It’s a welcome turn for the Fed chair, who has hoped to get rates off the ground throughout her three-year tenure, and now sees the economy on track and investors aligned around the idea.

Bill Hall: Trump’s Secret Wall Street Plan

President Trump and his administration have a plan for the economy that he didn’t tell anyone about in his address. It’s a plan that Wall Street insiders already know is firmly in place but that the popular press isn’t aware of. And that plan is good for stocks in the short run but has its fair share of land mines. … it’s a simple nine-step program whose aim is to get the electorate accustomed to a massive debt load in the developed world and anemic future economic growth. …

when you listen carefully, you’ll be able to spot the plan progressing when you hear Janet Yellen talk about raising the Fed Funds Rate three times this year (Step 5) or see it playing out right before your very eyes when Trump talks about the four pillars of his economic plan that I detailed in my January 20 Money and Markets article (Step 6).

You’ll also know exactly where new Treasury Secretary Steven Mnuchin is headed when he talks about the very real possibility of issuing U.S. Treasury bonds with 50- and even 100-year maturities (Step 7). You’ll recognize the Laffer Curve (See Comment of 3 March below) when you see it in the mainstream media as a justification to cut taxes and introduce tariffs on imports (Step 8).

And, you’ll know why the traditionally dovish Janet Yellen is turning into a monetary hawk as she attempts to reshape her legacy before her term as Federal Reserve chairman ends in January 2018. (Step 9).

In a nutshell, what this nine-step plan means is that we are headed for a long period of slow growth, low interest rates and central bank intervention anytime the financial markets signal a collapse. That’s why equities are marching higher because Wall Street is in on it, too.

27 February

The money masters already know that in a slow-growth, low-interest-rate environment, where the world’s central banks are committed to providing a safety net, STOCKS — which represent the only chance at growth — are the best way forward.

Missing: Donald Trump’s Trillion-Dollar Infrastructure Plan

(NYT) Which of Donald Trump’s many campaign promises would bring real benefits to the economy? Which would almost certainly win support even among people who voted against him? And which seems to have disappeared completely from the White House radar?

The answer to all three questions is Mr. Trump’s pledge to put his self-described talents as a builder to work by spending $1 trillion on restoring the country’s crumbling bridges, potholed roads, rust-bucket trains and shabby-not-chic airports. More than a month into his presidency, no such plan has emerged, and there are no signs that one is coming anytime soon.

Republican sources told the news organization Axios last week that the White House wouldn’t unveil an infrastructure proposal until 2018. Congress, meanwhile, seems fixated on other issues — rolling back Obamacare, cutting taxes — while its leaders, the House speaker, Paul Ryan, and Mitch McConnell, the Senate majority leader — seem decidedly unenthusiastic about the idea of a huge infrastructure spending proposal.

Wilbur Ross, soon to be secretary of commerce, and Peter Navarro, an economics professor who now heads a trade council for the president — published a white paper in October proposing tax credits to private developers, a plan more likely to provide a windfall for projects that would be built anyway. The credits wouldn’t spur needed investment in water systems, mass transit and other infrastructure that are public utilities, not vehicles for private profit.

A big infrastructure package involving direct government spending would, politically and economically, be a slam-dunk compared with other misguided investments and policies, like building a border wall or cutting taxes for the wealthy. Experts say that the United States needs a huge increase in spending on public works after years of neglect and to prepare for the increased threat from climate change.

(Quartz) Donald Trump meets with US state governors. The discussion is expected to focus on key infrastructure projects. Ever since Trump made “rebuilding America” a key campaign promise, governors have been drafting wish lists of big ticket projects. Expect billion-dollar price tags.

22 February

Jennifer Rubin: Paul Ryan’s tax plan is destined for failure

(WaPost via Chicago Tribune) For weeks now, House Speaker Paul Ryan, R-Wis., has struggled to convince his colleagues of the benefits of the border adjustment tax. If his reasons seem unsound and unconservative (why should the government dictate which suppliers you use?), it’s because he is not being honest about the motivation behind the plan to tax imports. The one and only reason behind the push centers on the massive deficit the rest of the GOP tax plan would create. (Take a fiscally irresponsible tax plan and add in a counterproductive border tax adjustment!) In short, his tax plan needs the infusion of cash that a tax passed on to U.S. consumers would raise.

Without the border adjustment tax, the GOP tax plan will be (rightly) excoriated for blasting an enormous hole in the budget. However, with the border adjustment tax, the Senate and a great many House Republicans will not vote for it.

Retailers have organized against the border adjustment tax. In particular, small businesses — the darling of Democrats and Republicans alike — foresee disaster. The Wall Street Journal recently reported that small businesses “typically have less ability to negotiate better deals with suppliers or push through price increases to customers or spend time and money modeling tax changes. More than 95 percent of U.S. importers have fewer than 250 employees, according to 2014 U.S. Census data.”

Dodd-Frank Wall Street Reform and Consumer Protection Act

The Dodd-Frank Wall Street Reform and Consumer Protection Act is a massive piece of financial reform legislation passed by the Obama administration in 2010 as a response to the financial crisis of 2008. Named after sponsors U.S. Senator Christopher J. Dodd and U.S. Representative Barney Frank, the act’s numerous provisions, spelled out over roughly 2,300 pages, are being implemented over a period of several years and are intended to decrease various risks in the U.S. financial system. The act established a number of new government agencies tasked with overseeing various components of the act and by extension various aspects of the banking system. President Donald Trump has pledged to repeal Dodd-Frank.

7 February

Revamping Dodd-Frank a ‘this-year priority’: U.S. lawmaker

(Reuters) Republican Representative Jeb Hensarling said he would soon reintroduce his legislation that gives banks a choice between complying with Dodd-Frank and holding more capital.

While the bill is expected to easily pass the Republican-led House, it will face resistance in the Senate, where Democrats hold enough seats to filibuster. Pence can cast votes to break ties on legislation.

On Friday, Trump ordered a review of Dodd-Frank’s effects on business and the economy, which raised the possibility he may use his executive powers to block, undo or kill by neglect parts of the law on his own.

There’s been some confusion over the “fiduciary rule,” which requires brokerage firms to put their clients’ interests first when advising them about 401(k) plans or individual retirement accounts. The Trump administration was originally expected to delay implementation of the rule for 180 days. But Trump’s most recent memo to the Labor Department was considerably weaker, calling only for a review of the rule. This has confused brokers, but they’re preparing to comply with the rule anyway.

6 February

Andrew Ross Sorkin:A Quiet Giant of Investing Weighs In on Trump

(NYT) While Mr. Klarman has long kept a low public profile, he is considered a giant within investment circles. He is often compared to Warren Buffett, and The Economist magazine once described him as “The Oracle of Boston,” where Baupost is based. For good measure, he is one of the very few hedge managers Mr. Buffett has publicly praised.

In his letter, Mr. Klarman sets forth a countervailing view to the euphoria that has buoyed the stock market since Mr. Trump took office, describing “perilously high valuations.”

“Exuberant investors have focused on the potential benefits of stimulative tax cuts, while mostly ignoring the risks from America-first protectionism and the erection of new trade barriers,” he wrote.

“President Trump may be able to temporarily hold off the sweep of automation and globalization by cajoling companies to keep jobs at home, but bolstering inefficient and uncompetitive enterprises is likely to only temporarily stave off market forces,” he continued. “While they might be popular, the reason the U.S. long ago abandoned protectionist trade policies is because they not only don’t work, they actually leave society worse off.”

4 February

Gary Cohn Emerges From Trump Shadows Touting Dodd-Frank Overhaul

(Bloomberg) As director of the National Economic Council, one of the most influential White House posts, he played front man for Trump’s bid to overhaul financial regulations. Cohn made a series of television appearances on Friday to promote the president’s initial executive actions to undo Obama-era policies, including the Dodd-Frank law and a rule requiring financial advisers to act in their clients’ best interests.

“From the executive office, the number one priority we have is job growth,” Cohn said on Bloomberg Television. “We’ve been told we need deregulation to grow jobs in this country. We are not anti-regulation. We want smart regulation that allows our financial services to be the envy of the world.”

3 February

Elizabeth Warren Is NOT Amused With Trump’s Dodd-Frank Rollback

Elizabeth Warren Is NOT Amused With Trump’s Dodd-Frank Rollback

(Heisenberg Report via Seeking Alpha) To put it colloquially, Warren will gladly burn your ass if she thinks what you’re doing is in any way nefarious. And that goes triple for anyone doing something she perceives as designed to return Wall Street to the pre-Dodd Frank glory days.

Trump Says He Cut Wall Street Reform Because His “Friends” Need Money

(Vanity Fair) On Friday, Donald Trump signed an executive order intended to roll back Dodd-Frank, the sprawling regulatory framework President Obama signed into law in 2010 to avoid another financial crisis, which was not entirely beloved on Wall Street. He also scrapped a fiduciary rule intended to protect retirees by forcing brokers and advisers to “work in the best interest of their clients.“ (This, too, was controversial.)

According to its defenders, Dodd-Frank has been a modestly successful, if tortuous affair, requiring banks to bend over backwards to comply with regulations that protect investors and consumers from abusive practices and excessive risk. According to Trump, it was inconveniencing his friends:

“There is nobody better to tell me about Dodd-Frank than [JP Morgan C.E.O.] Jamie [Dimon]. So he has to tell me about it, but we expect to be cutting a lot from Dodd-Frank because, frankly, I have so many people, friends of mine, that have nice businesses, they can’t borrow money,” Trump said Friday morning, shortly before signing the executive orders. “They just can’t get any money because the banks just won’t let them borrow because of the rules and regulations in Dodd-Frank.”

Fiduciary Rule Is Now in Question. What’s Next for Investors

(NYT) The so-called fiduciary rule, the subject of years of intense debate and industry lobbying, was set to take effect in April, but the order removes that deadline, and the rule will likely disappear. Gary Cohn, the former Goldman Sachs executive who is now the director of the National Economic Council, told The Wall Street Journal that he wanted it gone. … The technical terminology gets confusing, but a financial planner or investment adviser in a stand-alone firm may be required to act in your best interest or may pledge to in all instances. But some stockbrokers and many people who sell life insurance, annuities and other more esoteric investment products merely have to follow what’s known as the “suitability” standard.

Trump Announces Plan to Let Wall Street Scam America Again

(New York Magazine) Donald Trump has filled his administration with Wall Street veterans, who believe that their industry is over-regulated. (Financial firms accounted for 30 percent of all corporate profits before the economic crisis, but only 17 percent now, thanks largely to Dodd-Frank’s tighter regulation.) “Americans are going to have better choices and Americans are going to have better products because we’re not going to burden the banks with literally hundreds of billions of dollars of regulatory costs every year,” National Economic Council Director and Goldman Sachs veteran Gary Cohn tells The Wall Street Journal.

Cohn is planning to weaken the fiduciary rule, which he believes robs Americans of their freedom to hire financial advisers who might want to rip them off. “This is like putting only healthy food on the menu,” he tells the Journal, “because unhealthy food tastes good but you still shouldn’t eat it because you might die younger.”

Trump to Order Dodd-Frank Review, Halt Obama Fiduciary Rule

Trump also will halt another of former President Barack Obama’s regulations, hated by the financial industry, that requires advisers on retirement accounts to work in the best interests of their clients. Trump’s order will give the new administration time to review the change, known as the fiduciary rule.

Taken together, the actions are designed to lay down the Trump administration’s approach to financial markets, with an emphasis on removing regulatory burdens and opening up investor options, said the White House official, who briefed reporters on condition of anonymity.

The orders are the most aggressive steps yet by Trump to loosen regulations in the financial services industry and come after he has sought to stock his administration with veterans of the industry in key positions. His plans are sure to face fierce criticism by Democrats who charge that Trump is intent on undoing changes designed to protect everything from average investors to the global banking system.

2 February

Nouriel Roubini: The End of Trump’s Market Honeymoon

(Project Syndicate) It is little wonder that corporations and investors have been happy. This traditional Republican embrace of trickle-down supply-side economics will mostly favor corporations and wealthy individuals, while doing almost nothing to create jobs or raise blue-collar workers’ incomes. According to the nonpartisan Tax Policy Center, almost half of the benefits from Trump’s proposed tax cuts would go to the top 1% of income earners.

For starters, the anticipation of fiscal stimulus may have pushed stock prices up, but it also led to higher long-term interest rates, which hurts capital spending and interest-sensitive sectors such as real estate. Meanwhile, the strengthening dollar will destroy more of the jobs typically held by Trump’s blue-collar base. The president may have “saved” 1,000 jobs in Indiana by bullying and cajoling the air-conditioner manufacturer Carrier; but the US dollar’s appreciation since the election could destroy almost 400,000 manufacturing jobs over time.

1 February

This is the Republican plot to kill the US corporate income tax as we know it

(Quartz) Last week, White House press secretary Sean Spicer said Trump wanted to slap a 20% tax on goods imported from Mexico to pay for a new wall along the United States’ southern border. In the context of the escalating tensions between the two countries, the idea came off as just what it was: an undiplomatic, knee-jerk proposal to punish an important trading partner targeted by the US president.

But Spicer’s freelancing generated confusion about a serious proposal, developed over years, to restructure the US corporate tax system from one that taxes profits to one that taxes domestic consumption. It includes a 20% assessment on imports, but it is not targeted at Mexico, and its purpose is not to penalize trade.

27 January

The rise of Gary Cohn, from Midwestern kid to Goldman Sachs boss — and now adviser to President Trump

The rise of Gary Cohn, from Midwestern kid to Goldman Sachs boss — and now adviser to President Trump

(Business Insider) Gary Cohn, the former chief operating officer and president of Goldman Sachs, is taking up the role of director of the National Economic Council in the Trump administration.

25 January

Gary Cohn Joins Trump with a $284 Million Parting Gift from Goldman

(Vanity Fair – Hive) After spending his campaign railing against Wall Street, with a particular emphasis on Goldman Sachs, Donald Trump kicked off his transition by hiring, without any apparent cognitive dissonance, a half-dozen employees or alumni of Goldman Sachs. While the Treasury will likely be run by 17-year veteran of the firm Steven Mnuchin, Trump’s biggest score was convincing the firm’s president, Gary Cohn, to head to D.C., too. Sure, the fact that Cohn has spent interminable years sitting in his office stewing about Lloyd Blankfein selfishly sticking around as C.E.O. when he should’ve retired and let other people (Cohn) shine certainly helped. But trading the number two job at the bank to head the National Economic Council represents something in the range of, we’re guessing, a 99 percent pay cut. Luckily, it turns out that Cohn will still be able to put food on the table despite becoming a lowly public servant [thanks to] a $285 million parting gift from Goldman.

12 December

Trump officially taps Goldman Sachs President Gary Cohn to be National Economic Council director

2 Comments on "Trump administration: U.S. Economy 2017 Chapter I"

Re the Money & Markets piece & the Laffer curve

1. Art Laffer, when I last heard, was at the University of Southern California. He once had some connection with the University of Chicago, probably as a student. His message at the time of the early Reagan Administration was that a government can decrease tax rates, with the effect of increasing economic activity resulting in actually increasing tax revenues. The original Laffer curve was famously drawn on a napkin. It is a two dimensional graph, with tax rates ranging from 0% to 100% on the vertical axis, and tax revenues measured in 4 on the horizontal axis. Revenues are 0 at both extreme rates. As you raise rates from 0% revenues rise, hit a maximum, and shrink back to 0 at 100%. The trick is to set the tax rate where the revenue is at its maximum. This was used in the Reagan Administration to assume that tax rates were then above the maximum revenue rate, thus tax-cuts will increase government revenues. They did not. This points to the uselessness of the Laffer Curve, because nobody knows where we are at the beginning of the exercise, thus whether an increase or a cut in tax rates will increase the amount of taxes collected.

2. The rest of the stuff is pure nonsense. It is a way to sell to the uninformed the idea that “there is a plan”. In fact, the Administration has sent to Congress a budget that a Republican Congress should have a great deal of trouble accepting. There is nothing else visible out of the White House except for “alternate facts” such as “the money keeps pouring in” at NATO. – AD

If proposed US corporate tax reforms are enacted, then a renewed race to the bottom across global jurisdictions may be set in motion and potentially shift fiscal policy debates in many countries including NAFTA neighbours. Further, when the proposals were announced, there was—and remains— no focus upon how to pay for them other than to say that the tax reform package would “pay for itself” with growth and through closing deductions and loopholes that would generate “trillions and trillions” in revenues. … highly doubt[ful] that will happen as it relies in no small part upon Laffer curve type of thinking whereby lowered tax rates generate faster growth in the economy and hence revenues. … declines (increases) in the personal effective tax rate through policy changes or changes in the composition of personal income generally result in increases (declines) in revenues. That’s even more likely now with aging baby boomers in my opinion; having gone through a massive wealth and income shock in the Global Financial Crisis that interrupted retirement plans and still being down on real house prices, boomers may hoard tax cuts rather than spending them. As evidence of this, there has been no grand consumption boom in response to an energy tax cut over the past three years. Scotiabank Economics